Canoo Inc. (GOEV): Price and Financial Metrics

GOEV Price/Volume Stats

| Current price | $2.07 | 52-week high | $15.96 |

| Prev. close | $2.06 | 52-week low | $1.22 |

| Day low | $2.02 | Volume | 1,047,571 |

| Day high | $2.12 | Avg. volume | 5,854,362 |

| 50-day MA | $2.22 | Dividend yield | N/A |

| 200-day MA | $3.89 | Market Cap | 141.93M |

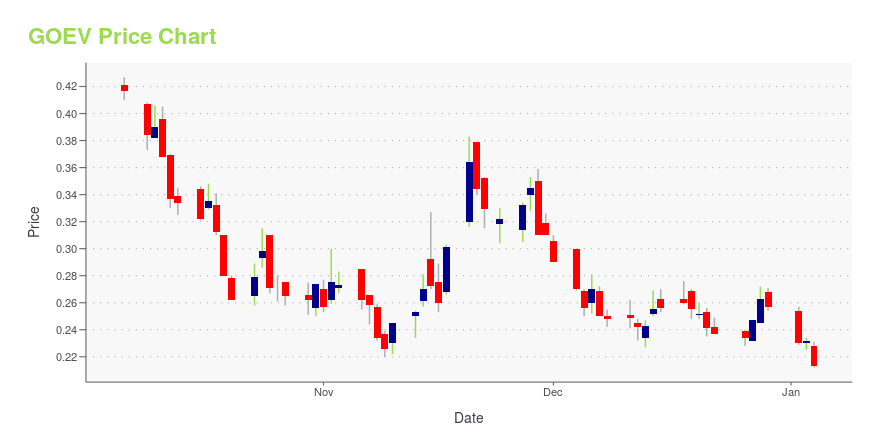

GOEV Stock Price Chart Interactive Chart >

Canoo Inc. (GOEV) Company Bio

Canoo Inc., a mobility technology company, designs and manufactures electric vehicles for commercial and consumer markets in the United States. The company offers business-to-business (B2B) delivery vehicles, lifestyle vehicles, and sport vehicles using skateboard architecture technology. It serves retailers, large corporations, logistics companies, fleet managers, and other customers. The company was formerly known as EVelozcity Holdings Ltd. Canoo Inc. founded in 2017 and is headquartered in Torrance, California.

Latest GOEV News From Around the Web

Below are the latest news stories about CANOO INC that investors may wish to consider to help them evaluate GOEV as an investment opportunity.

Down a Shocking 99%, Is Canoo Stock a Buy for 2024?Canoo stock has suffered as the hype and enthusiasm for EV stocks is fading. |

Canoo Adjourns Annual Shareholder Meeting Until December 29, 2023Justin, Texas, Dec. 19, 2023 (GLOBE NEWSWIRE) -- Canoo Inc. (NASDAQ: GOEV), a leading high-tech advanced mobility company, today announced the adjournment of its annual shareholder meeting until Friday, December 29, 2023 at 8:30 a.m. Central Time, to provide additional time to solicit votes to reach a quorum and conduct business. About Canoo Canoo's mission is to bring EVs to Everyone. The company has developed breakthrough electric vehicles that are reinventing the automotive landscape with the |

3 Tech Stocks I Wouldn’t Touch With a 10-Foot PoleSpeculative tech stocks are soaring this holiday season. |

Beyond Canoo: A Pick-and-Shovel Play on the Growth of EVs and MexicoThe much-hyped EV start-up is on the cusp of financial failure. You really can build wealth investing in far less risky businesses. |

Canoo Names Michael Carter as Chief People OfficerCanoo Inc. Attachment Justin, Texas, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Canoo Inc. (Nasdaq: GOEV), a leading high-tech advanced mobility company, today announced Michael Carter as Chief People Officer. Carter will be responsible for helping the company through its growth and scaling manufacturing in Oklahoma. “We’re excited to welcome Michael to the Canoo team,” said Tony Aquila, Investor, Executive Chairman, and CEO at Canoo. “This important next phase in our journey requires ramping up our manu |

GOEV Price Returns

| 1-mo | 5.61% |

| 3-mo | -25.27% |

| 6-mo | -42.05% |

| 1-year | -82.75% |

| 3-year | -98.89% |

| 5-year | N/A |

| YTD | -65.01% |

| 2023 | -79.09% |

| 2022 | -84.07% |

| 2021 | -44.06% |

| 2020 | 35.83% |

| 2019 | N/A |

Loading social stream, please wait...