Greenpro Capital Corp. (GRNQ): Price and Financial Metrics

GRNQ Price/Volume Stats

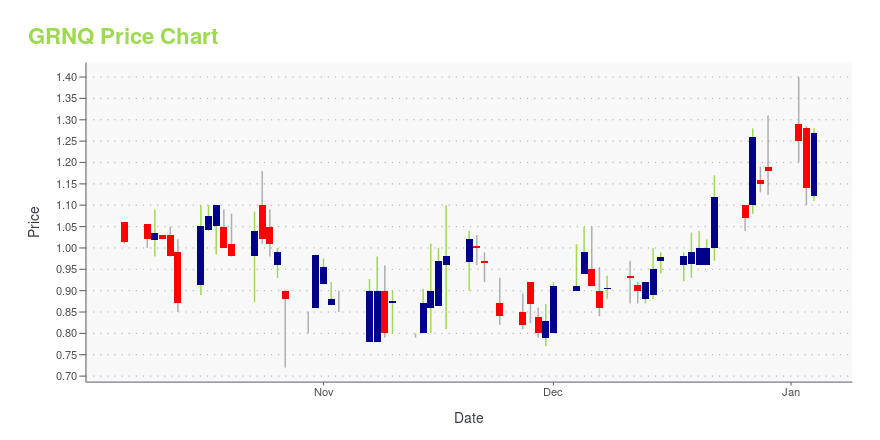

| Current price | $1.09 | 52-week high | $1.88 |

| Prev. close | $1.13 | 52-week low | $0.72 |

| Day low | $1.03 | Volume | 10,344 |

| Day high | $1.20 | Avg. volume | 132,762 |

| 50-day MA | $1.07 | Dividend yield | N/A |

| 200-day MA | $1.16 | Market Cap | 8.19M |

GRNQ Stock Price Chart Interactive Chart >

Greenpro Capital Corp. (GRNQ) Company Bio

Greenpro Capital Corp. engages in the provision of business solution services to small and medium-size enterprises. It operates through the Service Business and Real Estate Business segments. The Service Business segment offers advisory and business solution services. The Real Estate Business segment trades or leases commercial real estate properties in Hong Kong and Malaysia. The company was founded by Chong Kuang Lee on July 19, 2013 and is headquartered in Hong Kong.

Latest GRNQ News From Around the Web

Below are the latest news stories about GREENPRO CAPITAL CORP that investors may wish to consider to help them evaluate GRNQ as an investment opportunity.

Greenpro’s Digital Asset Exchange, Green-X is Awarded by ESGAM for Establishment of Carbon Credit Tokenization PlatformKUALA LUMPUR, MALAYSIA / ACCESSWIRE / December 22, 2023 / Greenpro Capital Corp. (NASDAQ:GRNQ) today announced that the company's Digital Asset Exchange, Green-X have been accorded a special Appreciation Award from ESG Association Malaysia ("ESGAM") ... |

Greenpro Announces Business Expansion into Carbon Credit TokenizationKUALA LUMPUR, MALAYSIA / ACCESSWIRE / December 19, 2023 / Greenpro Capital Corp. (NASDAQ:GRNQ) today announced its ambitious venture into the burgeoning field of carbon credit tokenization. This Business Expansion will be conducted through its wholly ... |

Greenpro Incubated Company Brighsun EV Group to Drive ESG Initiatives Through its Core Recyclable Battery TechnologiesKUALA LUMPUR, MALAYSIA / ACCESSWIRE / November 9, 2023 / Greenpro Capital Corp. (NASDAQ:GRNQ) incubated company, Australia's Brighsun EV Group lay out its Group expansion plan using proprietary Lithium Iron Phosphate (LFP) battery and Lithium Sulphate ... |

Greenpro Incubated Company Brighsun EV Group Commence Trading of 2UT STO Token on Green-XKUALA LUMPUR, MALAYSIA / ACCESSWIRE / October 24, 2023 / Greenpro Capital Corp. (NASDAQ:GRNQ) today announced the 2UT STO token, issued by Australia's Brighsun EV Group, has started trading on October 23, 2023. Users can now trade 2UT token on Green-X, ... |

Greenpro Incubated Company Brighsun EV Group Announced Mass-Production for 1,000 KM EV CarsKUALA LUMPUR, MALAYSIA / ACCESSWIRE / October 3, 2023 / Greenpro Capital Corp. (NASDAQ:GRNQ) today announced the incubated company, Australia's Brighsun EV Group is ready for mass-production of its 2U Chat EV, a long-range, semi solid battery electric ... |

GRNQ Price Returns

| 1-mo | 14.74% |

| 3-mo | -6.03% |

| 6-mo | -5.22% |

| 1-year | -23.78% |

| 3-year | -86.89% |

| 5-year | -90.09% |

| YTD | -7.63% |

| 2023 | 9.26% |

| 2022 | -82.55% |

| 2021 | -69.81% |

| 2020 | 259.65% |

| 2019 | -87.87% |

Continue Researching GRNQ

Want to see what other sources are saying about Greenpro Capital Corp's financials and stock price? Try the links below:Greenpro Capital Corp (GRNQ) Stock Price | Nasdaq

Greenpro Capital Corp (GRNQ) Stock Quote, History and News - Yahoo Finance

Greenpro Capital Corp (GRNQ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...