Finwise Bancorp (FINW): Price and Financial Metrics

FINW Price/Volume Stats

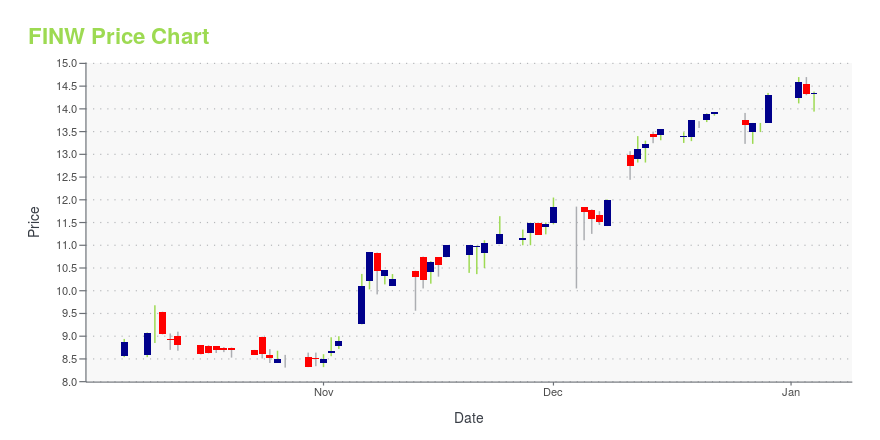

| Current price | $12.32 | 52-week high | $14.98 |

| Prev. close | $11.76 | 52-week low | $8.31 |

| Day low | $11.54 | Volume | 86,400 |

| Day high | $12.36 | Avg. volume | 19,484 |

| 50-day MA | $10.59 | Dividend yield | N/A |

| 200-day MA | $10.95 | Market Cap | 157.62M |

FINW Stock Price Chart Interactive Chart >

Finwise Bancorp (FINW) Company Bio

FinWise Bancorp operates as the bank holding company for FinWise Bank that provides various banking services to individual and corporate customers. It offers various deposit products, including interest and noninterest bearing demand, negotiable order of withdrawal, money market, and checking and savings accounts, as well as time deposits and certificates of deposit. The company also provides small business administration, commercial, commercial real estate, residential real estate, and consumer loans. In addition, it offers a range of deposit services, such as debit cards, remote deposit capture, online banking, mobile banking, and direct deposit services; and cash management services. The company operates one full-service banking location in Sandy, Utah; and a loan production office in Rockville Centre, New York. FinWise Bancorp was founded in 1999 and is headquartered in Murray, Utah.

Latest FINW News From Around the Web

Below are the latest news stories about FINWISE BANCORP that investors may wish to consider to help them evaluate FINW as an investment opportunity.

FinWise Bancorp (FINW) is on the Move, Here's Why the Trend Could be SustainableFinWise Bancorp (FINW) could be a great choice for investors looking to make a profit from fundamentally strong stocks that are currently on the move. It is one of the several stocks that made it through our "Recent Price Strength" screen. |

Best Momentum Stocks to Buy for December 11thGCT, GME and FINW made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on December 11, 2023. |

Recent Price Trend in FinWise Bancorp (FINW) is Your Friend, Here's WhyIf you are looking for stocks that are well positioned to maintain their recent uptrend, FinWise Bancorp (FINW) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen. |

New Strong Buy Stocks for December 11thTWODY, GCT, GME and FINW have been added to the Zacks Rank #1 (Strong Buy) List on December 11, 2023. |

FinWise Bancorp (FINW) Moves to Strong Buy: Rationale Behind the UpgradeFinWise Bancorp (FINW) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

FINW Price Returns

| 1-mo | 21.50% |

| 3-mo | 15.68% |

| 6-mo | -16.42% |

| 1-year | 39.68% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -13.91% |

| 2023 | 54.54% |

| 2022 | -32.85% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...