FEMASYS INC (FEMY): Price and Financial Metrics

FEMY Price/Volume Stats

| Current price | $1.14 | 52-week high | $4.75 |

| Prev. close | $1.13 | 52-week low | $0.25 |

| Day low | $1.00 | Volume | 681,439 |

| Day high | $1.29 | Avg. volume | 428,019 |

| 50-day MA | $1.14 | Dividend yield | N/A |

| 200-day MA | $1.22 | Market Cap | 25.33M |

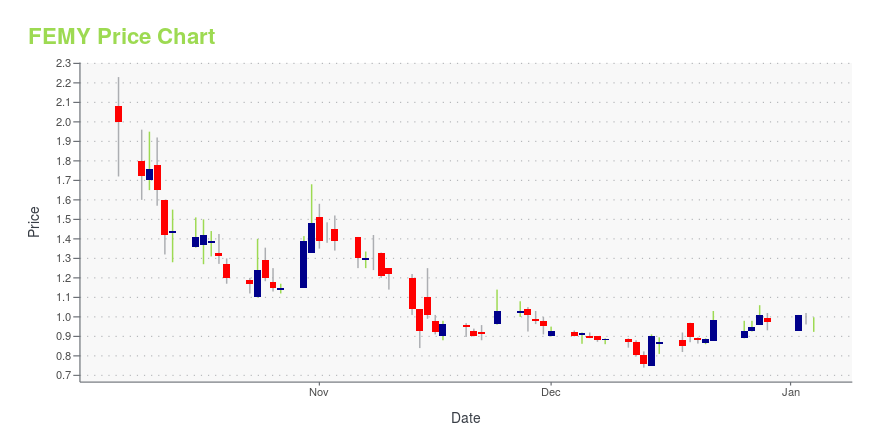

FEMY Stock Price Chart Interactive Chart >

FEMASYS INC (FEMY) Company Bio

Femasys Inc., a biomedical company, researches, develops, and manufactures medical devices for the women's healthcare market in the United States. The company develops permanent birth control solutions, such as FemBloc and FemChec; FemaSeed, an artificial insemination solution; FemCerv, a sterile, single-use disposable endocervical curettage product; and FemEMB, a product candidate for endometrial sampling in support of uterine cancer detection testing. It also commercializes FemVue saline-air device in the United States, Europe, Canada, Japan, and internationally. The company offers its infertility products to obstetrics-gynecological physicians, related healthcare professionals, women's healthcare provider organizations, and reproductive endocrinologists. Femasys Inc. was incorporated in 2004 and is based in Suwanee, Georgia.

Latest FEMY News From Around the Web

Below are the latest news stories about FEMASYS INC that investors may wish to consider to help them evaluate FEMY as an investment opportunity.

Femasys Inc. Begins FemBloc Pivotal Trial Enrollment at Stanford Medicine- Stanford Medicine, a center with a long tradition of leadership in pioneering gynecological research and innovation, is the second academic center to participate in the FemBloc pivotal trial since enrollment began last quarter - - Faculty of the Stanford Medicine Obstetrics and Gynecology (OB/GYN) Department, Paul Blumenthal, M.D. and Erica Cahill, M.D., participated in Femasys’ earlier FemBloc studies - - FemBloc is being developed as a first-of-its-kind, non-surgical permanent birth control |

Femasys Inc. Announces the Appointment of James Liu, M.D., as Chief Medical Officer-- Thought leader from top-ranked academic gynecology program to lead clinical and medical affairs at Femasys --ATLANTA, Nov. 30, 2023 (GLOBE NEWSWIRE) -- Femasys Inc. (NASDAQ: FEMY), a biomedical company focused on meeting significant unmet needs for women worldwide with a broad portfolio of in-office, accessible solutions, including a lead, late-clinical stage product candidate and innovative therapeutic and diagnostic products, today announced the appointment of James Liu, M.D., as Chief Medi |

30 Countries with the Lowest Median Age in the WorldIn this article, we will be analyzing the age structures globally while covering the 30 countries with the lowest median age in the world. If you wish to skip our detailed analysis, you can move directly to the 5 Countries with the Lowest Median Age in the World. Age Dynamics Around the World While the […] |

Femasys Inc. Completes Enrollment of FemaSeed Pivotal Trial in Support of Commercial Launch- Topline results from FemaSeed® pivotal trial expected in 1H 2024 - - Commercial launch planned for early 2024 - ATLANTA, Nov. 28, 2023 (GLOBE NEWSWIRE) -- Femasys Inc. (NASDAQ: FEMY), a biomedical company focused on meeting significant unmet needs for women worldwide with a broad portfolio of in-office, accessible solutions, including a lead, late-clinical stage product candidate and innovative therapeutic and diagnostic products, today announced completion of enrollment in the LOCAL FemaSeed® |

20 Countries with the Highest Teenage Pregnancy RatesIn this article, we will be navigating through adolescent fertility across the world while covering the 20 countries with the highest teenage pregnancy rates. If you wish to skip our detailed analysis, you can move directly to the 5 Countries with the Highest Teenage Pregnancy Rates. Adolescent Pregnancy Across the Globe Early pregnancy and motherhood […] |

FEMY Price Returns

| 1-mo | 9.62% |

| 3-mo | -10.24% |

| 6-mo | 41.14% |

| 1-year | 35.71% |

| 3-year | -84.47% |

| 5-year | N/A |

| YTD | 16.92% |

| 2023 | 8.33% |

| 2022 | -76.92% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...