The Goodyear Tire & Rubber Company (GT): Price and Financial Metrics

GT Price/Volume Stats

| Current price | $12.10 | 52-week high | $16.50 |

| Prev. close | $11.82 | 52-week low | $10.60 |

| Day low | $11.79 | Volume | 5,289,861 |

| Day high | $12.26 | Avg. volume | 3,316,068 |

| 50-day MA | $11.81 | Dividend yield | N/A |

| 200-day MA | $12.76 | Market Cap | 3.44B |

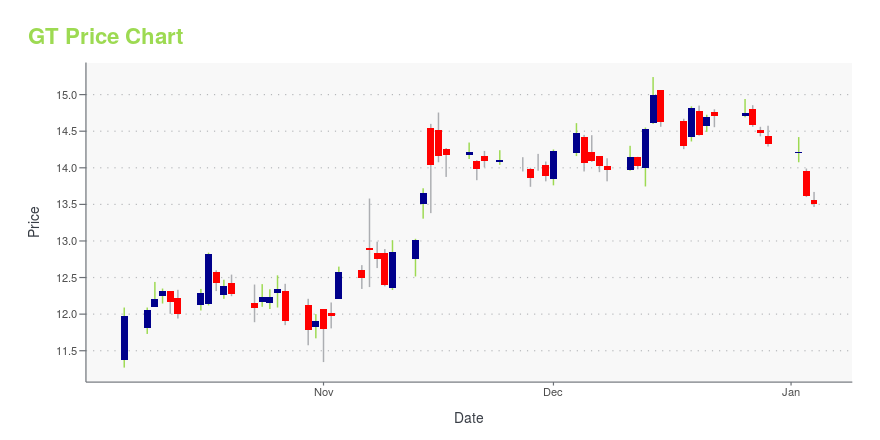

GT Stock Price Chart Interactive Chart >

The Goodyear Tire & Rubber Company (GT) Company Bio

Goodyear Tire & Rubber develops, manufactures, distributes, and sells tires, and related products and services in North America, Europe, the Middle East, Africa, Latin America, and the Asia Pacific. The company was founded in 1898 and is based in Akron, Ohio.

Latest GT News From Around the Web

Below are the latest news stories about GOODYEAR TIRE & RUBBER CO that investors may wish to consider to help them evaluate GT as an investment opportunity.

GOODYEAR CELEBRATES THE OHIO STATE UNIVERSITY AND THE UNIVERSITY OF MISSOURI'S ROAD TO THE 88TH GOODYEAR COTTON BOWL CLASSIC WITH MASCOT TIRE ART TRADITIONToday, The Goodyear Tire & Rubber Company welcomed The Ohio State University's Brutus Buckeye and the University of Missouri's Truman the Tiger to its elite lineup of larger-than-life tire art sculptures handcrafted annually for the 88th Goodyear Cotton Bowl Classic. |

3 Auto Stocks Gaining More Than 25% This Year With Room to RunAllison (ALSN), Autoliv (ALV) and Goodyear Tire (GT) are well-positioned to continue with their solid momentum due to their robust innovation technology and cost optimization efforts amid the current inflationary scenario. |

Insider Sell: EVP & Chief Admin. Officer Darren Wells Sells 12,258 Shares of Goodyear Tire ...Goodyear Tire & Rubber Co (NASDAQ:GT) has recently witnessed an insider sell that has caught the attention of investors and market analysts. |

Goodyear Tire & Rubber (NASDAQ:GT) delivers shareholders respectable 12% CAGR over 3 years, surging 4.7% in the last week aloneBy buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger... |

Insider Sell Alert: EVP & Chief Admin. ...Goodyear Tire & Rubber Co (NASDAQ:GT) has recently witnessed an insider sell that could signal investors to pay closer attention to the company's stock movements. |

GT Price Returns

| 1-mo | 9.30% |

| 3-mo | 2.20% |

| 6-mo | -17.52% |

| 1-year | -23.76% |

| 3-year | -21.63% |

| 5-year | -11.66% |

| YTD | -15.50% |

| 2023 | 41.08% |

| 2022 | -52.39% |

| 2021 | 95.42% |

| 2020 | -29.02% |

| 2019 | -20.89% |

Continue Researching GT

Want to see what other sources are saying about Goodyear Tire & Rubber Co's financials and stock price? Try the links below:Goodyear Tire & Rubber Co (GT) Stock Price | Nasdaq

Goodyear Tire & Rubber Co (GT) Stock Quote, History and News - Yahoo Finance

Goodyear Tire & Rubber Co (GT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...