Evelo Biosciences, Inc. (EVLO): Price and Financial Metrics

EVLO Price/Volume Stats

| Current price | $0.00 | 52-week high | $0.02 |

| Prev. close | $0.00 | 52-week low | $0.00 |

| Day low | $0.00 | Volume | 3,000 |

| Day high | $0.00 | Avg. volume | 12,403 |

| 50-day MA | $0.00 | Dividend yield | N/A |

| 200-day MA | $0.02 | Market Cap | 9.49K |

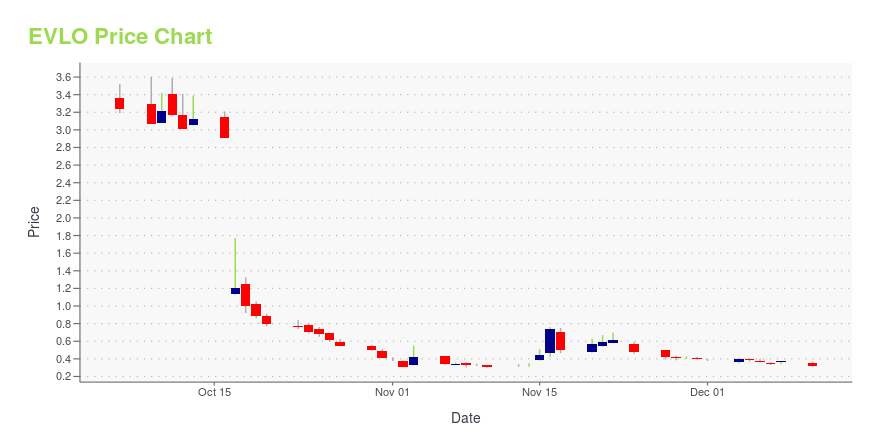

EVLO Stock Price Chart Interactive Chart >

Evelo Biosciences, Inc. (EVLO) Company Bio

Evelo Biosciences, Inc. focuses on the development of monocolonal microbials for the treatment of inflammatory diseases and cancer. It is involved in developing EDP1066 and EDP1815 for patients with psoriasis and atopic dermatitis, rheumatoid arthritis, and ulcerative colitis/crohn’s colitis; and EDP1503 for the treatment of colorectal cancer, renal cell carcinoma, and melanoma, as well as patients who have relapsed on prior PD-1/L1 inhibitor treatment across multiple tumor types. The company was founded in 2014 and is based in Cambridge, Massachusetts.

EVLO Price Returns

| 1-mo | N/A |

| 3-mo | 0.00% |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 0.00% |

| 5-year | 0.00% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -99.81% |

| 2022 | -73.48% |

| 2021 | -49.79% |

| 2020 | 197.78% |

Loading social stream, please wait...