Gevo, Inc. (GEVO): Price and Financial Metrics

GEVO Price/Volume Stats

| Current price | $0.61 | 52-week high | $1.73 |

| Prev. close | $0.61 | 52-week low | $0.53 |

| Day low | $0.60 | Volume | 735,600 |

| Day high | $0.63 | Avg. volume | 5,141,792 |

| 50-day MA | $0.63 | Dividend yield | N/A |

| 200-day MA | $0.86 | Market Cap | 143.20M |

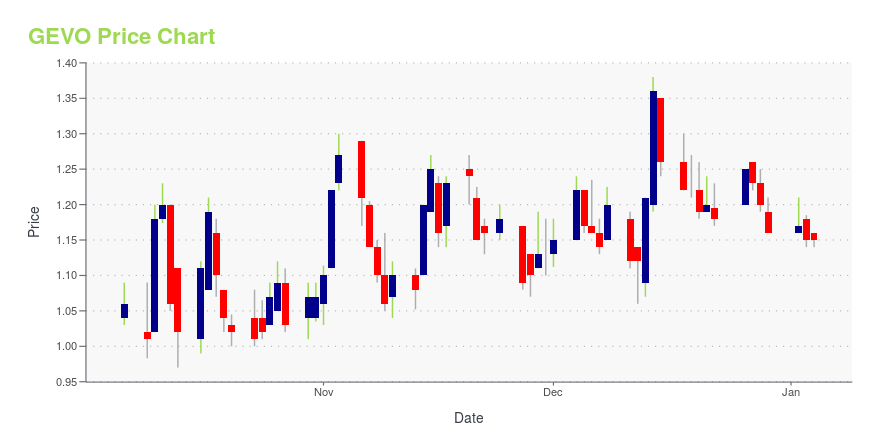

GEVO Stock Price Chart Interactive Chart >

Latest GEVO News From Around the Web

Below are the latest news stories about GEVO INC that investors may wish to consider to help them evaluate GEVO as an investment opportunity.

11 High Growth Micro-Cap Stocks to BuyIn this article, we discuss 11 high-growth micro-cap stocks to buy. To skip the detailed analysis and past performance of micro-cap stocks, go directly to the 5 High Growth Micro-cap Stocks to Buy. Shares of small companies with market capitalization usually between $50 to $300 million are considered micro-cap stocks. The risk in these investments […] |

Gevo VP of Government Relations Lindsay Fitzgerald and VP of Finance & Strategy Eric Frey to Participate in a Water Tower Research Fireside Chat on Tuesday, December 19th at 10:00 am ETENGLEWOOD, Colo., Dec. 18, 2023 (GLOBE NEWSWIRE) -- Gevo, Inc. (NASDAQ: GEVO), announced today that Lindsay Fitzgerald, Vice President of Government Relations, and Eric Frey, Vice President of Finance & Strategy, will participate in a Water Tower Research Fireside Chat on Tuesday, December 19, 2023, at 10:00 am ET. Topics will include an overview of federal and state incentives for clean fuels, including feedback on the recent U.S. Department of Treasury’s guidance on the 40B sustainable aviatio |

7 Promising Penny Stocks With the Potential to Defy ExpectationsYou know you want it. |

Gevo Statement on Treasury Guidance for SAF Tax CreditGevo welcomes the Biden Administration’s use of the Argonne GREET method for Sustainable Aviation Fuel (SAF) credit complianceENGLEWOOD, Colo., Dec. 15, 2023 (GLOBE NEWSWIRE) -- Gevo, Inc. (Nasdaq: GEVO) issued the following statement regarding the release of the U.S. Department of Treasury’s guidance on the 40B sustainable aviation fuel (SAF) tax credit. “Gevo greatly appreciates the Biden Administration’s intent to use the Argonne GREET method and model for sustainable aviation fuel (SAF). Tod |

Water Tower Research US Climate Virtual Investor Conference: Presentations Now Available for Online ViewingCompany Executives Share Vision and Answer Questions Live at VirtualInvestorConferences.comNEW YORK, Dec. 08, 2023 (GLOBE NEWSWIRE) -- Virtual Investor Conferences, the leading proprietary investor conference series, today announced the presentations from the US Climate Hybrid Investor Conference sponsored by Water Tower Research and Virtual Investor Conferences, held December 7th, are now available for online viewing. REGISTER NOW AT: https://bit.ly/47K6Xfp The company presentations will be ava |

GEVO Price Returns

| 1-mo | -4.69% |

| 3-mo | -5.78% |

| 6-mo | -34.30% |

| 1-year | -62.35% |

| 3-year | -89.46% |

| 5-year | -76.54% |

| YTD | -47.41% |

| 2023 | -38.95% |

| 2022 | -55.61% |

| 2021 | 0.71% |

| 2020 | 83.98% |

| 2019 | 17.86% |

Continue Researching GEVO

Want to see what other sources are saying about Gevo Inc's financials and stock price? Try the links below:Gevo Inc (GEVO) Stock Price | Nasdaq

Gevo Inc (GEVO) Stock Quote, History and News - Yahoo Finance

Gevo Inc (GEVO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...