Equillium, Inc. (EQ): Price and Financial Metrics

EQ Price/Volume Stats

| Current price | $0.42 | 52-week high | $1.50 |

| Prev. close | $0.42 | 52-week low | $0.27 |

| Day low | $0.41 | Volume | 287,000 |

| Day high | $0.46 | Avg. volume | 731,970 |

| 50-day MA | $0.36 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 14.83M |

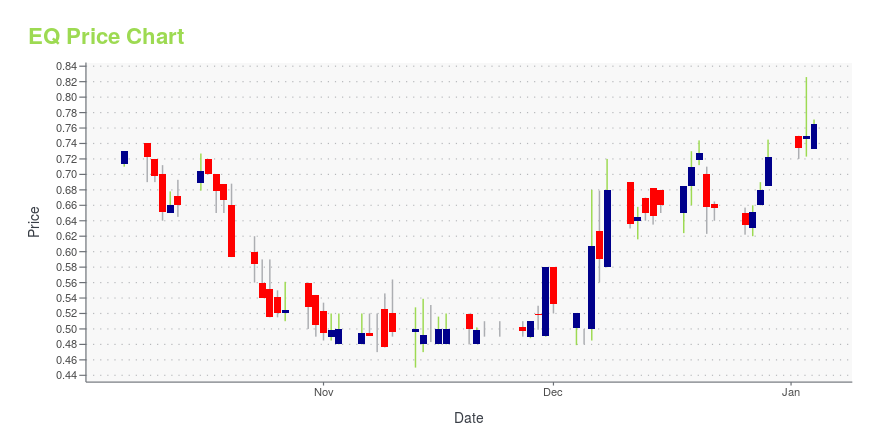

EQ Stock Price Chart Interactive Chart >

Equillium, Inc. (EQ) Company Bio

Equillium Inc. is leveraging deep understanding of immunobiology to develop products for severe autoimmune and inflammatory, or immuno-inflammatory, disorders with high unmet medical need. The company is based in La Jolla, California.

EQ Price Returns

| 1-mo | 28.48% |

| 3-mo | -12.48% |

| 6-mo | -33.34% |

| 1-year | -51.72% |

| 3-year | -79.00% |

| 5-year | -96.86% |

| YTD | -43.87% |

| 2024 | 3.49% |

| 2023 | -31.79% |

| 2022 | -71.88% |

| 2021 | -29.53% |

| 2020 | 58.28% |

Loading social stream, please wait...