Global Medical REIT Inc. (GMRE): Price and Financial Metrics

GMRE Price/Volume Stats

| Current price | $9.85 | 52-week high | $11.59 |

| Prev. close | $9.63 | 52-week low | $7.98 |

| Day low | $9.74 | Volume | 210,116 |

| Day high | $9.88 | Avg. volume | 383,231 |

| 50-day MA | $9.16 | Dividend yield | 8.68% |

| 200-day MA | $9.35 | Market Cap | 646.04M |

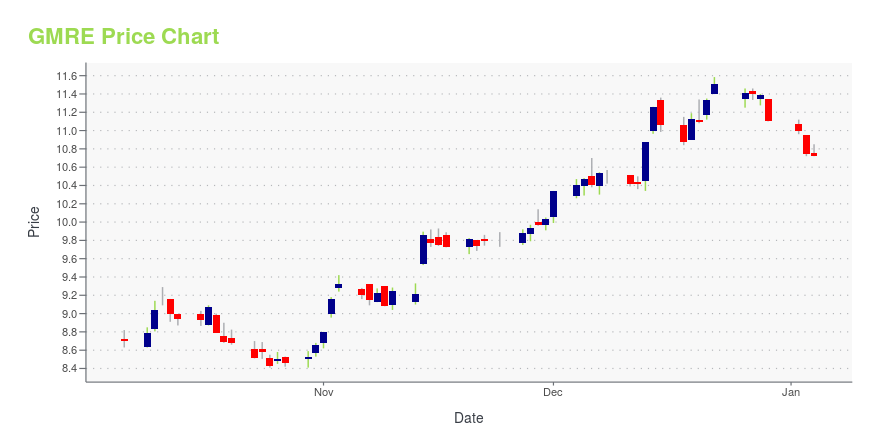

GMRE Stock Price Chart Interactive Chart >

Global Medical REIT Inc. (GMRE) Company Bio

Global Medical REIT engages primarily in the acquisition of licensed, state-of-the-art, purpose-built healthcare facilities and the leasing of these facilities to leading clinical operators. The company was founded in 2011 and is based in Bethesda, Maryland.

Latest GMRE News From Around the Web

Below are the latest news stories about GLOBAL MEDICAL REIT INC that investors may wish to consider to help them evaluate GMRE as an investment opportunity.

Global Medical REIT Inc's Dividend AnalysisGlobal Medical REIT Inc (NYSE:GMRE) recently announced a dividend of $0.21 per share, payable on 2024-01-09, with the ex-dividend date set for 2023-12-26. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Global Medical REIT Inc's dividend performance and assess its sustainability. |

Global Medical REIT Inc. Board Declares 2023 Fourth Quarter Common and Preferred DividendsBETHESDA, Md., December 12, 2023--Global Medical REIT Inc. (NYSE: GMRE) (the "Company" or "GMRE"), a net-lease medical office real estate investment trust (REIT) that acquires healthcare facilities and leases those facilities to physician groups and regional and national healthcare systems, announced today that its Board of Directors ("Board") has declared the Company’s 2023 fourth quarter common and preferred dividends. |

Should You Buy Global Medical REIT (GMRE) After Golden Cross?Good things could be on the horizon when a stock experiences a golden cross event. How should investors react? |

Global Medical REIT Inc. (NYSE:GMRE) Q3 2023 Earnings Call TranscriptGlobal Medical REIT Inc. (NYSE:GMRE) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Greetings, and welcome to the Global Medical REIT Third Quarter 2023 Earnings Conference Call. [Operator Instructions]. As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Steve, Investor Relations. Thank you, sir. You may […] |

Q3 2023 Global Medical REIT Inc Earnings CallQ3 2023 Global Medical REIT Inc Earnings Call |

GMRE Price Returns

| 1-mo | 11.80% |

| 3-mo | 24.28% |

| 6-mo | 0.70% |

| 1-year | 7.07% |

| 3-year | -20.47% |

| 5-year | 38.09% |

| YTD | -7.01% |

| 2023 | 27.91% |

| 2022 | -42.38% |

| 2021 | 43.51% |

| 2020 | 5.76% |

| 2019 | 59.98% |

GMRE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GMRE

Here are a few links from around the web to help you further your research on Global Medical REIT Inc's stock as an investment opportunity:Global Medical REIT Inc (GMRE) Stock Price | Nasdaq

Global Medical REIT Inc (GMRE) Stock Quote, History and News - Yahoo Finance

Global Medical REIT Inc (GMRE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...