Giga-tronics Incorporated (GIGA): Price and Financial Metrics

GIGA Price/Volume Stats

| Current price | $0.11 | 52-week high | $0.69 |

| Prev. close | $0.12 | 52-week low | $0.06 |

| Day low | $0.11 | Volume | 200 |

| Day high | $0.11 | Avg. volume | 6,667 |

| 50-day MA | $0.13 | Dividend yield | N/A |

| 200-day MA | $0.21 | Market Cap | 836.83K |

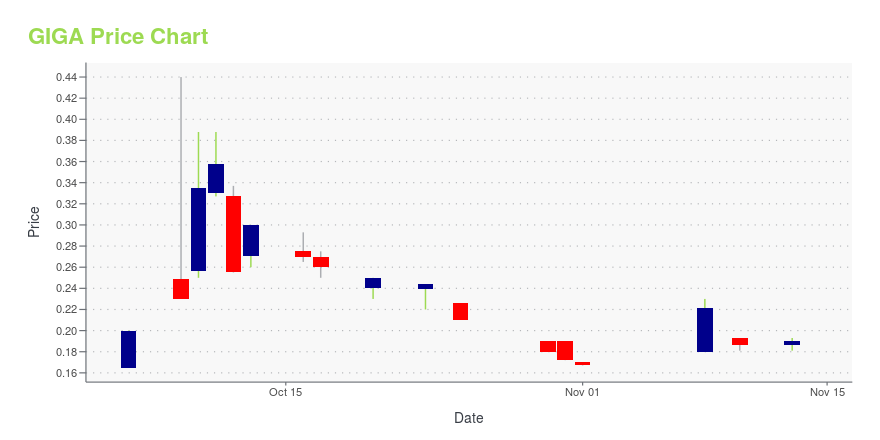

GIGA Stock Price Chart Interactive Chart >

Giga-tronics Incorporated (GIGA) Company Bio

Giga-tronics Incorporated, together with its subsidiaries, develops and manufactures electronics equipment for military test and airborne operational applications in the United States, Europe, Asia, and internationally. It operates through two segments, Microsource and the Giga-tronics Division. The company also develops microwave integrated components, as well as MIC components; Band Reject Filters for RADAR/EW (electronic warfare) for solving interference problems in RADAR/EW applications; self-protection systems for military aircrafts; and RADAR filters for military fighter jet aircraft. In addition, it designs, manufactures, and markets functional test products for testing RADAR/EW equipment of the defense electronics market. The company serves prime defense contractors, the armed services, and research institutes. Giga-tronics Incorporated was founded in 1980 and is headquartered in Dublin, Californi

Latest GIGA News From Around the Web

Below are the latest news stories about GIGA TRONICS INC that investors may wish to consider to help them evaluate GIGA as an investment opportunity.

Gresham Worldwide’s Subsidiary, Enertec Systems, Wins $20 Million ContractSCOTTSDALE, Ariz., October 09, 2023--Gresham Worldwide’s Subsidiary, Enertec Systems, Wins $20 Million Contract; Delivery of Systems to Major Strategic Defense Customer Will Span 3 Years |

Gresham Worldwide Reports Significant Increase in Third Quarter BusinessSCOTTSDALE, Ariz., October 05, 2023--Gresham Worldwide Reports Significant Increase in Third Quarter Business; Bookings for Q3 2023 Exceed $15.4 Million, 52% Increase Quarter-Over-Quarter |

Ault Alliance Announces Gresham Worldwide Third Quarter 2023 Orders Increase to $15.4 MillionLAS VEGAS, October 05, 2023--Ault Alliance Announces Gresham Worldwide 3rd Quarter 2023 Orders Increase to $15.4 Million; Gresham Marks 52% Increase in Quarter-Over-Quarter Boost |

Ault Alliance Announces Update on Dividend of Almost Seven Million Shares of Giga-tronics Common Stock to Its StockholdersLAS VEGAS, August 01, 2023--Ault Alliance Announces Update on Dividend of Almost Seven Million Shares of GIGA Common Stock; GIGA Advances Process Filing Registration Statement |

Ault Alliance Announces Gresham Worldwide Bookings for the Second Quarter of 2023 Exceed $10.2 MillionLAS VEGAS, July 20, 2023--Ault Alliance Announces Gresham Worldwide Bookings for the Q2 2023 Exceed $10.2 Million; Strong Bookings From Marquee Defense and Medical Customers |

GIGA Price Returns

| 1-mo | -6.38% |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | -97.85% |

| YTD | -25.42% |

| 2023 | -78.31% |

| 2022 | -80.63% |

| 2021 | 4.78% |

| 2020 | N/A |

| 2019 | 0.00% |

Continue Researching GIGA

Want to do more research on Giga Tronics Inc's stock and its price? Try the links below:Giga Tronics Inc (GIGA) Stock Price | Nasdaq

Giga Tronics Inc (GIGA) Stock Quote, History and News - Yahoo Finance

Giga Tronics Inc (GIGA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...