Arcimoto Inc. (FUV): Price and Financial Metrics

FUV Price/Volume Stats

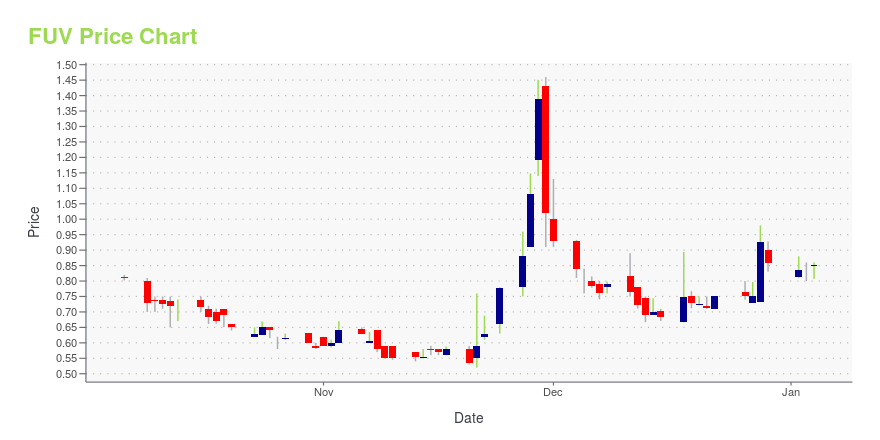

| Current price | $0.38 | 52-week high | $1.85 |

| Prev. close | $0.40 | 52-week low | $0.38 |

| Day low | $0.38 | Volume | 116,000 |

| Day high | $0.43 | Avg. volume | 59,661 |

| 50-day MA | $0.48 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 3.59M |

FUV Stock Price Chart Interactive Chart >

Arcimoto Inc. (FUV) Company Bio

Arcimoto, Inc. develops and manufactures electric vehicles to help the world shift to a transportation system. Its FUV purpose is to built for everyday driving, transforming ordinary trips into pure-electric joyrides and Deliverator and Rapid Responder provides last-mile delivery and emergency response functionality at a fraction of the environmental impact of traditional gas-powered vehicles. The company was founded by Mark Frohnmayer on November 21, 2007 and is headquartered in Eugene, OR.

FUV Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -88.34% |

| 5-year | -93.39% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -73.98% |

| 2022 | -57.58% |

| 2021 | -41.19% |

| 2020 | 721.74% |

Continue Researching FUV

Want to do more research on Arcimoto Inc's stock and its price? Try the links below:Arcimoto Inc (FUV) Stock Price | Nasdaq

Arcimoto Inc (FUV) Stock Quote, History and News - Yahoo Finance

Arcimoto Inc (FUV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...