GreenPower Motor Co. Inc. (GP): Price and Financial Metrics

GP Price/Volume Stats

| Current price | $1.11 | 52-week high | $4.64 |

| Prev. close | $1.09 | 52-week low | $0.98 |

| Day low | $1.09 | Volume | 27,200 |

| Day high | $1.11 | Avg. volume | 60,213 |

| 50-day MA | $1.16 | Dividend yield | N/A |

| 200-day MA | $2.17 | Market Cap | 29.41M |

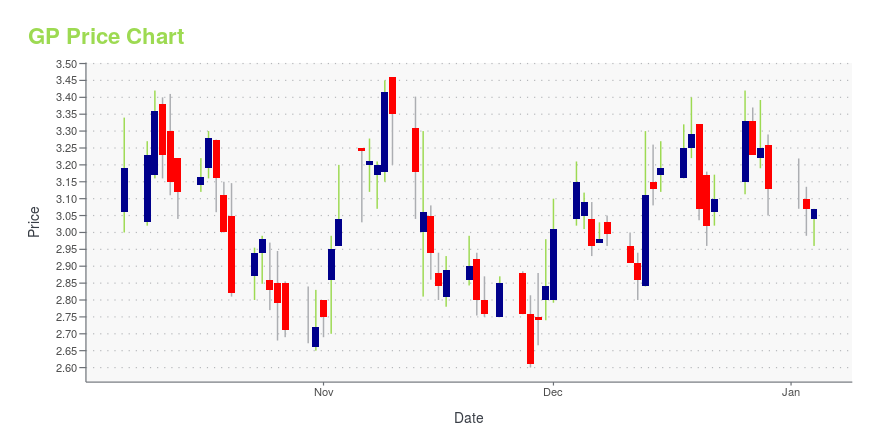

GP Stock Price Chart Interactive Chart >

GreenPower Motor Co. Inc. (GP) Company Bio

GreenPower Motor Co., Inc. engages in the design, manufacture, and distribution of electric powered vehicles for commercial markets. It offers electric-powered school buses, vans, charter buses, and double-deckers. The company was founded by Fraser Atkinson and Phillip W. Oldridge on March 30, 2010 and is headquartered in Vancouver, Canada.

Latest GP News From Around the Web

Below are the latest news stories about GREENPOWER MOTOR CO INC that investors may wish to consider to help them evaluate GP as an investment opportunity.

4 Top-Ranked Auto Stocks That Crushed the Market in 2023Despite high vehicle financing costs, auto sales witnessed growth on pent-up demand and improved inventory levels. Industry players like STLA, RACE, GP and CARG handily outpaced the market. |

GreenPower Delivers Four Nano BEAST All-Electric, School Buses to West Virginia School DistrictsGreenPower Motor Company Inc. (NASDAQ: GP) (TSXV: GPV) ("GreenPower"), a leading manufacturer and distributor of purpose-built, all-electric, zero-emission medium and heavy-duty vehicles serving the cargo and delivery market, shuttle and transit space and school bus sector, today announced the delivery of four all-electric, purpose-built Type A Nano BEAST school buses to Cabell, Clay, Monongalia and Kanawha counties in West Virginia. The deliveries followed the roll out of the first manufactured |

There’s an EV Delivery Event Today. It’s Different From the Cybertruck One.GreenPower Motor is delivering its first four electric school buses from a plant in West Virginia on Wednesday. |

GreenPower Announces Production of its First All-Electric School Buses at West Virginia Manufacturing FacilityGreenPower Motor Company Inc. (NASDAQ: GP) (TSXV: GPV) ("GreenPower"), a leading manufacturer and distributor of purpose-built, all-electric, zero-emission medium and heavy-duty vehicles serving the cargo and delivery market, shuttle and transit space and school bus sector, today announced that the company has completed manufacturing of its first four all-electric, purpose-built school buses at its West Virginia facility. The Type A Nano BEAST school buses will roll out of the facility today and |

GreenPower Panel Shares Real-World Experiences from Deploying the Type A Nano BEAST in Special Needs SituationsGreenPower Motor Company Inc. (NASDAQ: GP) (TSXV: GPV) ("GreenPower"), a leading manufacturer and distributor of purpose-built, all-electric, zero-emission medium and heavy-duty vehicles serving the cargo and delivery market, shuttle and transit space and school bus sector, held a panel discussion at the recent TSD (Transporting Students with Disabilities and Special Needs) conference in Frisco, Texas where school districts shared their real-world experiences in deploying the Type A all-electric |

GP Price Returns

| 1-mo | 12.11% |

| 3-mo | -39.34% |

| 6-mo | -60.36% |

| 1-year | -72.66% |

| 3-year | -93.78% |

| 5-year | N/A |

| YTD | -64.54% |

| 2023 | 80.92% |

| 2022 | -81.75% |

| 2021 | -67.43% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...