Fuwei Films (Holdings) Co. Ltd. (FFHL): Price and Financial Metrics

FFHL Price/Volume Stats

| Current price | $8.30 | 52-week high | $10.98 |

| Prev. close | $8.50 | 52-week low | $4.40 |

| Day low | $7.86 | Volume | 6,000 |

| Day high | $8.30 | Avg. volume | 11,985 |

| 50-day MA | $7.71 | Dividend yield | N/A |

| 200-day MA | $7.21 | Market Cap | 27.11M |

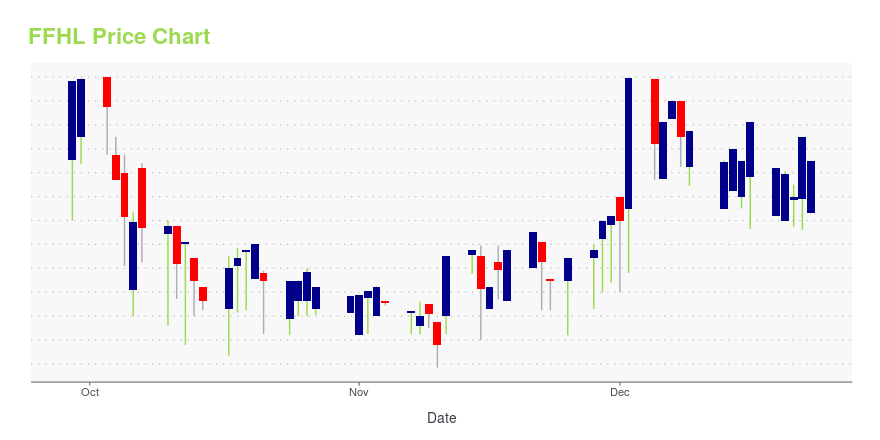

FFHL Stock Price Chart Interactive Chart >

Fuwei Films (Holdings) Co. Ltd. (FFHL) Company Bio

Fuwei Films (Holdings) Co. Ltd. engages in the development, manufacture and distribution of plastic film using the biaxially-oriented polyethylene terephthalate (BOPET) film. Its BOPET film is used for packaging food, medicine, cosmetics, tobacco, and alcohol, as well as in the imaging, electronics, and magnetic products industries. It markets its products under the brand name Fuwei Films. The company was founded on August 9, 2004 and is headquartered in Weifang, China.

Latest FFHL News From Around the Web

Below are the latest news stories about FUWEI FILMS (HOLDINGS) CO LTD that investors may wish to consider to help them evaluate FFHL as an investment opportunity.

Baijiayun Group Ltd Announces Change in Nasdaq Ticker Symbol to "RTC" Post Completion of MergerBaijiayun Group Ltd ("Baijiayun" or the "Company") (Nasdaq: FFHL) today announced that it will change its ticker symbol on the Nasdaq Capital Market from "FFHL" to "RTC." Trading under the new ticker symbol will begin at market opening on Friday, December 30, 2022. |

Chinese Audio And Video SaaS Platform Baijiayun Listed On Nasdaq On 25 Dec.This is the first Chinese audio and video SaaS company listed in the US. |

BaiJiaYun Limited Announces Completion of Merger and New Board and ManagementBaiJiaYun Limited ("BaiJiaYun") today announced the successful completion of the transaction (the "Transaction") previously announced on July 19, 2022 between BaiJiaYun and Fuwei Films (Holdings) Co., Ltd. ("Fuwei Films" or the "Company"). As announced on September 26, 2022, the Transaction and certain additional Transaction-related proposals were approved by Fuwei Films' shareholders at an extraordinary general meeting held on September 24, 2022 (the "EGM"). Among such proposals, the Company's |

Fuwei Films (Holdings) Co., Ltd. Announces Proposed New Executive OfficerFuwei Films (Holdings) Co., Ltd. (Nasdaq: FFHL) ("Fuwei Films" or the "Company"), a manufacturer and distributor of high-quality BOPET plastic films in China, announced that immediately upon the completion of the merger transaction previously announced on July 19, 2022 contemplated by the agreement and plan of merger between Fuwei Films and BaiJiaYun Limited, Mr. Yong Fang will be appointed as the chief financial officer of the Company and Ms. Jingjing Cheng, the current chief financial officer |

Fuwei Films shareholder receives partial waiver regarding lock-upFuwei Films (FFHL) has announced that BaiJiaYun entered into a letter with Apex Glory Holdings, exempting Apex from limitations on disposition with respect to certain equity… |

FFHL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -14.17% |

| 5-year | 323.47% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | -32.85% |

| 2020 | 318.79% |

| 2019 | 31.78% |

Continue Researching FFHL

Want to see what other sources are saying about Fuwei Films (Holdings) Co Ltd's financials and stock price? Try the links below:Fuwei Films (Holdings) Co Ltd (FFHL) Stock Price | Nasdaq

Fuwei Films (Holdings) Co Ltd (FFHL) Stock Quote, History and News - Yahoo Finance

Fuwei Films (Holdings) Co Ltd (FFHL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...