EPAM Systems Inc. (EPAM): Price and Financial Metrics

EPAM Price/Volume Stats

| Current price | $211.05 | 52-week high | $317.50 |

| Prev. close | $207.14 | 52-week low | $169.43 |

| Day low | $207.67 | Volume | 318,277 |

| Day high | $211.55 | Avg. volume | 637,487 |

| 50-day MA | $187.54 | Dividend yield | N/A |

| 200-day MA | $248.36 | Market Cap | 12.24B |

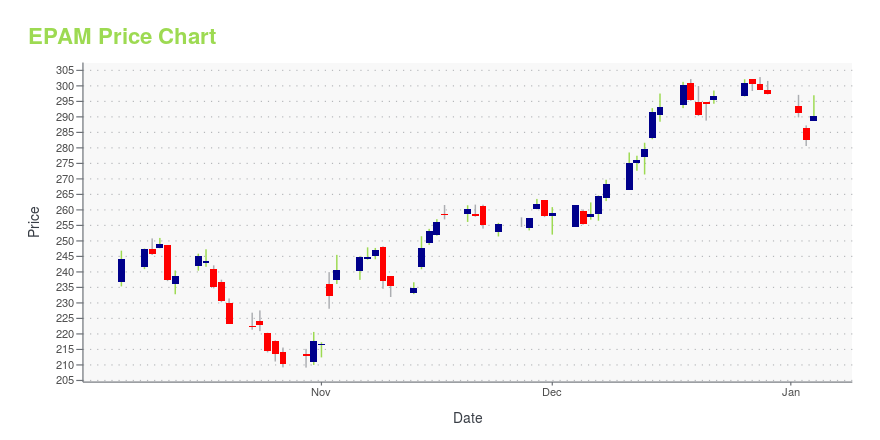

EPAM Stock Price Chart Interactive Chart >

EPAM Systems Inc. (EPAM) Company Bio

EPAM Systems, Inc. ("Effective Programming for America") is an American company that specializes in service development, digital platform engineering, and digital product design, operating out of Newtown, Pennsylvania. (Source:Wikipedia)

Latest EPAM News From Around the Web

Below are the latest news stories about EPAM SYSTEMS INC that investors may wish to consider to help them evaluate EPAM as an investment opportunity.

If You Invested $1000 in Epam a Decade Ago, This is How Much It'd Be Worth NowHolding on to popular or trending stocks for the long-term can make your portfolio a winner. |

EPAM Systems Inc CFO Jason Peterson Sells Company SharesJason Peterson, the CFO of EPAM Systems Inc (NYSE:EPAM), sold 900 shares of the company on December 18, 2023, according to a recent SEC Filing. |

Is It Time To Consider Buying EPAM Systems, Inc. (NYSE:EPAM)?EPAM Systems, Inc. ( NYSE:EPAM ) received a lot of attention from a substantial price increase on the NYSE over the... |

Insider Sell: CFO Jason Peterson Sells Shares of EPAM Systems IncIn the realm of stock market movements, insider trading activity is often a significant indicator that investors and analysts closely monitor. |

EPAM Launches Open-Source DIAL Platform Based on Apache 2.0EPAM unveils the open-source iteration of its Deterministic Integrator of Applications and Large Language Models ("DIAL") platform based on Apache 2.0 License. |

EPAM Price Returns

| 1-mo | 15.59% |

| 3-mo | -11.23% |

| 6-mo | -26.81% |

| 1-year | -6.96% |

| 3-year | -61.89% |

| 5-year | 5.09% |

| YTD | -29.02% |

| 2023 | -9.28% |

| 2022 | -50.97% |

| 2021 | 86.54% |

| 2020 | 68.91% |

| 2019 | 82.88% |

Continue Researching EPAM

Here are a few links from around the web to help you further your research on EPAM Systems Inc's stock as an investment opportunity:EPAM Systems Inc (EPAM) Stock Price | Nasdaq

EPAM Systems Inc (EPAM) Stock Quote, History and News - Yahoo Finance

EPAM Systems Inc (EPAM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...