Gelesis Holdings Inc., (GLS): Price and Financial Metrics

GLS Price/Volume Stats

| Current price | $0.16 | 52-week high | $5.71 |

| Prev. close | $0.16 | 52-week low | $0.11 |

| Day low | $0.15 | Volume | 185,100 |

| Day high | $0.16 | Avg. volume | 386,034 |

| 50-day MA | $0.24 | Dividend yield | N/A |

| 200-day MA | $0.72 | Market Cap | 11.63M |

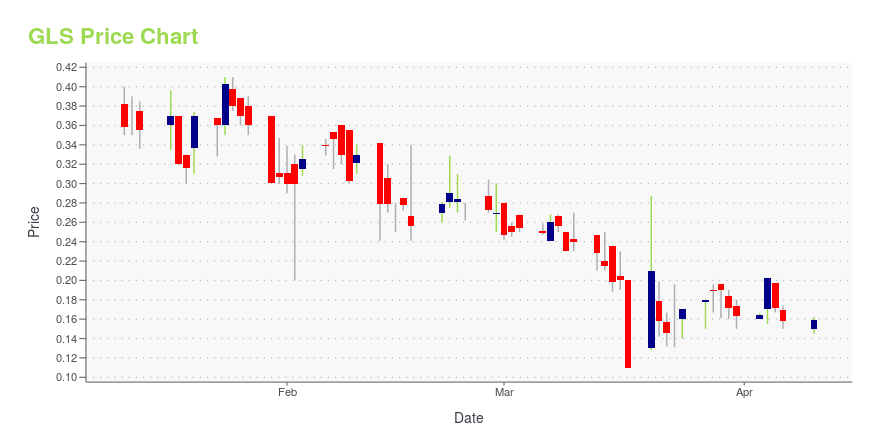

GLS Stock Price Chart Interactive Chart >

Gelesis Holdings Inc., (GLS) Company Bio

Gelesis Holdings Inc., a biotherapeutics company, developing a novel category of treatments for weight management and gut related chronic diseases. It develops a mechanobiology technology platform to treat obesity and other chronic diseases related to the GI pathway. The company also provides PLENITY, an orally administered, non-stimulant, and non-systemic aid for weight management. In addition, it offers a product for obesity and overweight and a pipeline with potential therapies for non-alcoholic fatty liver disease/non-alcoholic steatohepatitis, type 2 diabetes, and chronic idiopathic constipation. Gelesis Holdings Inc. was incorporated in 2006 and is based in Boston, Massachusetts.

Latest GLS News From Around the Web

Below are the latest news stories about GELESIS HOLDINGS INC that investors may wish to consider to help them evaluate GLS as an investment opportunity.

Sight Sciences Appoints Ali Bauerlein as Chief Financial OfficerAli Bauerlein Ali Bauerlein has been appointed Sight Sciences’ Chief Financial Officer and Treasurer, effective April 3, 2023 MENLO PARK, Calif., April 03, 2023 (GLOBE NEWSWIRE) -- Sight Sciences, Inc. (Nasdaq: SGHT) (“Sight Sciences” or the “Company”), an eyecare technology company focused on creating innovative solutions intended to transform care and improve patients’ lives, today announces the appointment of Alison “Ali” Bauerlein as its Chief Financial Officer and Treasurer, effective April |

Gelesis Reports Fourth Quarter and Full Year 2022 ResultsBOSTON, March 28, 2023--Gelesis Holdings, Inc. (NYSE: GLS) ("Gelesis" or the "Company"), the maker of Plenity for weight management, today reported financial results for the year ended December 31, 2022. Plenity is a novel orally administered, FDA-cleared weight management therapy that helps people feel satisfied with smaller portions, so they can eat less and lose weight, while still enjoying the foods they love. Plenity is the only FDA-cleared aid for weight management for people with a BMI as |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayWe're starting off the day with a look at the biggest pre-market stock movers traders need to know about on Tuesday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayWe're starting off the week with a look at the biggest pre-market stock movers traders need to know about on Monday morning! |

Gelesis to Participate in the 25th Annual ICR ConferenceBOSTON, January 05, 2023--Gelesis (NYSE: GLS), the maker of Plenity for weight management, today announced that the Company will participate in the 25th Annual ICR Conference in Orlando, Florida on Monday, January 9, 2023. |

GLS Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -98.37% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -97.08% |

| 2021 | -1.87% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...