Generac Holdlings Inc. (GNRC): Price and Financial Metrics

GNRC Price/Volume Stats

| Current price | $159.43 | 52-week high | $161.80 |

| Prev. close | $152.78 | 52-week low | $79.86 |

| Day low | $154.40 | Volume | 798,316 |

| Day high | $160.14 | Avg. volume | 994,571 |

| 50-day MA | $144.95 | Dividend yield | N/A |

| 200-day MA | $125.01 | Market Cap | 9.66B |

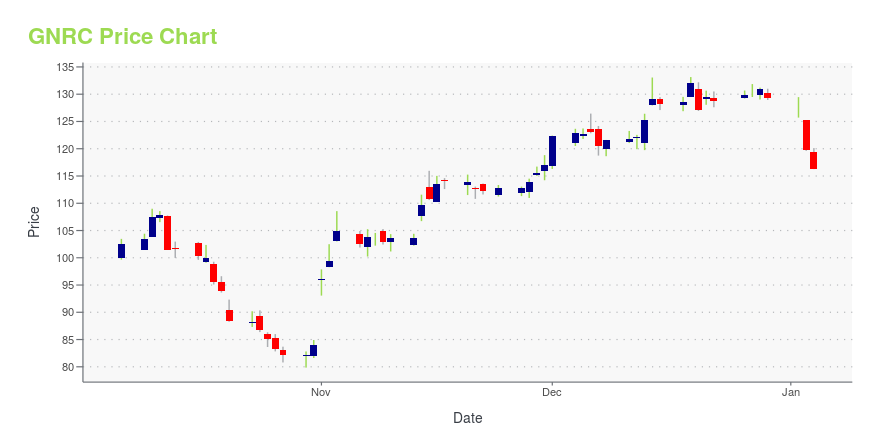

GNRC Stock Price Chart Interactive Chart >

Generac Holdlings Inc. (GNRC) Company Bio

Generac Holdings Inc., commonly referred to as Generac, is a Fortune 1000 American manufacturer of backup power generation products for residential, light commercial and industrial markets. Generac's power systems range in output from 800 watts to 9 megawatts, and are available through independent dealers, retailers and wholesalers. Generac is headquartered in Waukesha, Wisconsin, and has manufacturing facilities in Berlin, Oshkosh, Jefferson, Eagle, and Whitewater; all in Wisconsin. (Source:Wikipedia)

Latest GNRC News From Around the Web

Below are the latest news stories about GENERAC HOLDINGS INC that investors may wish to consider to help them evaluate GNRC as an investment opportunity.

Generac Holdings' (NYSE:GNRC) investors will be pleased with their stellar 136% return over the last five yearsThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you... |

Generac (GNRC) & Wallbox Partner to Improve Distribution NetworkGenerac (GNRC) collaborates with Wallbox to enhance its distribution capacity in the United States. |

ecobee and Generac Expand Thermostat Integration Capabilities to Include Propane TanksTORONTO, December 05, 2023--ecobee, together with parent company Generac Power Systems, Inc. (NYSE: GNRC), a leading global designer and manufacturer of energy technology solutions and other power products, today announced that all ecobee smart thermostats released since 2014 can now integrate with Generac 4G LTE Cellular Propane Tank Monitors to easily monitor fuel levels in the propane tank right from the smart thermostat screen. This integration marks the latest milestone in ecobee and Genera |

Generac and Wallbox Announce Strategic Investment and Commercial AgreementGenerac Power Systems, Inc. (NYSE: GNRC), a leading global designer and manufacturer of energy technology solutions and other power products, today announced it has made a minority investment in Wallbox (NYSE: WBX), a global leader in smart electric vehicle (EV) charging and energy management solutions. The minority investment includes adding a Generac seat on Wallbox's board of directors and a global commercial agreement to provide Generac's residential and commercial customers with the next ge |

Should You Sell Generac Holdings (GNRC)?Artisan Partners, an investment management company, released its “Artisan Small Cap Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, its Investor Class fund ARTSX returned -7.98%, Advisor Class fund APDSX posted a return of -7.96%, and Institutional Class fund APHSX returned -7.97%, compared to a […] |

GNRC Price Returns

| 1-mo | 18.39% |

| 3-mo | 13.78% |

| 6-mo | 39.01% |

| 1-year | 7.13% |

| 3-year | -63.68% |

| 5-year | 116.91% |

| YTD | 23.36% |

| 2023 | 28.39% |

| 2022 | -71.40% |

| 2021 | 54.75% |

| 2020 | 126.08% |

| 2019 | 102.39% |

Continue Researching GNRC

Want to see what other sources are saying about Generac Holdings Inc's financials and stock price? Try the links below:Generac Holdings Inc (GNRC) Stock Price | Nasdaq

Generac Holdings Inc (GNRC) Stock Quote, History and News - Yahoo Finance

Generac Holdings Inc (GNRC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...