Embraer S.A. (ERJ): Price and Financial Metrics

ERJ Price/Volume Stats

| Current price | $29.30 | 52-week high | $31.27 |

| Prev. close | $28.77 | 52-week low | $12.48 |

| Day low | $28.93 | Volume | 1,271,406 |

| Day high | $29.46 | Avg. volume | 1,681,365 |

| 50-day MA | $28.55 | Dividend yield | N/A |

| 200-day MA | $21.95 | Market Cap | 5.38B |

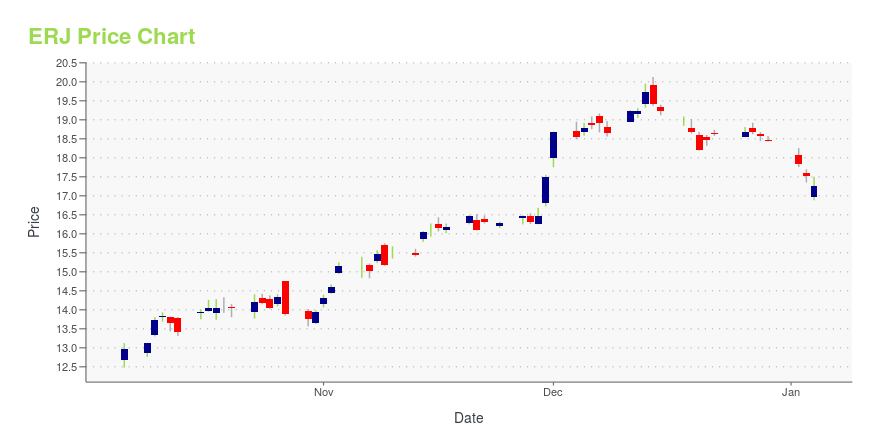

ERJ Stock Price Chart Interactive Chart >

Embraer S.A. (ERJ) Company Bio

Embraer develops, manufactures, and sells aircraft and systems; and provides technical support and after-sales service in Brazil, North America, Latin America, the Asia Pacific, Europe, and internationally. It operates through Commercial Aviation, Executive Jets, Defense & Security, and Other Related Businesses segments. The company was founded in 1969 and is based in São José dos Campos, Brazil.

Latest ERJ News From Around the Web

Below are the latest news stories about EMBRAER SA that investors may wish to consider to help them evaluate ERJ as an investment opportunity.

The Year That Was: Analyzing 2023’s Top Performing Stocks and SectorsThe start of the new year is the perfect time to recap the stock market. |

Cross-Border Champions: 3 Stocks Excelling in International MarketsWhile isolationism and nationalism appear to be rising themes in global politics, with the investing game, diversity is a core strength, thus boosting the narrative of international stocks. |

Boeing (BA) Set to Deliver 5 878 Dreamliners to LATAM GroupBoeing's (BA) improved relationship with LATAM airlines will help expand its presence in the Latin America region. |

Embraer (ERJ) Doubles Service Units to Give Prompt AssistanceEmbraer (ERJ) continues to enjoy the benefit of rising orders in the commercial airspace but also makes sure to provide prompt after-sale service to its customers in the United States. |

Embraer doubles its service center capacity by expanding maintenance and customer support capabilities in the USAEmbraer (NYSE: ERJ, B3: EMBR3) announced today that it is doubling its maintenance service capacity in the United States, to support the continued growth of its executive jets' customer base through the addition of three Executive Aviation Maintenance, Repair and Overhaul (MRO) facilities in Dallas Love Field, TX, Cleveland, OH, and Sanford, FL. |

ERJ Price Returns

| 1-mo | 6.93% |

| 3-mo | 12.74% |

| 6-mo | 61.17% |

| 1-year | 91.38% |

| 3-year | 101.93% |

| 5-year | 42.16% |

| YTD | 58.81% |

| 2023 | 68.80% |

| 2022 | -38.42% |

| 2021 | 160.65% |

| 2020 | -65.06% |

| 2019 | -11.93% |

Continue Researching ERJ

Here are a few links from around the web to help you further your research on Embraer Sa's stock as an investment opportunity:Embraer Sa (ERJ) Stock Price | Nasdaq

Embraer Sa (ERJ) Stock Quote, History and News - Yahoo Finance

Embraer Sa (ERJ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...