New Concept Energy, Inc (GBR): Price and Financial Metrics

GBR Price/Volume Stats

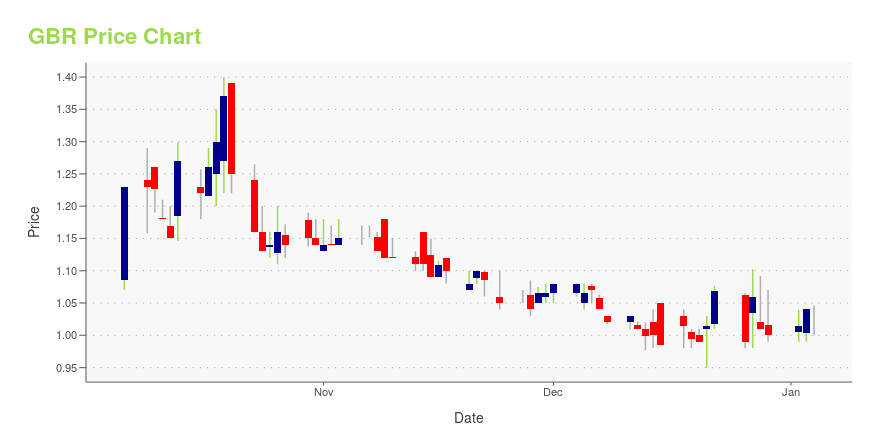

| Current price | $1.50 | 52-week high | $1.82 |

| Prev. close | $1.56 | 52-week low | $0.95 |

| Day low | $1.50 | Volume | 3,700 |

| Day high | $1.57 | Avg. volume | 50,157 |

| 50-day MA | $1.53 | Dividend yield | N/A |

| 200-day MA | $1.20 | Market Cap | 7.70M |

GBR Stock Price Chart Interactive Chart >

New Concept Energy, Inc (GBR) Company Bio

New Concept Energy, Inc., through its subsidiaries, owns and operates oil and gas wells, and mineral leases primarily in the United States. Its oil and gas wells, and mineral leases are located in Athens and Meigs counties in Ohio; and Calhoun, Jackson, and Roane counties in West Virginia. As of December 31, 2019, the company had 153 producing gas wells; 44 non-producing wells and related equipment; and mineral leases covering approximately 20,000 acres. The company was formerly known as CabelTel International Corporation and changed its name to New Concept Energy, Inc. in May 2008. The company was founded in 1978 and is based in Dallas, Texas. New Concept Energy, Inc. is a subsidiary of Realty Advisors, Inc.

Latest GBR News From Around the Web

Below are the latest news stories about NEW CONCEPT ENERGY INC that investors may wish to consider to help them evaluate GBR as an investment opportunity.

New Concept Energy, Inc. Reports Third Quarter 2023 ResultsDALLAS, November 09, 2023--New Concept Energy, Inc. (NYSE American: GBR), (the "Company" or "NCE") a Dallas-based company, today reported Results of Operations for the third quarter ended September 30, 2023. |

New Concept Energy, Inc. Reports Second Quarter 2023 ResultsDALLAS, August 07, 2023--New Concept Energy, Inc. (NYSE American: GBR), (the "Company" or "NCE") a Dallas-based company, today reported Results of Operations for the second quarter ended June 30, 2023. |

3 Penny Stocks That Pack a Surprising PunchA controversial segment of the market, the concept of strong penny stocks nevertheless carries a certain charm. Now, let’s get something straight. Investing in this extremely risky space carries with it obvious dangers. Because of their low price and lack of attention (trading volume), these publicly traded securities can be wildly volatile. Don’t wager more than you can afford to lose. Still, some high-risk ideas represent surprisingly good penny stocks. Here’s another reality. With thousands u |

New Concept Energy, Inc. Reports First Quarter 2023 ResultsDALLAS, May 10, 2023--New Concept Energy, Inc. (NYSE American: GBR), (the "Company" or "NCE") a Dallas-based company, today reported Results of Operations for the first quarter ended March 31, 2023. |

New Concept Energy, Inc. Reports Fourth Quarter and Full Year 2022 ResultsDALLAS, March 21, 2023--New Concept Energy, Inc. (NYSE American: GBR), (the "Company" or "NCE") a Dallas-based company, today reported Results of Operations for the fourth quarter and the full year ended December 31, 2022. |

GBR Price Returns

| 1-mo | -5.66% |

| 3-mo | 19.05% |

| 6-mo | 48.51% |

| 1-year | 32.74% |

| 3-year | -67.74% |

| 5-year | -9.64% |

| YTD | 50.00% |

| 2023 | -8.26% |

| 2022 | -54.20% |

| 2021 | 22.80% |

| 2020 | 57.57% |

| 2019 | -12.14% |

Continue Researching GBR

Want to see what other sources are saying about New Concept Energy Inc's financials and stock price? Try the links below:New Concept Energy Inc (GBR) Stock Price | Nasdaq

New Concept Energy Inc (GBR) Stock Quote, History and News - Yahoo Finance

New Concept Energy Inc (GBR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...