Fusion Acquisition Corp. (FUSE): Price and Financial Metrics

FUSE Price/Volume Stats

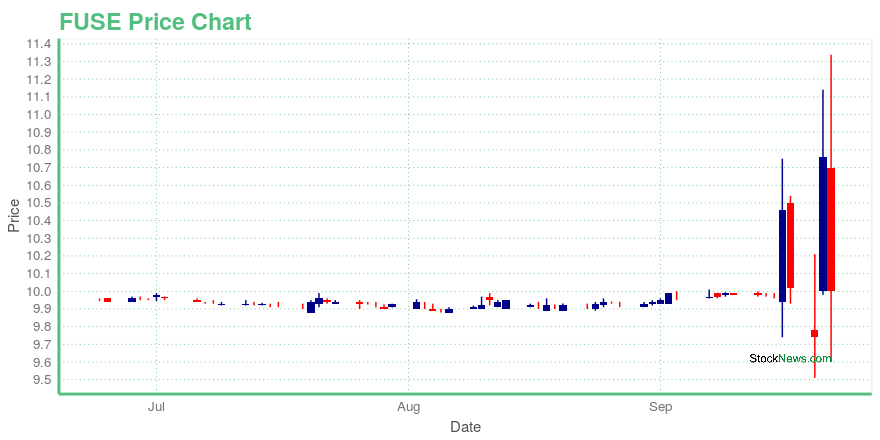

| Current price | $10.00 | 52-week high | $12.90 |

| Prev. close | $10.76 | 52-week low | $9.51 |

| Day low | $9.60 | Volume | 3,769,600 |

| Day high | $11.34 | Avg. volume | 1,124,506 |

| 50-day MA | $9.96 | Dividend yield | N/A |

| 200-day MA | $10.35 | Market Cap | 437.50M |

FUSE Stock Price Chart Interactive Chart >

Fusion Acquisition Corp. (FUSE) Company Bio

Fusion Acquisition Corp. focuses on entering into a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company was founded in 2020 and is based in New York, New York.

Latest FUSE News From Around the Web

Below are the latest news stories about Fusion Acquisition Corp that investors may wish to consider to help them evaluate FUSE as an investment opportunity.

MoneyLion to Become Publicly Traded Following Completion of Business Combination with Fusion Acquisition Corp.MoneyLion to Begin Trading Tomorrow on the NYSE Under Ticker Symbol “ML”NEW YORK, Sept. 22, 2021 (GLOBE NEWSWIRE) -- MoneyLion Inc. (“MoneyLion”) an award-winning, data-driven, digital financial platform, announced today that it has closed its previously announced business combination with Fusion Acquisition Corp. (“Fusion”). The transaction was approved at a special meeting of Fusion’s stockholders on September 21, 2021. The combined company will be renamed “MoneyLion Inc.” and will be led by i |

MoneyLion Launches New Cryptocurrency Offering With $1,000,000 Prize Pool GiveawayNew Service Enables Users to Buy and Sell Bitcoin and Ethereum as well as Earn Bitcoin through Spending RoundupsNEW YORK, Sept. 13, 2021 (GLOBE NEWSWIRE) -- MoneyLion Inc. (“MoneyLion” or the “Company”), an award-winning, data-driven, digital financial platform, today announced the launch of its new cryptocurrency capabilities, enabling customers to buy and sell digital currencies within the Company’s all-in-one app. Eligible MoneyLion customers will initially be able to buy and sell Bitcoin and |

MoneyLion Raises Annual Revenue GuidanceExpects higher user growth and contribution of new products to drive increased revenue growth through 2023NEW YORK, Sept. 08, 2021 (GLOBE NEWSWIRE) -- MoneyLion Inc. (“MoneyLion” or the “Company”), an award-winning, data-driven, digital financial platform, announced today an update to its annual guidance for fiscal years 2021, 2022 and 2023, ahead of the planned closing of its previously announced business combination (the “Business Combination”) with Fusion Acquisition Corp. (NYSE: FUSE) (“Fusi |

MoneyLion to Host Virtual Investor Conference on Monday, September 13, 2021 in Advance of Planned Closing of Business Combination with Fusion Acquisition Corp. (NYSE:FUSE)NEW YORK, Sept. 07, 2021 (GLOBE NEWSWIRE) -- MoneyLion Inc. (“MoneyLion”), an award-winning, data-driven, digital financial platform, announced today it will host a virtual Investor Conference on Monday, September 13, 2021, at 1:00 p.m. Eastern Time, ahead of the planned closing of its previously announced business combination (the “Business Combination”) with Fusion Acquisition Corp. (NYSE: FUSE) (“Fusion”). MoneyLion’s CEO and Founder, Dee Choubey, along with Chief Financial Officer Rick Corre |

MoneyLion Announces Effectiveness of S-4 Registration Statement for Proposed Business Combination with Fusion Acquisition Corp. (NYSE: FUSE)Special meeting of Fusion Acquisition Corp. shareholders to approve the proposed business combination to be held on September 21, 2021 at 9:00 a.m. Eastern TimeNEW YORK, Sept. 03, 2021 (GLOBE NEWSWIRE) -- MoneyLion, Inc. (“MoneyLion”), an award-winning, data-driven, digital financial platform, today announced that the U.S. Securities and Exchange Commission ("SEC") has declared effective the registration statement on Form S-4 relating to MoneyLion’s previously announced proposed business combina |

FUSE Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 0.70% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | 0.00% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...