Evolus, Inc. (EOLS): Price and Financial Metrics

EOLS Price/Volume Stats

| Current price | $12.31 | 52-week high | $15.43 |

| Prev. close | $12.13 | 52-week low | $7.44 |

| Day low | $12.05 | Volume | 250,431 |

| Day high | $12.40 | Avg. volume | 579,451 |

| 50-day MA | $11.89 | Dividend yield | N/A |

| 200-day MA | $11.50 | Market Cap | 770.61M |

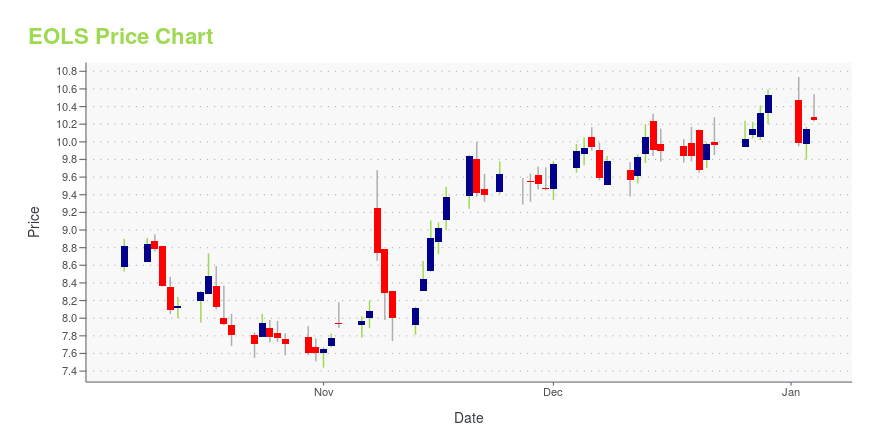

EOLS Stock Price Chart Interactive Chart >

Evolus, Inc. (EOLS) Company Bio

Evolus, Inc. provides medical aesthetic products for physicians and their patients in the United States. It offers DWP-450, an injectable 900 kilodalton botulinum toxin type A complex designed to address the needs of the facial aesthetics market. The company was founded in 2012 and is based in Irvine, California.

Latest EOLS News From Around the Web

Below are the latest news stories about EVOLUS INC that investors may wish to consider to help them evaluate EOLS as an investment opportunity.

Evolus Enters into Licensing Agreement with Symatese to Exclusively Distribute Next-Generation Dermal Fillers in EuropeNEWPORT BEACH, Calif., December 20, 2023--Evolus, Inc. (NASDAQ: EOLS), a performance beauty company with a focus on building an aesthetic portfolio, today announced it has entered into a definitive agreement with Symatese to be the exclusive distributor in the United Kingdom (U.K.) and Europe of four unique dermal fillers in late-stage development with anticipated regulatory clearances in second half of 2024 and commercialization under the brand name Estyme® (pronounced "esteem") fillers in 2025 |

Evolus Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)NEWPORT BEACH, Calif., December 08, 2023--Evolus, Inc. (NASDAQ: EOLS), a performance beauty company with a focus on building an aesthetic portfolio of consumer brands, today reported the grant in December of an aggregate of 28,328 restricted stock units (RSUs) of the company’s common stock to 7 newly hired non-executive employees of the company. The awards were approved by the compensation committee of the company’s board of directors under the Evolus’ 2023 Inducement Incentive Plan, with a gran |

Evolus, Inc. (NASDAQ:EOLS) Q3 2023 Earnings Call TranscriptEvolus, Inc. (NASDAQ:EOLS) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Good afternoon, and welcome to the Evolus Third Quarter 2023 Earnings Conference Call. [Operator Instructions]. I would now like to turn the conference over to your host, Mr. Ned Mitchell from Investor Relations. Ned? Ned Mitchell: Thank you, operator, and welcome to everyone […] |

Evolus Reports Record Third Quarter 2023 Financial Results and Phase II Data for Extra-Strength 40U Formulation of Jeuveau®NEWPORT BEACH, Calif., November 07, 2023--Evolus, Inc. (NASDAQ: EOLS), a performance beauty company with a focus on building an aesthetic portfolio of consumer brands, today reported financial results for the third quarter ended September 30, 2023. |

"Extra-Strength" 40U Formulation of Jeuveau® Demonstrates Effects Lasting 26 Weeks in Phase II Data Presented at 2023 ASDS Annual MeetingNEWPORT BEACH, Calif., November 06, 2023--Evolus, Inc. (NASDAQ: EOLS), a performance beauty company with a focus on building an aesthetic portfolio of consumer brands, announced results from the Phase 2 clinical study evaluating the "extra-strength" 40U dose for extended duration of Jeuveau® (prabotulinumtoxinA-xvfs), the only neurotoxin dedicated exclusively to aesthetics. Final data were presented at the 2023 American Society for Dermatologic Surgery (ASDS) Annual Meeting on November 3, 2023, |

EOLS Price Returns

| 1-mo | 14.62% |

| 3-mo | 7.70% |

| 6-mo | 3.10% |

| 1-year | 21.52% |

| 3-year | 15.26% |

| 5-year | -30.25% |

| YTD | 16.90% |

| 2023 | 40.21% |

| 2022 | 15.36% |

| 2021 | 93.75% |

| 2020 | -72.39% |

| 2019 | 2.27% |

Continue Researching EOLS

Want to see what other sources are saying about Evolus Inc's financials and stock price? Try the links below:Evolus Inc (EOLS) Stock Price | Nasdaq

Evolus Inc (EOLS) Stock Quote, History and News - Yahoo Finance

Evolus Inc (EOLS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...