GMS Inc. (GMS): Price and Financial Metrics

GMS Price/Volume Stats

| Current price | $94.03 | 52-week high | $101.04 |

| Prev. close | $91.98 | 52-week low | $56.58 |

| Day low | $93.78 | Volume | 380,780 |

| Day high | $96.70 | Avg. volume | 380,358 |

| 50-day MA | $88.50 | Dividend yield | N/A |

| 200-day MA | $83.17 | Market Cap | 3.73B |

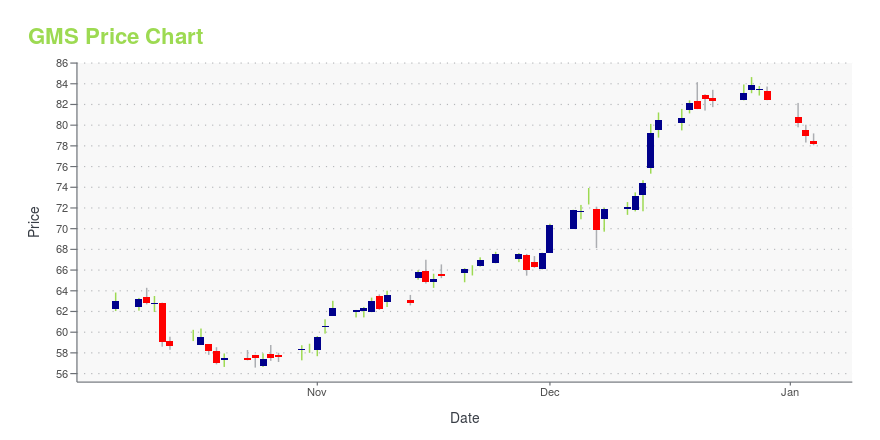

GMS Stock Price Chart Interactive Chart >

GMS Inc. (GMS) Company Bio

GMS Inc. distributes gypsum wallboard, acoustical ceiling products, and other specialty building materials to the interior contractors of commercial and residential buildings in North America. The company was founded in 1971 and is based Tucker, Georgia.

Latest GMS News From Around the Web

Below are the latest news stories about GMS INC that investors may wish to consider to help them evaluate GMS as an investment opportunity.

GMS to Buy Kamco, Lifts Market Expansion & Product CategoriesGMS' recent move represents an opportunity to advance its strategic priorities, including market expansion in the core product categories and continuous development in the New York metropolitan market. |

GMS to Acquire Kamco Supply CorporationTUCKER, Ga., December 21, 2023--GMS Inc. (NYSE: GMS), a leading North American specialty building products distributor, today announced that it has entered into an agreement to acquire Kamco Supply Corporation and affiliates ("Kamco" or the "Company"). The transaction is expected to close during the fourth quarter of fiscal 2024 for GMS, which ends on April 30, 2024. |

Is There Now An Opportunity In GMS Inc. (NYSE:GMS)?GMS Inc. ( NYSE:GMS ), is not the largest company out there, but it saw a significant share price rise of over 20% in... |

GMS' Q2 Earnings & Net Sales Surpass Estimates, Decrease Y/YGMS' second-quarter fiscal 2024 earnings reflect a slowdown in single-family construction and lower steel prices. |

GMS Inc. (NYSE:GMS) Q2 2024 Earnings Call TranscriptGMS Inc. (NYSE:GMS) Q2 2024 Earnings Call Transcript December 7, 2023 GMS Inc. beats earnings expectations. Reported EPS is $2.3, expectations were $2.24. Operator: Greeting, welcome to GMS Second Quarter 2024 Earnings Conference Call. At this time all participants’ are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] As […] |

GMS Price Returns

| 1-mo | 18.40% |

| 3-mo | 1.23% |

| 6-mo | 13.74% |

| 1-year | 29.25% |

| 3-year | 97.46% |

| 5-year | 308.29% |

| YTD | 14.07% |

| 2023 | 65.52% |

| 2022 | -17.15% |

| 2021 | 97.21% |

| 2020 | 12.56% |

| 2019 | 82.23% |

Continue Researching GMS

Want to do more research on GMS Inc's stock and its price? Try the links below:GMS Inc (GMS) Stock Price | Nasdaq

GMS Inc (GMS) Stock Quote, History and News - Yahoo Finance

GMS Inc (GMS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...