Fox Corp. CI A (FOXA): Price and Financial Metrics

FOXA Price/Volume Stats

| Current price | $31.21 | 52-week high | $35.40 |

| Prev. close | $31.68 | 52-week low | $28.28 |

| Day low | $31.08 | Volume | 3,166,000 |

| Day high | $31.69 | Avg. volume | 3,344,542 |

| 50-day MA | $30.31 | Dividend yield | 1.64% |

| 200-day MA | $31.06 | Market Cap | 14.82B |

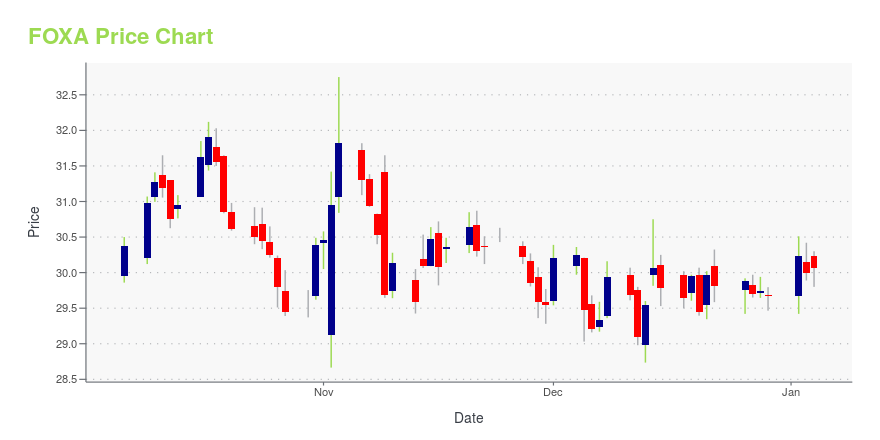

FOXA Stock Price Chart Interactive Chart >

Fox Corp. CI A (FOXA) Company Bio

Fox Corporation (stylized in all-caps as FOX Corporation) is a publicly traded American mass media company operated and controlled by media mogul Rupert Murdoch and headquartered at 1211 Avenue of the Americas in New York City. Incorporated in Delaware, it was formed in 2019 as a result of the acquisition of 21st Century Fox by The Walt Disney Company; the assets that were not acquired by Disney were spun off from 21st Century Fox as the new Fox Corp., and its stock began trading on March 19, 2019. The company is controlled by the Murdoch family via a family trust with 39.6% ownership share.(Source:Wikipedia)

Latest FOXA News From Around the Web

Below are the latest news stories about FOX CORP that investors may wish to consider to help them evaluate FOXA as an investment opportunity.

New York Times/Siena College Poll Finds Voters Choose FOX News Channel as Their Dominant Single Source of NewsNEW YORK, December 21, 2023--FOX News Channel (FNC) is named as the single news network voters turn to most often, according to a recent New York Times/Siena College poll of registered voters nationwide. Ranking as the number one news network, FNC placed above CNN and MSNBC, along with topping the New York Times, Wall Street Journal, PBS and NPR. |

The 17 most transformative media moments of 2023From OpenAI to newsroom layoffs, the last 12 months, which were absolutely brimming with consequential and disruptive moments across the media landscape. |

OutKick Sees Strong Growth in November 2023NEW YORK, December 19, 2023--OutKick, the fastest growing national multimedia sports platform, saw strong growth month over month in November 2023 with over 6.4 million total multiplatform unique visitors (up 6% versus the prior month), 24 million total multiplatform views, (up 2% versus the prior month), and 23 million total multiplatform minutes (up 1% flat versus the prior month), according to Comscore. |

Fox (FOXA) News Digital Rides on Multiplatform Views in NovemberFox (FOXA) News Digital maintains a strong performance in November, outperforming other prominent news brands in terms of multiplatform viewership and engagement time. |

FOX News Digital Continues to Lead News Brands With Multiplatform Views and MinutesNEW YORK, December 18, 2023--FOX News Digital finished November continuing its streak as the top news brand with both multiplatform views and minutes, according to Comscore. Notably, this marks 33 consecutive months that FOX News Digital has led news brands with multiplatform minutes and 14 consecutive months that it has been the leader in multiplatform views. FOX News Digital closed out the month reaching 2.9 billion total multiplatform minutes, 1.7 billion total multiplatform views, and 89 mil |

FOXA Price Returns

| 1-mo | -0.19% |

| 3-mo | -2.26% |

| 6-mo | 6.43% |

| 1-year | -4.56% |

| 3-year | -13.80% |

| 5-year | -13.95% |

| YTD | 6.14% |

| 2023 | -0.83% |

| 2022 | -16.61% |

| 2021 | 28.24% |

| 2020 | -20.22% |

| 2019 | N/A |

FOXA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FOXA

Want to do more research on Fox Corp's stock and its price? Try the links below:Fox Corp (FOXA) Stock Price | Nasdaq

Fox Corp (FOXA) Stock Quote, History and News - Yahoo Finance

Fox Corp (FOXA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...