Genesis Healthcare, Inc. (GEN): Price and Financial Metrics

GEN Price/Volume Stats

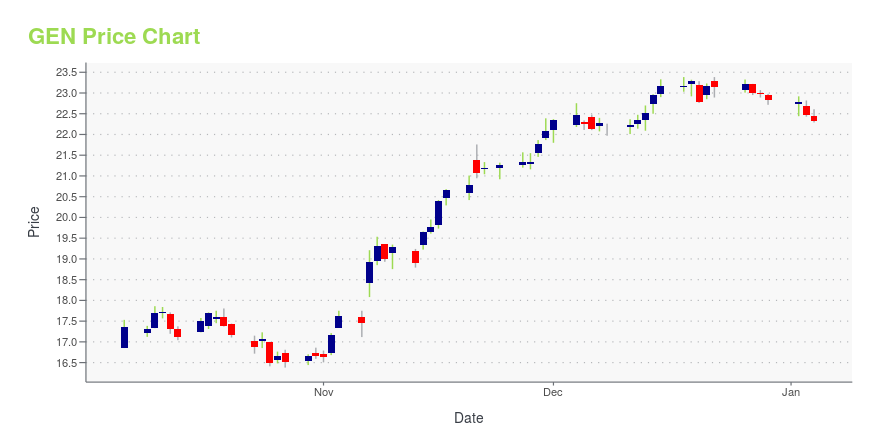

| Current price | $26.09 | 52-week high | $26.27 |

| Prev. close | $25.21 | 52-week low | $16.38 |

| Day low | $25.37 | Volume | 4,689,600 |

| Day high | $26.27 | Avg. volume | 4,665,451 |

| 50-day MA | $24.83 | Dividend yield | 1.98% |

| 200-day MA | $22.08 | Market Cap | 16.34B |

GEN Stock Price Chart Interactive Chart >

Genesis Healthcare, Inc. (GEN) Company Bio

Genesis Healthcare provides post-acute care services through a network of skilled nursing centers and assisted/senior living communities in the United States. It operates through three segments: Long-Term Care Services, Therapy Services, and Hospice and Home Health Services. The company was founded in 2003 and is based in Kennett Square, Pennsylvania.

Latest GEN News From Around the Web

Below are the latest news stories about GEN DIGITAL INC that investors may wish to consider to help them evaluate GEN as an investment opportunity.

7 Compelling Tech Stocks to Snag From the Discount BinYou don’t need to be a Wall Street expert to realize that innovators dominated the equities space in 2023. |

Why These 3 Growth Stocks Should Be on Your Radar in 2024Are you looking to build your portfolio in 2024? |

Best Growth Stocks 2024: 7 to Add to Your Must-Buy ListMany investors made it a point to avoid growth stocks after a disastrous 2022, but long-term investors were rewarded this year. |

Jacobs Solutions (J) Up 1.8% Since Last Earnings Report: Can It Continue?Jacobs Solutions (J) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

How To Make Sustainability Part of Your Holiday SeasonNORTHAMPTON, MA / ACCESSWIRE / December 20, 2023 / Gen By Amanda Davis The holidays are here again. For many of us, this time of year means gifts, gatherings, eating and good memories as we celebrate with friends and family. The trouble is, all that ... |

GEN Price Returns

| 1-mo | 5.97% |

| 3-mo | 27.09% |

| 6-mo | 9.07% |

| 1-year | 37.07% |

| 3-year | 10.41% |

| 5-year | 31.75% |

| YTD | 15.57% |

| 2023 | 9.29% |

| 2022 | -15.81% |

| 2021 | 27.59% |

| 2020 | -16.60% |

| 2019 | 37.17% |

GEN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GEN

Here are a few links from around the web to help you further your research on Genesis Healthcare Inc's stock as an investment opportunity:Genesis Healthcare Inc (GEN) Stock Price | Nasdaq

Genesis Healthcare Inc (GEN) Stock Quote, History and News - Yahoo Finance

Genesis Healthcare Inc (GEN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...