Federal National Mortgage Association (FNMA): Price and Financial Metrics

FNMA Price/Volume Stats

| Current price | $9.48 | 52-week high | $11.91 |

| Prev. close | $9.35 | 52-week low | $1.02 |

| Day low | $9.15 | Volume | 2,369,900 |

| Day high | $9.55 | Avg. volume | 12,354,025 |

| 50-day MA | $8.50 | Dividend yield | N/A |

| 200-day MA | $5.20 | Market Cap | 10.98B |

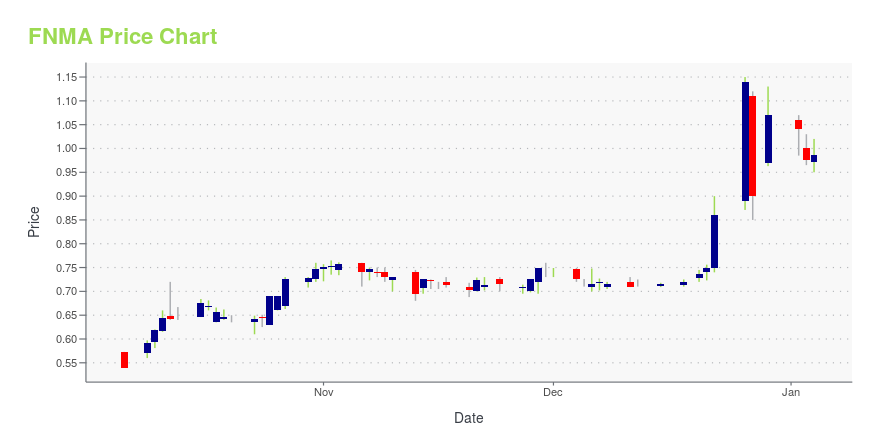

FNMA Stock Price Chart Interactive Chart >

Federal National Mortgage Association (FNMA) Company Bio

Federal National Mortgage Association provides a source of financing for mortgages in the United States. It securitizes mortgage loans originated by lenders into Fannie Mae mortgage-backed securities (Fannie Mae MBS). The company operates in two segments, Single-Family and Multifamily. The Single-Family segment securitizes and purchases single-family fixed-rate or adjustable-rate, first-lien mortgage loans, or mortgage-related securities backed by these loans; and loans that are insured by Federal Housing Administration, loans guaranteed by the Department of Veterans Affairs and Rural Development Housing and Community Facilities Program of the U.S. Department of Agriculture, manufactured housing mortgage loans, and other mortgage-related securities. This segment also provides single-family mortgage, as well as credit risk and loss management services. The Multifamily segment securitizes multifamily mortgage loans into Fannie Mae MBS; purchases multifamily mortgage loans; and provides credit enhancement for bonds issued by state and local housing finance authorities to finance multifamily housing. This segment also issues structured MBS backed by Fannie Mae multifamily MBS; buys and sells multifamily agency mortgage-backed securities; and offers delegated underwriting and servicing, as well as multifamily mortgage, and credit risk and loss management services. The company serves mortgage banking companies, savings and loan associations, savings banks, commercial banks, credit unions, community banks, specialty servicers, insurance companies, and state and local housing finance agencies. Federal National Mortgage Association was founded in 1938 and is headquartered in Washington, the District of Columbia.

FNMA Price Returns

| 1-mo | 5.10% |

| 3-mo | 67.79% |

| 6-mo | 117.43% |

| 1-year | 549.32% |

| 3-year | 1,924.34% |

| 5-year | 345.07% |

| YTD | 189.02% |

| 2024 | 206.54% |

| 2023 | 202.77% |

| 2022 | -56.91% |

| 2021 | -65.69% |

| 2020 | -23.40% |

Continue Researching FNMA

Want to see what other sources are saying about Federal National Mortgage Association Fannie Mae's financials and stock price? Try the links below:Federal National Mortgage Association Fannie Mae (FNMA) Stock Price | Nasdaq

Federal National Mortgage Association Fannie Mae (FNMA) Stock Quote, History and News - Yahoo Finance

Federal National Mortgage Association Fannie Mae (FNMA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...