Fluent, Inc. (FLNT): Price and Financial Metrics

FLNT Price/Volume Stats

| Current price | $2.19 | 52-week high | $3.83 |

| Prev. close | $2.25 | 52-week low | $1.50 |

| Day low | $2.12 | Volume | 17,831 |

| Day high | $2.35 | Avg. volume | 15,093 |

| 50-day MA | $2.02 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 45.21M |

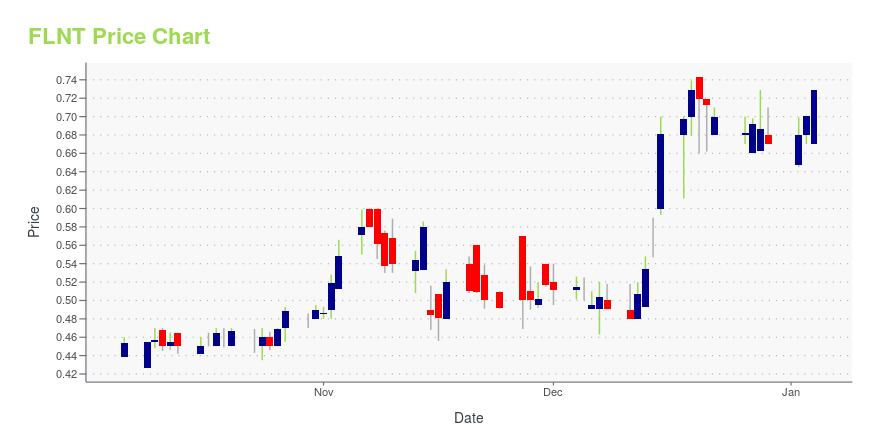

FLNT Stock Price Chart Interactive Chart >

Fluent, Inc. (FLNT) Company Bio

Fluent Inc. (formerly Cogint, Inc.) provides data and analytical solutions in the United States. It empowers clients across markets and industries to execute various aspects of their business, including managing risk, conducting investigations, identifying fraud and abuse, collecting debts, and identifying and acquiring new customers. he company was formerly known as IDI, Inc. and changed its name to Cogint, Inc. in September 2016. The company is based in Boca Raton, Florida.

FLNT Price Returns

| 1-mo | 18.38% |

| 3-mo | N/A |

| 6-mo | -24.17% |

| 1-year | -37.43% |

| 3-year | -71.26% |

| 5-year | -82.11% |

| YTD | -13.10% |

| 2024 | -37.31% |

| 2023 | -38.53% |

| 2022 | -45.23% |

| 2021 | -62.52% |

| 2020 | 112.40% |

Continue Researching FLNT

Want to do more research on Fluent Inc's stock and its price? Try the links below:Fluent Inc (FLNT) Stock Price | Nasdaq

Fluent Inc (FLNT) Stock Quote, History and News - Yahoo Finance

Fluent Inc (FLNT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...