Fisker Inc. (FSR): Price and Financial Metrics

FSR Price/Volume Stats

| Current price | $0.09 | 52-week high | $7.22 |

| Prev. close | $0.12 | 52-week low | $0.09 |

| Day low | $0.09 | Volume | 62,229,200 |

| Day high | $0.09 | Avg. volume | 85,294,414 |

| 50-day MA | $0.60 | Dividend yield | N/A |

| 200-day MA | $3.68 | Market Cap | 31.44M |

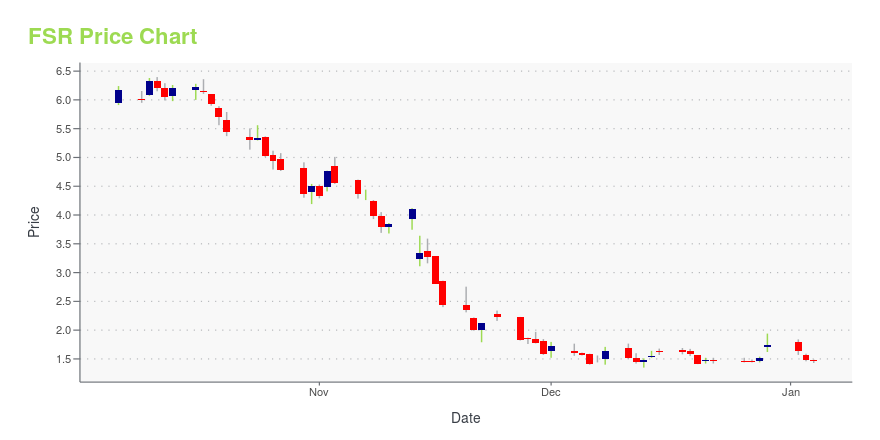

FSR Stock Price Chart Interactive Chart >

Fisker Inc. (FSR) Company Bio

Fisker, Inc. operates in the automotive industry that develops eco-friendly electric vehicles. The company is based in Manhattan Beach, California.

Latest FSR News From Around the Web

Below are the latest news stories about FISKER INC that investors may wish to consider to help them evaluate FSR as an investment opportunity.

FSR Stock Climbs as Fisker Deliveries Jump 300% in Q4FSR stock is rallying in early trading after Fisker reported that its deliveries had jumped 300% in Q4 versus Q3. |

Fisker (FSR) Commences Deliveries of Ocean Sports in U.K.Fisker (FSR) hands over its Ocean Sport electric SUV to the first customer at the Fisker Lounge London. |

Fisker Enhances Its Loyalty Program to Include Additional Benefits, Rewards, and Exclusive PerksLOS ANGELES, December 28, 2023--Fisker Inc. (NYSE: FSR) ("Fisker"), driven by a mission to create the world’s most emotional and sustainable electric vehicles, has enhanced its Loyalty Program to provide customers with lifetime benefits, rewards, exclusive perks, and giveaways. |

Fisker Delivers First Fisker Ocean Sport to CustomerLOS ANGELES & MUNICH, December 27, 2023--Fisker Inc. (NYSE: FSR) ("Fisker"), driven by a mission to create the world’s most emotional and sustainable electric vehicles, today announced the first customer hand-over of a Fisker Ocean Sport electric SUV at the Fisker Lounge London location in the Westfield London mall. |

LCID Stock: Lucid Motors Fans Cheer Potential Tariffs on Chinese EVsPresident Biden may be considering a tariff increase on Chinese exports. |

FSR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -88.79% |

| 1-year | -98.40% |

| 3-year | -99.43% |

| 5-year | N/A |

| YTD | -94.86% |

| 2023 | -75.93% |

| 2022 | -53.78% |

| 2021 | 7.37% |

| 2020 | 44.08% |

| 2019 | N/A |

Loading social stream, please wait...