Fox Factory Holding Corp. (FOXF): Price and Financial Metrics

FOXF Price/Volume Stats

| Current price | $52.08 | 52-week high | $117.68 |

| Prev. close | $51.00 | 52-week low | $37.98 |

| Day low | $50.74 | Volume | 478,958 |

| Day high | $52.29 | Avg. volume | 613,383 |

| 50-day MA | $47.35 | Dividend yield | N/A |

| 200-day MA | $56.93 | Market Cap | 2.17B |

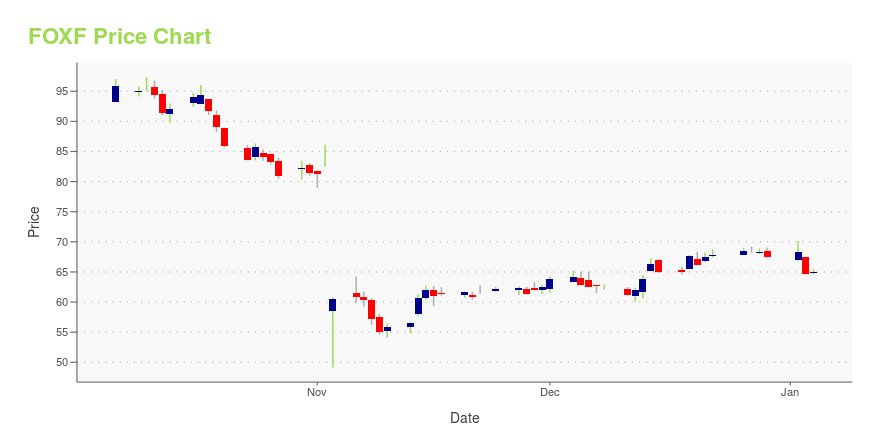

FOXF Stock Price Chart Interactive Chart >

Fox Factory Holding Corp. (FOXF) Company Bio

Fox Factory Holding Corporation designs and manufactures high-performance ride dynamics products primarily for bicycles, side-by-side vehicles, on-road and off-road vehicles and trucks, all-terrain vehicles, snowmobiles, specialty vehicles and applications, and motorcycles. The company was incorporated in 2007 and is based in Scotts Valley, California.

Latest FOXF News From Around the Web

Below are the latest news stories about FOX FACTORY HOLDING CORP that investors may wish to consider to help them evaluate FOXF as an investment opportunity.

What Makes Fox Factory Holding Corp. (FOXF) an Attractive Investment?Baron Funds, an investment management company, released its “Baron Small Cap Fund” third-quarter 2023 investor letter. A copy of the same can be downloaded here. The fund had a fine quarter and is having a good year. The fund was down 3.11% (Institutional Shares) in the third quarter, in a weak market and year-to-date the fund […] |

Compass Diversified Completes Sale of Marucci SportsWESTPORT, Conn., Nov. 15, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, announced today the completion of the Company’s previously announced sale of its majority owned subsidiary, Wheelhouse Holdings, Inc. (“Marucci”), the parent company of Marucci Sports, LLC, to Fox Factory Holding Corp. (NASDAQ: FOXF) (“FOX”), a designer and manufacturer of performance-defining ride dynamics products primarily for a wide rang |

Fox Factory Completes Acquisition of Marucci Sports, Enhancing Combined Company’s Ability to Deliver Diversified Revenue and Profitable Growth$572 million acquisition will be immediately accretive to top and bottom-line Combination offers expected engineering, manufacturing and sourcing synergiesCompanies share complementary cultures that drive category leadership in enthusiast brands by successfully winning over passionate consumer basesFOX recently reaffirmed 2025 target of $2.0 billion sales and 25% adjusted EBITDA margin – which excludes MarucciAcquisition continues FOX’s track record of generating successful returns from M&A outs |

Is There An Opportunity With Fox Factory Holding Corp.'s (NASDAQ:FOXF) 43% Undervaluation?Key Insights The projected fair value for Fox Factory Holding is US$96.99 based on 2 Stage Free Cash Flow to Equity Fox... |

Fox Factory Holding Corp. (NASDAQ:FOXF) Q3 2023 Earnings Call TranscriptFox Factory Holding Corp. (NASDAQ:FOXF) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good afternoon ladies and gentlemen and thank you for standing by. Welcome to the Fox Factory Holdings Corporation Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal […] |

FOXF Price Returns

| 1-mo | 8.18% |

| 3-mo | 28.75% |

| 6-mo | -18.63% |

| 1-year | -52.20% |

| 3-year | -66.43% |

| 5-year | -39.74% |

| YTD | -22.82% |

| 2023 | -26.03% |

| 2022 | -46.37% |

| 2021 | 60.91% |

| 2020 | 51.95% |

| 2019 | 18.18% |

Continue Researching FOXF

Here are a few links from around the web to help you further your research on Fox Factory Holding Corp's stock as an investment opportunity:Fox Factory Holding Corp (FOXF) Stock Price | Nasdaq

Fox Factory Holding Corp (FOXF) Stock Quote, History and News - Yahoo Finance

Fox Factory Holding Corp (FOXF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...