Fox Corp. CI A (FOXA): Price and Financial Metrics

FOXA Price/Volume Stats

| Current price | $54.73 | 52-week high | $58.74 |

| Prev. close | $54.92 | 52-week low | $30.02 |

| Day low | $54.38 | Volume | 3,149,300 |

| Day high | $55.51 | Avg. volume | 4,016,673 |

| 50-day MA | $53.54 | Dividend yield | 0.98% |

| 200-day MA | $44.62 | Market Cap | 24.82B |

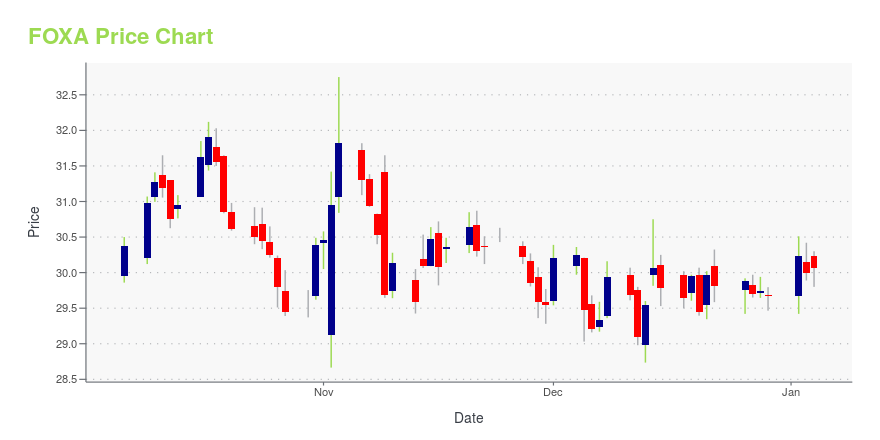

FOXA Stock Price Chart Interactive Chart >

Fox Corp. CI A (FOXA) Company Bio

Fox Corporation (stylized in all-caps as FOX Corporation) is a publicly traded American mass media company operated and controlled by media mogul Rupert Murdoch and headquartered at 1211 Avenue of the Americas in New York City. Incorporated in Delaware, it was formed in 2019 as a result of the acquisition of 21st Century Fox by The Walt Disney Company; the assets that were not acquired by Disney were spun off from 21st Century Fox as the new Fox Corp., and its stock began trading on March 19, 2019. The company is controlled by the Murdoch family via a family trust with 39.6% ownership share.(Source:Wikipedia)

FOXA Price Returns

| 1-mo | -4.52% |

| 3-mo | 13.20% |

| 6-mo | 30.97% |

| 1-year | N/A |

| 3-year | 45.12% |

| 5-year | 162.41% |

| YTD | 13.20% |

| 2024 | 66.31% |

| 2023 | -0.83% |

| 2022 | -16.61% |

| 2021 | 28.24% |

| 2020 | -20.22% |

FOXA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FOXA

Want to do more research on Fox Corp's stock and its price? Try the links below:Fox Corp (FOXA) Stock Price | Nasdaq

Fox Corp (FOXA) Stock Quote, History and News - Yahoo Finance

Fox Corp (FOXA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...