Phoenix New Media Ltd. Cl A ADR (FENG): Price and Financial Metrics

FENG Price/Volume Stats

| Current price | $3.37 | 52-week high | $4.15 |

| Prev. close | $3.33 | 52-week low | $1.10 |

| Day low | $3.20 | Volume | 2,000 |

| Day high | $3.43 | Avg. volume | 66,163 |

| 50-day MA | $2.75 | Dividend yield | N/A |

| 200-day MA | $1.85 | Market Cap | 40.74M |

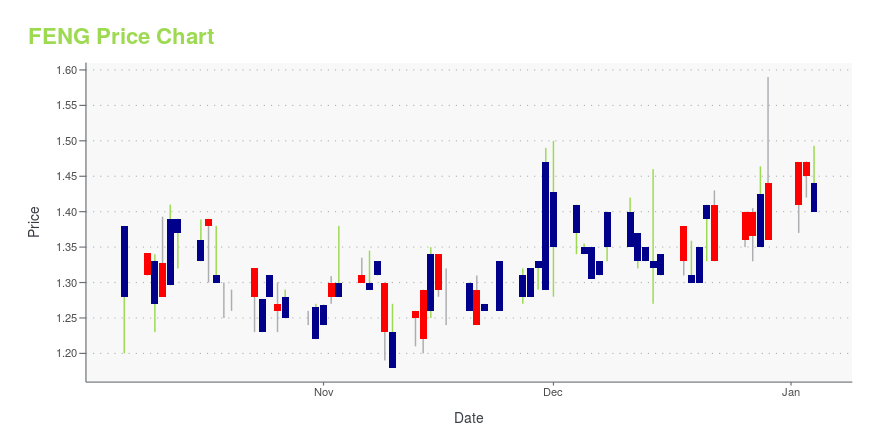

FENG Stock Price Chart Interactive Chart >

Phoenix New Media Ltd. Cl A ADR (FENG) Company Bio

Phoenix New Media Limited provides content on an integrated platform across Internet, mobile, and TV channels in the Peoples Republic of China. It offers content and services through three channels, including ifeng.com channel, video channel, and mobile channel, as well as transmits content to TV viewers, primarily through Phoenix TV. The company was founded in 2007 and is based in Beijing, China.

Latest FENG News From Around the Web

Below are the latest news stories about PHOENIX NEW MEDIA LTD that investors may wish to consider to help them evaluate FENG as an investment opportunity.

Phoenix New Media Limited (NYSE:FENG) Q3 2023 Earnings Call TranscriptPhoenix New Media Limited (NYSE:FENG) Q3 2023 Earnings Call Transcript November 15, 2023 Operator: Good day and thank you for standing by. Welcome to Phoenix New Media Third Quarter 2023 Earnings Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] Please […] |

Phoenix New Media Announces up to US$2 Million Share Repurchase ProgramPhoenix New Media Limited (NYSE: FENG) ("Phoenix New Media", "ifeng" or the "Company"), a leading new media company in China, today announced that the board of directors of the Company has approved a new share repurchase program. Under the terms of the approved program, the Company may repurchase up to US$2 million worth of its outstanding American depositary shares ("ADSs"), each representing 48 Class A ordinary shares of the Company, from time to time for a period not to exceed five (5) months |

Phoenix New Media Limited (NYSE:FENG) Q2 2023 Earnings Call TranscriptPhoenix New Media Limited (NYSE:FENG) Q2 2023 Earnings Call Transcript August 16, 2023 Operator: Good day, and thank you for standing by. Welcome to the Phoenix New Media Second Quarter 2023 Earnings Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] […] |

We Think Phoenix New Media (NYSE:FENG) Needs To Drive Business Growth CarefullyEven when a business is losing money, it's possible for shareholders to make money if they buy a good business at the... |

Phoenix New Media Announces Change of Chief Executive OfficerPhoenix New Media Limited ("Phoenix New Media," "ifeng" or the "Company") (NYSE: FENG), a leading new media company in China, today announced that Mr. Yusheng Sun has replaced Mr. Shuang Liu as the chief executive officer of the Company (the "CEO"). |

FENG Price Returns

| 1-mo | 26.22% |

| 3-mo | 92.57% |

| 6-mo | 135.66% |

| 1-year | 90.40% |

| 3-year | -59.59% |

| 5-year | -80.70% |

| YTD | 147.79% |

| 2023 | -49.25% |

| 2022 | -48.18% |

| 2021 | -28.17% |

| 2020 | -38.78% |

| 2019 | -38.75% |

Continue Researching FENG

Here are a few links from around the web to help you further your research on Phoenix New Media Ltd's stock as an investment opportunity:Phoenix New Media Ltd (FENG) Stock Price | Nasdaq

Phoenix New Media Ltd (FENG) Stock Quote, History and News - Yahoo Finance

Phoenix New Media Ltd (FENG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...