Gold Fields Ltd. ADR (GFI): Price and Financial Metrics

GFI Price/Volume Stats

| Current price | $16.32 | 52-week high | $18.97 |

| Prev. close | $16.19 | 52-week low | $10.31 |

| Day low | $16.31 | Volume | 1,510,986 |

| Day high | $16.58 | Avg. volume | 3,899,475 |

| 50-day MA | $15.69 | Dividend yield | 2.14% |

| 200-day MA | $14.91 | Market Cap | 14.61B |

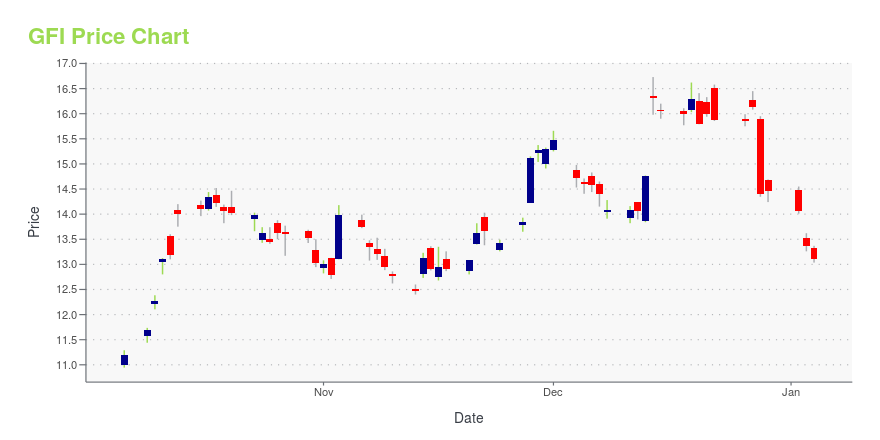

GFI Stock Price Chart Interactive Chart >

Gold Fields Ltd. ADR (GFI) Company Bio

Gold Fields Ltd. engages in the exploration, extraction, processing, and smelting of gold and copper properties in South Africa, Ghana, Australia, and Peru. The company was founded in 1887 and is based in Sandton, South Africa.

Latest GFI News From Around the Web

Below are the latest news stories about GOLD FIELDS LTD that investors may wish to consider to help them evaluate GFI as an investment opportunity.

Gold Fields tumbles 10% after cutting production outlook at Chilean mineMore on Gold Fields |

Gold Fields to Acquire Additional Shares of Galiano Gold Upon Disposal of its Interest In the Asanko Gold MineGold Fields Limited ("Gold Fields") announces that certain of its wholly-owned subsidiaries have entered a share purchase agreement dated December 20, 2023 (the "Share Purchase Agreement") with Galiano Gold Inc. (formerly Asanko Gold Inc.) ("Galiano") and certain of its affiliates, pursuant to which all of Gold Fields' interest in the Asanko joint venture in Ghana (the "Asanko JV") will be acquired, directly or indirectly, by Galiano and its subsidiaries (the "Transaction"). |

12 Most Undervalued Gold Stocks To Buy According To Hedge FundsIn this piece, we will take a look at the 12 most undervalued gold stocks to buy according to hedge funds. If you want to skip our overview of the gold industry and some recent developments, then take a look at the 5 Most Undervalued Gold Stocks To Buy According To Hedge Funds. The gold […] |

20 Largest Economies in Africa Ranked by PPPIn this article, we will discuss the 20 largest economies in Africa ranked by PPP. If you want to skip the detailed analysis of the African economy, click 5 Largest Economies in Africa Ranked by PPP. Economic Outlook for Africa African economy holds a huge potential considering its rich natural resources and young human capital. […] |

Top 20 Gold Mining Companies in the WorldThis article will highlight the leading companies in gold mining and their current valuation. If you want to skip our overview of the trends and patterns in gold mining, read the Top 5 Gold Mining Companies in the World. In Q3 2023, the demand for gold, excluding over-the-counter transactions, was 8% higher than the five-year […] |

GFI Price Returns

| 1-mo | 7.65% |

| 3-mo | -6.90% |

| 6-mo | 17.75% |

| 1-year | 12.27% |

| 3-year | 87.21% |

| 5-year | 239.28% |

| YTD | 14.17% |

| 2023 | 43.81% |

| 2022 | -3.37% |

| 2021 | 22.41% |

| 2020 | 42.40% |

| 2019 | 89.08% |

GFI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GFI

Want to do more research on Gold Fields Ltd's stock and its price? Try the links below:Gold Fields Ltd (GFI) Stock Price | Nasdaq

Gold Fields Ltd (GFI) Stock Quote, History and News - Yahoo Finance

Gold Fields Ltd (GFI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...