Gaia, Inc. - (GAIA): Price and Financial Metrics

GAIA Price/Volume Stats

| Current price | $5.07 | 52-week high | $5.19 |

| Prev. close | $4.97 | 52-week low | $2.11 |

| Day low | $4.93 | Volume | 12,981 |

| Day high | $5.10 | Avg. volume | 31,488 |

| 50-day MA | $4.63 | Dividend yield | N/A |

| 200-day MA | $3.42 | Market Cap | 118.87M |

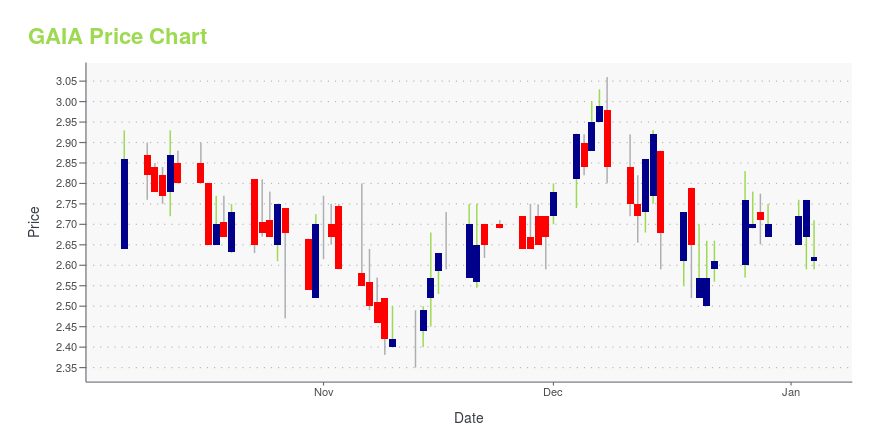

GAIA Stock Price Chart Interactive Chart >

Gaia, Inc. - (GAIA) Company Bio

Gaiam, Inc. provides a range of yoga, fitness, and well-being products worldwide. It operates in two segments, Gaiam Brand and Gaiam TV. The company develops and markets yoga and fitness accessories, including yoga mats, bags, straps, and blocks; restorative and massage accessories, such as rollers, resistance cords, balance balls, and various other offerings; apparel comprising pants, shorts, tops, and jackets designed around yoga; and media content consisting of digital media and apps under the Gaiam, Gaiam Restore, and SPRI brands. The company was founded in 1988 and is based in Louisville, Colorado.

Latest GAIA News From Around the Web

Below are the latest news stories about GAIA INC that investors may wish to consider to help them evaluate GAIA as an investment opportunity.

Gaia Appoints James Colquhoun as CEO and Launches New AI Powered SearchBOULDER, Colo., Dec. 04, 2023 (GLOBE NEWSWIRE) -- Gaia, Inc. (NASDAQ: GAIA), a conscious media and community company, today announced that it has appointed James Colquhoun as Chief Executive Officer. In his new role, Colquhoun will be responsible for overseeing Gaia’s growth and day-to-day operations, reporting to founder Jirka Rysavy in his role of executive chairman. Colquhoun will be leveraging his marketing skills and leadership abilities to help Gaia provide unique conscious content to its |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start the day with a breakdown of the biggest pre-market stock movers worth keeping tabs on for Thursday morning! |

Shareholders in Gaia (NASDAQ:GAIA) are in the red if they invested five years agoWe're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't... |

Q3 2023 Gaia Inc Earnings CallQ3 2023 Gaia Inc Earnings Call |

Gaia, Inc. (NASDAQ:GAIA) Q3 2023 Earnings Call TranscriptGaia, Inc. (NASDAQ:GAIA) Q3 2023 Earnings Call Transcript October 30, 2023 Gaia, Inc. misses on earnings expectations. Reported EPS is $-0.03 EPS, expectations were $-0.01. Operator: Good afternoon, everyone. And thank you for participating in today’s conference call to discuss Gaia, Inc.’s Financial Results for the Third Quarter ended September 30, 2023. Joining us today […] |

GAIA Price Returns

| 1-mo | 12.42% |

| 3-mo | 30.33% |

| 6-mo | 69.00% |

| 1-year | 136.92% |

| 3-year | -56.03% |

| 5-year | -16.34% |

| YTD | 87.78% |

| 2023 | 13.45% |

| 2022 | -72.23% |

| 2021 | -13.26% |

| 2020 | 23.65% |

| 2019 | -22.88% |

Continue Researching GAIA

Here are a few links from around the web to help you further your research on Gaia Inc's stock as an investment opportunity:Gaia Inc (GAIA) Stock Price | Nasdaq

Gaia Inc (GAIA) Stock Quote, History and News - Yahoo Finance

Gaia Inc (GAIA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...