Global Water Resources, Inc. - common stock (GWRS): Price and Financial Metrics

GWRS Price/Volume Stats

| Current price | $13.30 | 52-week high | $13.42 |

| Prev. close | $13.00 | 52-week low | $9.34 |

| Day low | $12.80 | Volume | 28,600 |

| Day high | $13.32 | Avg. volume | 24,315 |

| 50-day MA | $12.48 | Dividend yield | 2.27% |

| 200-day MA | $12.19 | Market Cap | 321.54M |

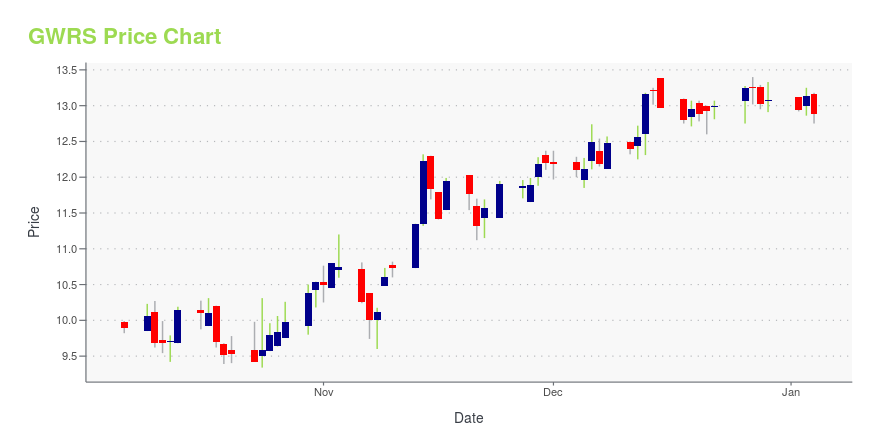

GWRS Stock Price Chart Interactive Chart >

Global Water Resources, Inc. - common stock (GWRS) Company Bio

Global Water Resources, Inc., a water resource management company, owns and operates regulated water, wastewater, and recycled water utilities primarily in metropolitan Phoenix, Arizona. The company was founded in 2003 and is based in Phoenix, Arizona.

Latest GWRS News From Around the Web

Below are the latest news stories about GLOBAL WATER RESOURCES INC that investors may wish to consider to help them evaluate GWRS as an investment opportunity.

Global Water Resources Declares Monthly DividendPHOENIX, Dec. 28, 2023 (GLOBE NEWSWIRE) -- Global Water Resources, Inc. (NASDAQ: GWRS), a pure-play water resource management company, has declared, under its dividend policy a monthly cash dividend in the amount of $0.02508 per common share (an annualized dividend rate of $0.30096 per share). The dividend will be payable on January 31, 2024, to holders of record at the close of business on January 17, 2024. About Global Water Resources Global Water Resources, Inc. is a leading water resource ma |

Investing in Water Sustainability: 3 Stocks Making WavesThese stocks can benefit from the growing demand for water services, as well as the regulatory and social incentives for water efficiency. |

3 Reasons Why Growth Investors Shouldn't Overlook Global Water Resources, Inc. (GWRS)Global Water Resources, Inc. (GWRS) is well positioned to outperform the market, as it exhibits above-average growth in financials. |

11 Best Water Stocks To BuyIn this article, we discuss 11 best water stocks to buy. If you want to skip our discussion on the water industry, head directly to 5 Best Water Stocks To Buy. 2023 has been riddled by volatility due to political, economic, and environmental factors that have had a cascading effect on the water sector, impacting […] |

Global Water Resources to Present at the ROTH Deer Valley EventROTH Deer Valley Event Global Water Resources to Present at the ROTH Deer Valley Event PHOENIX, Dec. 05, 2023 (GLOBE NEWSWIRE) -- Global Water Resources, Inc. (NASDAQ: GWRS), a pure-play water resource management company, has been invited to present at the ROTH 12th Annual Deer Valley Event being held at the Montage Deer Valley in Park City, UT on December 13-16. Global Water Resources CFO and SVP, Mike Liebman, is scheduled to participate in one-on-one meetings with institutional analysts and i |

GWRS Price Returns

| 1-mo | 9.05% |

| 3-mo | 9.75% |

| 6-mo | 7.77% |

| 1-year | 5.55% |

| 3-year | -20.67% |

| 5-year | 21.65% |

| YTD | 3.12% |

| 2023 | 1.17% |

| 2022 | -20.65% |

| 2021 | 20.09% |

| 2020 | 12.53% |

| 2019 | 33.23% |

GWRS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GWRS

Here are a few links from around the web to help you further your research on Global Water Resources Inc's stock as an investment opportunity:Global Water Resources Inc (GWRS) Stock Price | Nasdaq

Global Water Resources Inc (GWRS) Stock Quote, History and News - Yahoo Finance

Global Water Resources Inc (GWRS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...