Guardion Health Sciences, Inc. (GHSI): Price and Financial Metrics

GHSI Price/Volume Stats

| Current price | $9.57 | 52-week high | $10.75 |

| Prev. close | $9.85 | 52-week low | $5.01 |

| Day low | $9.50 | Volume | 1,000 |

| Day high | $9.90 | Avg. volume | 99,470 |

| 50-day MA | $9.63 | Dividend yield | N/A |

| 200-day MA | $7.68 | Market Cap | 12.29M |

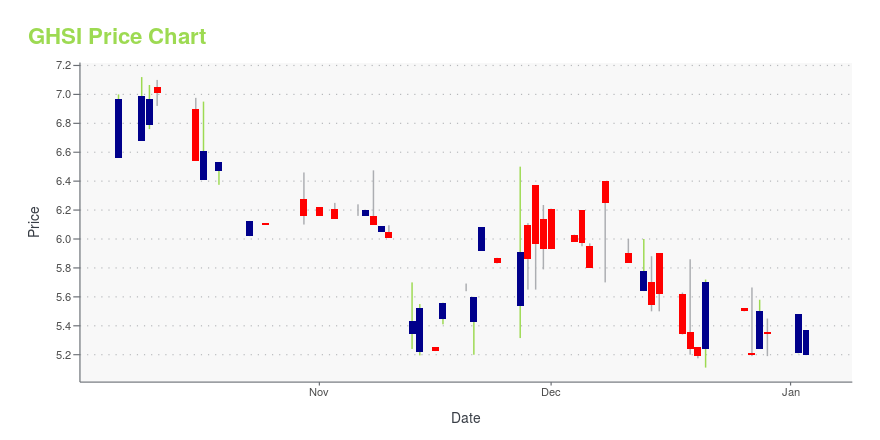

GHSI Stock Price Chart Interactive Chart >

Guardion Health Sciences, Inc. (GHSI) Company Bio

Guardion Health Sciences, Inc. provides health care services. It offers, Lumega-Z a medical food formulated to replenish and restore the macular protective pigment. The firm also develops medical devices that measures macular pigment density. The company was founded by Michael Favish in 2009 and is headquartered in San Diego, CA.

Latest GHSI News From Around the Web

Below are the latest news stories about GUARDION HEALTH SCIENCES INC that investors may wish to consider to help them evaluate GHSI as an investment opportunity.

Guardion Health Sciences Announces Financial Results for the Three Months and Nine Months Ended September 30, 2023Viactiv® Generated Net Revenues of Approximately $3.3 Million for the Three Months Ended September 30, 2023, an increase of 27% over the Three Months Ended September 30, 2022 HOUSTON, TEXAS, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”), a clinical nutrition company that offers a portfolio of science-based, clinically-supported products designed to support the health needs of consumers, healthcare professionals and providers and the |

Guardion Health Sciences Announces Financial Results for the Three Months and Six Months Ended June 30, 2023Viactiv® Product Line Total Revenue Increased Approximately 6% for the Six Months Ended June 30, 2023, as Compared to the Six Months Ended June 30, 2022; Robust Growth in Amazon Sales Channel Demonstrates Positive Results of Company’s Focus on eCommerce InitiativesHOUSTON, Aug. 14, 2023 (GLOBE NEWSWIRE) -- Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”), a clinical nutrition company that offers a portfolio of science-based, clinically-supported products designed to su |

Guardion Health Sciences Announces Appointment of Former Neutrogena and Coca-Cola Executive Jan Hall as President and Chief Executive OfficerFormer President and Chief Executive Officer Bret Scholtes Resigning to Pursue Other Business OpportunitiesHOUSTON, May 30, 2023 (GLOBE NEWSWIRE) -- Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”), a clinical nutrition company that offers a portfolio of science-based, clinically-supported products designed to support the health needs of consumers, healthcare professionals and providers and their patients, announced that Janet (“Jan”) Hall has been appointed as the Com |

Guardion Health Sciences Announces Financial Results for the Quarter Ended March 31, 2023Viactiv® Product Line Total Revenue Increased approximately 37% for the Quarter Ended March 31, 2023 as compared to the Quarter Ended March 31, 2022HOUSTON, May 15, 2023 (GLOBE NEWSWIRE) -- Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”), a clinical nutrition company that offers a portfolio of science-based, clinically-supported products designed to support the health needs of consumers, healthcare professionals and providers and their patients, announced its financia |

Guardion Health Sciences Announces Financial Results for the Year Ended December 31, 2022Viactiv® Product Line Generated Net Revenues of approximately $10.6 Million or 96% of Net Revenues for the Year Ended December 31, 2022HOUSTON, April 17, 2023 (GLOBE NEWSWIRE) -- Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”), a clinical nutrition company that offers a portfolio of science-based, clinically-supported products designed to support the health needs of consumers, healthcare professionals and providers and their patients, announced its financial results f |

GHSI Price Returns

| 1-mo | -3.03% |

| 3-mo | 21.14% |

| 6-mo | 67.90% |

| 1-year | 29.67% |

| 3-year | -86.03% |

| 5-year | -97.45% |

| YTD | 79.21% |

| 2023 | -26.40% |

| 2022 | -77.58% |

| 2021 | -74.01% |

| 2020 | 88.38% |

| 2019 | N/A |

Loading social stream, please wait...