Epsilon Energy Ltd. (EPSN): Price and Financial Metrics

EPSN Price/Volume Stats

| Current price | $5.41 | 52-week high | $6.35 |

| Prev. close | $5.40 | 52-week low | $4.70 |

| Day low | $5.36 | Volume | 46,213 |

| Day high | $5.50 | Avg. volume | 42,612 |

| 50-day MA | $5.40 | Dividend yield | 4.62% |

| 200-day MA | $5.26 | Market Cap | 118.60M |

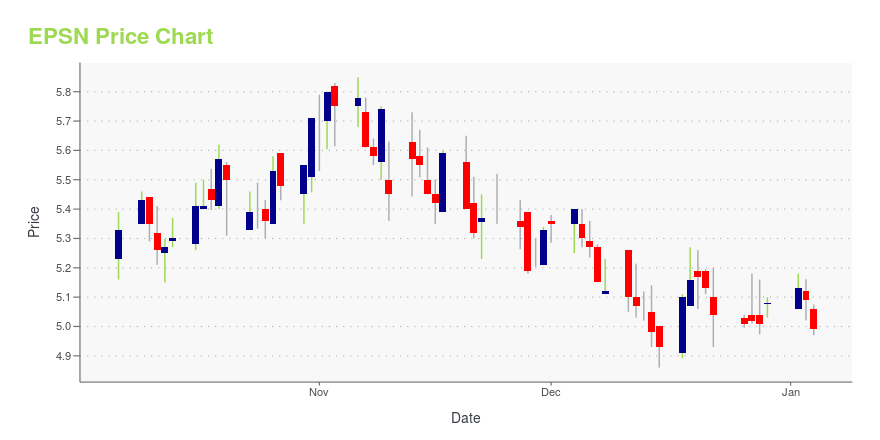

EPSN Stock Price Chart Interactive Chart >

Epsilon Energy Ltd. (EPSN) Company Bio

Epsilon Energy Ltd. engages in the development and production of natural gas and oil reserves. It operates through the following business segments: Upstream, Gathering System, and Corporate. The Upstream segment includes the acquisition, development, and production of oil and natural gas reserves on properties within the United States. The Gas Gathering segment represents two other companies to operate a natural gas gathering system. The Corporate segment covers corporate and governance functions. The company was founded by Zoran Arandjelovic and John K. Wilson on March 14, 2005 and is headquartered in Houston, TX.

Latest EPSN News From Around the Web

Below are the latest news stories about EPSILON ENERGY LTD that investors may wish to consider to help them evaluate EPSN as an investment opportunity.

Investors in Epsilon Energy (NASDAQ:EPSN) have seen respectable returns of 58% over the past three yearsOne simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive... |

Read This Before Considering Epsilon Energy Ltd. (NASDAQ:EPSN) For Its Upcoming US$0.063 DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Epsilon Energy (NASDAQ:EPSN) Is Paying Out A Dividend Of $0.0625The board of Epsilon Energy Ltd. ( NASDAQ:EPSN ) has announced that it will pay a dividend on the 29th of December... |

Epsilon Energy Ltd. Announces Quarterly Dividend and Provides Operational UpdateHOUSTON, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Epsilon Energy Ltd. (“Epsilon” or the “Company”) (NASDAQ: EPSN) today announced that its Board of Directors has declared a dividend of $0.0625 per share of common stock (annualized $0.25/sh) to the stock holders of record at the close of business on December 15th 2023, payable on December 29th 2023. All dividends paid by the Company are “eligible dividends” as defined in subsection 89(1) of the Income Tax Act (Canada), unless indicated otherwise. In Ect |

Epsilon Energy Ltd.'s (NASDAQ:EPSN) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?With its stock down 7.0% over the past month, it is easy to disregard Epsilon Energy (NASDAQ:EPSN). But if you pay... |

EPSN Price Returns

| 1-mo | -1.46% |

| 3-mo | 0.80% |

| 6-mo | 14.08% |

| 1-year | -1.88% |

| 3-year | 19.41% |

| 5-year | N/A |

| YTD | 9.14% |

| 2023 | -19.54% |

| 2022 | 21.37% |

| 2021 | 53.10% |

| 2020 | 12.42% |

| 2019 | -24.50% |

EPSN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...