Euronav N.V. (EURN): Price and Financial Metrics

EURN Price/Volume Stats

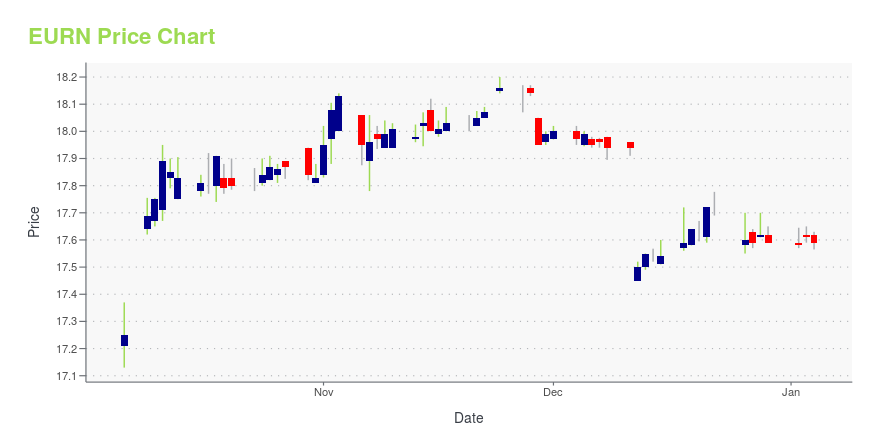

| Current price | $16.31 | 52-week high | $21.26 |

| Prev. close | $16.31 | 52-week low | $14.10 |

| Day low | $16.22 | Volume | 157,400 |

| Day high | $16.51 | Avg. volume | 896,483 |

| 50-day MA | $17.15 | Dividend yield | 4.64% |

| 200-day MA | $17.34 | Market Cap | 3.29B |

EURN Stock Price Chart Interactive Chart >

Euronav N.V. (EURN) Company Bio

Euronav NV engages in the transportation and storage of crude oil. The firm operates through the following segments: Operation of Crude Oil Tankers (Tankers) and Floating Production, Storage and Offloading Operation (FpSO). The Tankers segment provides shipping services for crude oil seaborne transportation. The FpSO segment receives hydrocarbon fluids pumped by nearby offshore platforms and provides field storage. Its activities include crew, ship and fleet management services. The company was founded in 1989 and is headquartered in Antwerp, Belgium.

Latest EURN News From Around the Web

Below are the latest news stories about EURONAV NV that investors may wish to consider to help them evaluate EURN as an investment opportunity.

Should I Buy Oil Stocks Now? Three Top Picks to ConsiderInvestors should buy oil stocks at this time because there’s always a chance that oil prices may rise again in these uncertain times. |

Strength Seen in Frontline (FRO): Can Its 7.7% Jump Turn into More Strength?Frontline (FRO) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Tanker shipping’s ‘odd couple’ prepares for a divorceTanker giant Frontline is poised to dramatically expand its fleet, while Euronav is on a path to privatization. The post Tanker shipping’s ‘odd couple’ prepares for a divorce appeared first on FreightWaves. |

Unveiling Euronav NV (EURN)'s Value: Is It Really Priced Right? A Comprehensive GuideAn in-depth look at the valuation of Euronav NV (EURN), a leading player in the international maritime shipping industry. |

Leading Tanker, LNG, LPG Companies Presenting at 15th Annual Capital Link/DNB New York Maritime ForumNEW YORK, Sept. 25, 2023 (GLOBE NEWSWIRE) -- Senior executives from leading tanker and LNG/LPG shipping and energy transportation companies will participate on panels and presentations at Capital Link’s 15th Annual International Shipping Forum on Tuesday, October 10, 2023, at the Metropolitan Club in New York City. The event is organized in partnership with DNB, and in cooperation with NASDAQ & NYSE. FORUM OVERVIEW AND STRUCTURE The Forum provides an interactive platform for maritime industry le |

EURN Price Returns

| 1-mo | -0.47% |

| 3-mo | -1.24% |

| 6-mo | -5.88% |

| 1-year | 14.59% |

| 3-year | 113.26% |

| 5-year | 134.17% |

| YTD | -5.39% |

| 2023 | 12.97% |

| 2022 | 91.68% |

| 2021 | 12.16% |

| 2020 | -28.24% |

| 2019 | 80.95% |

EURN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EURN

Here are a few links from around the web to help you further your research on Euronav NV's stock as an investment opportunity:Euronav NV (EURN) Stock Price | Nasdaq

Euronav NV (EURN) Stock Quote, History and News - Yahoo Finance

Euronav NV (EURN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...