Guardforce AI (GFAI): Price and Financial Metrics

GFAI Price/Volume Stats

| Current price | $1.41 | 52-week high | $3.88 |

| Prev. close | $1.41 | 52-week low | $0.76 |

| Day low | $1.36 | Volume | 1,639,000 |

| Day high | $1.50 | Avg. volume | 1,441,610 |

| 50-day MA | $1.16 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 25.11M |

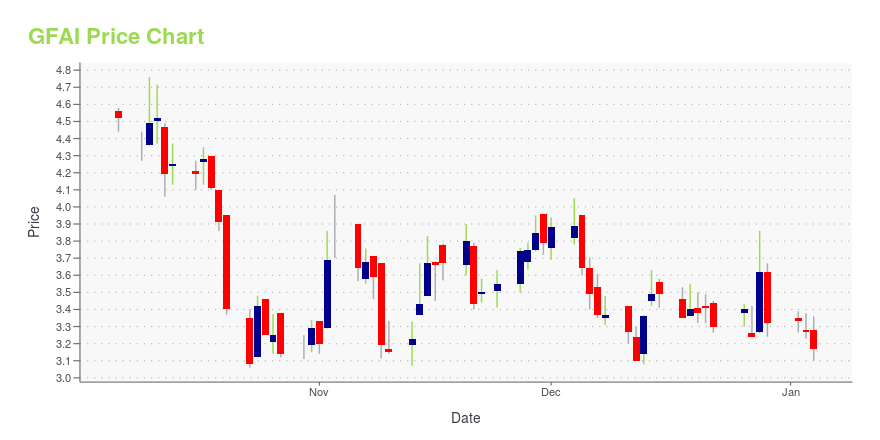

GFAI Stock Price Chart Interactive Chart >

Guardforce AI (GFAI) Company Bio

Guardforce AI Co., Limited offers cash solutions and cash handling services in Thailand. The company's services include cash-in-transit, vehicles to banks, ATM management, cash center operations, cash processing, coin processing, and cheque center services, as well as cash deposit machine solutions comprising cash deposit management and express cash services. Its customers include local commercial banks, chain retailers, coin manufacturing mints, and government authorities. The company was incorporated in 2018 and is based in Bangkok, Thailand.

GFAI Price Returns

| 1-mo | 21.55% |

| 3-mo | 39.60% |

| 6-mo | -30.88% |

| 1-year | -34.72% |

| 3-year | -90.21% |

| 5-year | N/A |

| YTD | -1.40% |

| 2024 | -56.93% |

| 2023 | -34.54% |

| 2022 | -88.26% |

| 2021 | N/A |

| 2020 | N/A |

Loading social stream, please wait...