Everi Holdings Inc. (EVRI): Price and Financial Metrics

EVRI Price/Volume Stats

| Current price | $12.82 | 52-week high | $15.25 |

| Prev. close | $9.14 | 52-week low | $6.37 |

| Day low | $12.78 | Volume | 35,460,500 |

| Day high | $13.01 | Avg. volume | 1,557,978 |

| 50-day MA | $8.09 | Dividend yield | N/A |

| 200-day MA | $9.74 | Market Cap | 1.08B |

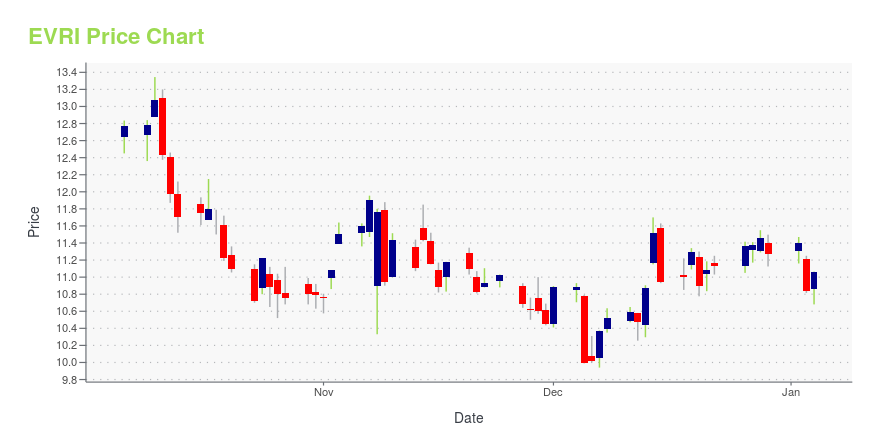

EVRI Stock Price Chart Interactive Chart >

Everi Holdings Inc. (EVRI) Company Bio

Everi Holdings Inc. provides cash access services and related equipment and services to the gaming industry. The company operates in Cash Advance, ATM, Check Services, Games, and Other segments.The company was founded in 1998 and is based in Las Vegas, Nevada.

Latest EVRI News From Around the Web

Below are the latest news stories about EVERI HOLDINGS INC that investors may wish to consider to help them evaluate EVRI as an investment opportunity.

Implied Volatility Surging for Everi Holdings (EVRI) Stock OptionsInvestors need to pay close attention to Everi Holdings (EVRI) stock based on the movements in the options market lately. |

Everi Holdings Inc.'s (NYSE:EVRI) Shares Lagging The Market But So Is The BusinessWhen close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may... |

EVERI EXECUTIVE CHAIRMAN OF THE BOARD, MICHAEL RUMBOLZ, ELECTED AMERICAN GAMING ASSOCIATION CHAIRMANEveri Holdings Inc. (NYSE: EVRI) ("Everi" or "the Company"), a premier provider of land-based and digital casino gaming content and products, financial technology, player loyalty solutions, and bingo, congratulates The Company's Executive Chairman of the Board, Michael Rumbolz, on his election to Chairman of the Board of the American Gaming Association ("AGA"). |

16 Most Undervalued Small-Cap Stocks To Buy According To Hedge FundsIn this article, we will take a look at the 16 most undervalued small-cap stocks to buy according to hedge funds. To see more such companies, go directly to 5 Most Undervalued Small-Cap Stocks To Buy According To Hedge Funds. Despite strong signs that the central bank would be ready to hit brakes on its […] |

Are Options Traders Betting on a Big Move in Everi Holdings (EVRI) Stock?Investors need to pay close attention to Everi Holdings (EVRI) stock based on the movements in the options market lately. |

EVRI Price Returns

| 1-mo | 57.69% |

| 3-mo | 52.98% |

| 6-mo | 21.75% |

| 1-year | -12.91% |

| 3-year | -43.99% |

| 5-year | 3.55% |

| YTD | 13.75% |

| 2023 | -21.46% |

| 2022 | -32.79% |

| 2021 | 54.60% |

| 2020 | 2.83% |

| 2019 | 160.78% |

Continue Researching EVRI

Want to do more research on Everi Holdings Inc's stock and its price? Try the links below:Everi Holdings Inc (EVRI) Stock Price | Nasdaq

Everi Holdings Inc (EVRI) Stock Quote, History and News - Yahoo Finance

Everi Holdings Inc (EVRI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...