Just Eat Takeaway.com N.V. ADR (GRUB): Price and Financial Metrics

GRUB Price/Volume Stats

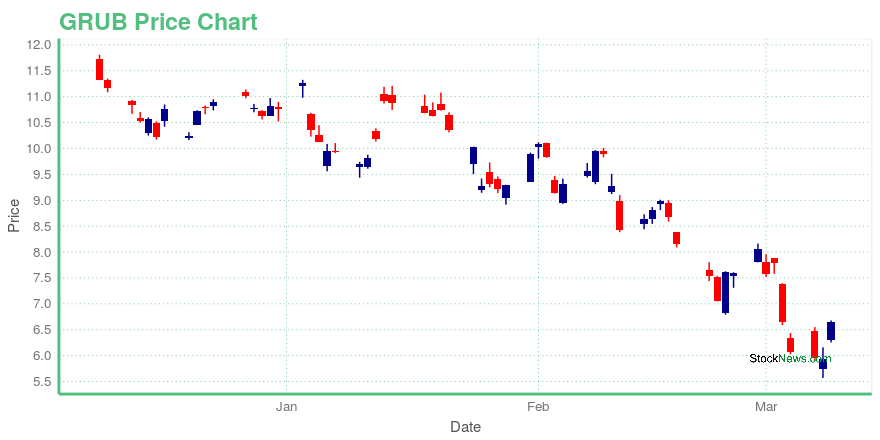

| Current price | $6.72 | 52-week high | $19.84 |

| Prev. close | $6.07 | 52-week low | $5.57 |

| Day low | $5.79 | Volume | 9,442,900 |

| Day high | $7.32 | Avg. volume | 2,737,008 |

| 50-day MA | $9.00 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 7.14B |

GRUB Stock Price Chart Interactive Chart >

Just Eat Takeaway.com N.V. ADR (GRUB) Company Bio

Just Eat Takeaway.com NV owns and manages food delivery websites. The company connects consumers and restaurants through its platform in European countries and Israel. It offers consumers a wide variety of food choice. The company was founded by Jitse Groen in 2000 and is headquartered in Amsterdam, the Netherlands.

Latest GRUB News From Around the Web

Below are the latest news stories about Just Eat Takeawaycom NV that investors may wish to consider to help them evaluate GRUB as an investment opportunity.

Grubhub and Buyk partner on ultrafast grocery deliveriesCustomers will be able order from more than 30 initial participating locations in New York City and Chicago in the coming weeks. |

Grubhub Launches Ultrafast Delivery in Partnership With BuykGrubhub, a leading U.S. food-ordering and delivery marketplace, and Buyk, the newest real-time grocery delivery service, announced today a partnership to bring ultrafast grocery delivery to the Grubhub marketplace through Buyk and Grubhub branded concepts. |

Grubhub Is Launching a Rapid Delivery Service in Partnership With Startup Buyk(Bloomberg) -- Grubhub is launching a new rapid delivery service, joining rival DoorDash Inc. in the competitive race to get products to people’s doors in record time.Most Read from BloombergEU Leaders Give Green Light to Sanctions Package: Ukraine UpdateRussia Invasion of Ukraine Ignites European Security CrisisRussia Hits Airfields; Kyiv Imposes Martial Law: Ukraine UpdateStocks Rise as Oil Pares Gain After Biden Address: Markets WrapSix Early Thoughts on Russia's Invasion of UkraineThe Just E |

UK Storm Disrupts Uber, Deliveroo, Just Eat's Food DeliveryStorm Eunice partially disrupted the services of food delivery companies, including Deliveroo PLC (OTC: DROOF), Just Eat Takeaway.com NV ADR (OTC: JETKY), and Uber Technologies Inc (NYSE: UBER) in the U.K., Bloomberg reports. The storm disrupted their services for several hours on February 18. The Met Office issued a red warning for London and Southeast England amid winds as high as 80 mph (129 kilometers). Some deliveries were available as conditions eased. However, strong winds will likely con |

DoorDash co-founder Tony Xu: We just busted this post-pandemic mythDoorDash co-founder has a hot take on the state of food delivery. |

GRUB Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -61.60% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching GRUB

Here are a few links from around the web to help you further your research on GrubHub Inc's stock as an investment opportunity:GrubHub Inc (GRUB) Stock Price | Nasdaq

GrubHub Inc (GRUB) Stock Quote, History and News - Yahoo Finance

GrubHub Inc (GRUB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...