Four Corners Property Trust, Inc. (FCPT): Price and Financial Metrics

FCPT Price/Volume Stats

| Current price | $27.50 | 52-week high | $27.60 |

| Prev. close | $27.01 | 52-week low | $20.51 |

| Day low | $27.08 | Volume | 283,400 |

| Day high | $27.60 | Avg. volume | 466,786 |

| 50-day MA | $25.04 | Dividend yield | 5.09% |

| 200-day MA | $23.95 | Market Cap | 2.53B |

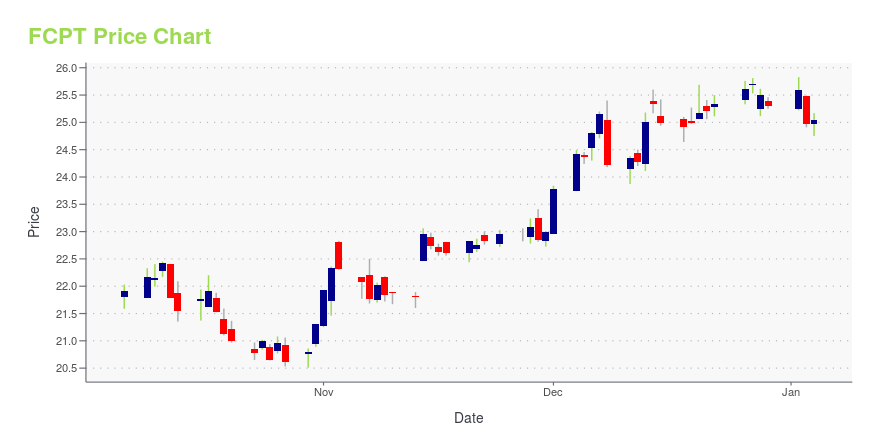

FCPT Stock Price Chart Interactive Chart >

Four Corners Property Trust, Inc. (FCPT) Company Bio

Four Corners Property Trust, a real estate investment trust (REIT), will be primarily engaged in the ownership, acquisition, and leasing of restaurant properties. The company was spun off from Darden Restaurants and is based in Orlando, FL.

Latest FCPT News From Around the Web

Below are the latest news stories about FOUR CORNERS PROPERTY TRUST INC that investors may wish to consider to help them evaluate FCPT as an investment opportunity.

FCPT announces acquisition of two Popeyes properties for $4.7MMore on Four Corners Property Trust |

FCPT Announces Acquisition of Two Popeyes Properties for $4.7 MillionMILL VALLEY, Calif., December 28, 2023--Four Corners Property Trust (NYSE:FCPT), a real estate investment trust primarily engaged in the ownership and acquisition of high-quality, net-leased restaurant and retail properties ("FCPT" or the "Company"), is pleased to announce the acquisition of two Popeyes properties for $4.7 million. The properties are located in strong retail corridors in Arizona and Illinois and are occupied under a long-term, triple net lease with approximately 20 years of term |

FCPT Announces Sale-Leaseback of a Tire Discounters Property for $1.7 MillionMILL VALLEY, Calif., December 27, 2023--Four Corners Property Trust (NYSE:FCPT), a real estate investment trust primarily engaged in the ownership and acquisition of high-quality, net-leased restaurant and retail properties ("FCPT" or the "Company"), is pleased to announce the acquisition of a Tire Discounters property for $1.7 million via sale-leaseback transaction. Tire Discounters is the country’s largest family-owned and operated automotive service provider, with its brands currently operati |

FCPT Announces Fourth Quarter 2023 DividendMILL VALLEY, Calif., November 10, 2023--Four Corners Property Trust, Inc. (NYSE: FCPT) today announced that its Board of Directors declared a quarterly cash dividend of $0.3450 per share (equivalent to $1.38 per share per annum) for the fourth quarter of 2023. This represents a 1.5% increase from the prior quarter. The dividend is payable on January 12, 2024 to shareholders of record as of December 29, 2023. |

FCPT Announces Acquisition of a Taco Bell Property for $2.2 MillionMILL VALLEY, Calif., November 08, 2023--Four Corners Property Trust (NYSE:FCPT), a real estate investment trust primarily engaged in the ownership and acquisition of high-quality, net-leased restaurant and retail properties ("FCPT" or the "Company"), is pleased to announce the acquisition of a Taco Bell property for $2.2 million. The property is located in a strong retail corridor in Oklahoma and is franchisee-operated under a triple net lease to K-MAC Enterprises, LLC with approximately five ye |

FCPT Price Returns

| 1-mo | 13.98% |

| 3-mo | 18.99% |

| 6-mo | 19.60% |

| 1-year | 8.81% |

| 3-year | 10.97% |

| 5-year | 30.94% |

| YTD | 11.84% |

| 2023 | 3.10% |

| 2022 | -7.20% |

| 2021 | 3.42% |

| 2020 | 12.37% |

| 2019 | 12.20% |

FCPT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FCPT

Want to do more research on Four Corners Property Trust Inc's stock and its price? Try the links below:Four Corners Property Trust Inc (FCPT) Stock Price | Nasdaq

Four Corners Property Trust Inc (FCPT) Stock Quote, History and News - Yahoo Finance

Four Corners Property Trust Inc (FCPT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...