Glatfelter (GLT): Price and Financial Metrics

GLT Price/Volume Stats

| Current price | $21.05 | 52-week high | $35.23 |

| Prev. close | $22.62 | 52-week low | $15.80 |

| Day low | $20.07 | Volume | 339,300 |

| Day high | $22.80 | Avg. volume | 56,880 |

| 50-day MA | $22.11 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 73.65M |

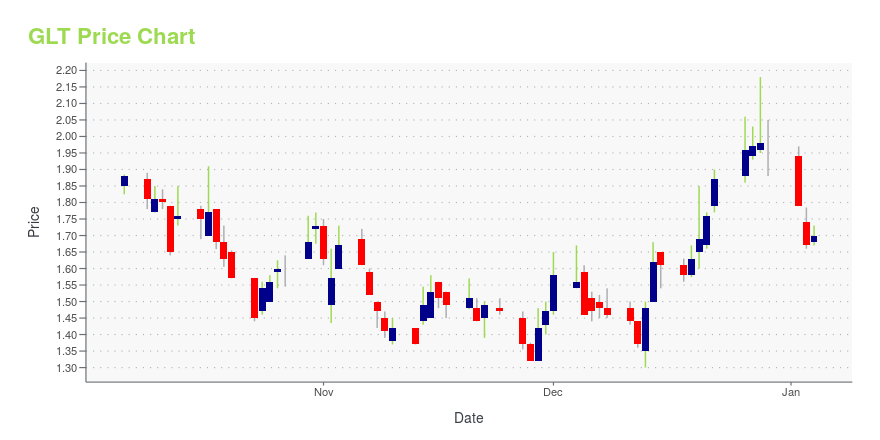

GLT Stock Price Chart Interactive Chart >

Glatfelter (GLT) Company Bio

PH Glatfelter Company manufactures and sells specialty papers and fiber-based engineered materials worldwide. The company operates through three business units: Composite Fibers, Advanced Airlaid Materials, and Specialty Papers. The company was founded in 1864 and is based in York, Pennsylvania.

GLT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 1,284.87% |

| 3-year | 207.30% |

| 5-year | 28.98% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -30.22% |

| 2022 | -83.84% |

| 2021 | 5.01% |

| 2020 | -10.49% |

Continue Researching GLT

Want to see what other sources are saying about Glatfelter P H Co's financials and stock price? Try the links below:Glatfelter P H Co (GLT) Stock Price | Nasdaq

Glatfelter P H Co (GLT) Stock Quote, History and News - Yahoo Finance

Glatfelter P H Co (GLT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...