Floor & Decor Holdings, Inc. (FND): Price and Financial Metrics

FND Price/Volume Stats

| Current price | $96.05 | 52-week high | $135.67 |

| Prev. close | $93.44 | 52-week low | $76.30 |

| Day low | $94.42 | Volume | 2,001,733 |

| Day high | $98.32 | Avg. volume | 1,465,414 |

| 50-day MA | $106.93 | Dividend yield | N/A |

| 200-day MA | $106.15 | Market Cap | 10.28B |

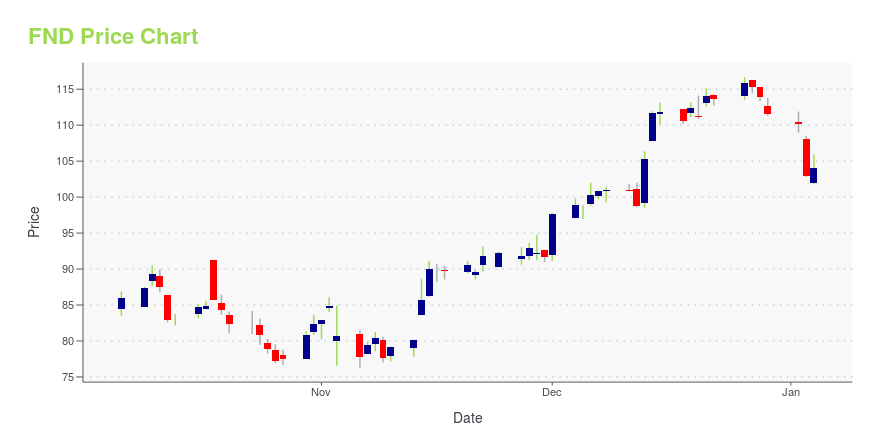

FND Stock Price Chart Interactive Chart >

Floor & Decor Holdings, Inc. (FND) Company Bio

Floor & Decor Holdings, Inc. operates as a specialty retailer of hard surface flooring and related accessories. Its stores offer a range of tile, wood, and laminate and natural stone flooring products, as well as decorative and installation accessories. The company serves professional installers, commercial businesses, and do it yourself customers. The company was founded in 2000 and is based in Smyrna, Georgia.

Latest FND News From Around the Web

Below are the latest news stories about FLOOR & DECOR HOLDINGS INC that investors may wish to consider to help them evaluate FND as an investment opportunity.

Floor & Decor (FND) Unveils 12th Store in NYC Metropolitan AreaFloor & Decor (FND) expands its presence in the New York City Metropolitan Area and unveils its 12th store in Springfield. |

Floor & Decor Announces Grand Opening of Port Chester, New York StoreATLANTA, December 28, 2023--Floor & Decor (NYSE: FND), the leading high-growth retailer specializing in hard-surface flooring for homeowners and professionals, has announced the grand opening of its thirteenth store in the New York City Metropolitan Area, with the addition of its newest location in Port Chester, New York. Located at 130 Midland Avenue, the warehouse store and design center will open with a team of about 50 full-time and part-time associates led by Gina Cox, the store Chief Execu |

Floor & Decor Announces Grand Opening of Springfield, New Jersey StoreATLANTA, December 27, 2023--Floor & Decor (NYSE: FND), the leading high-growth retailer specializing in hard-surface flooring for homeowners and professionals, has announced the grand opening of its twelfth store in the New York City Metropolitan Area, with the addition of its newest location in Springfield, New Jersey. Located at 114-128 U.S. 22, the warehouse store and design center will open with a team of about 50 full-time and part-time associates led by Ira Yellin, the store Chief Executiv |

EVP AND GENERAL COUNSEL David Christopherson Sells Shares of Floor & Decor Holdings IncOn December 21, 2023, David Christopherson, EVP AND GENERAL COUNSEL of Floor & Decor Holdings Inc (NYSE:FND), sold 19,634 shares of the company. |

Floor & Decor Announces Grand Opening of Shrewsbury, Massachusetts StoreATLANTA, December 21, 2023--Floor & Decor (NYSE: FND), the leading high-growth retailer specializing in hard-surface flooring for homeowners and professionals, has announced the grand opening of its seventh store in the Boston Metropolitan Area, with the addition of its newest location in Shrewsbury, Massachusetts. Located at 420 Boston Turnpike Bld #1, the warehouse store and design center will open with a team of about 50 full-time and part-time associates led by Nathaniel Shields, the store C |

FND Price Returns

| 1-mo | -9.01% |

| 3-mo | -13.41% |

| 6-mo | -11.37% |

| 1-year | -13.06% |

| 3-year | -19.16% |

| 5-year | 148.00% |

| YTD | -13.90% |

| 2023 | 60.22% |

| 2022 | -46.44% |

| 2021 | 40.02% |

| 2020 | 82.74% |

| 2019 | 96.18% |

Continue Researching FND

Want to do more research on Floor & Decor Holdings Inc's stock and its price? Try the links below:Floor & Decor Holdings Inc (FND) Stock Price | Nasdaq

Floor & Decor Holdings Inc (FND) Stock Quote, History and News - Yahoo Finance

Floor & Decor Holdings Inc (FND) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...