Hanesbrands Inc. (HBI): Price and Financial Metrics

HBI Price/Volume Stats

| Current price | $6.14 | 52-week high | $6.15 |

| Prev. close | $5.67 | 52-week low | $3.54 |

| Day low | $5.75 | Volume | 21,757,142 |

| Day high | $6.15 | Avg. volume | 8,198,854 |

| 50-day MA | $5.06 | Dividend yield | N/A |

| 200-day MA | $4.66 | Market Cap | 2.16B |

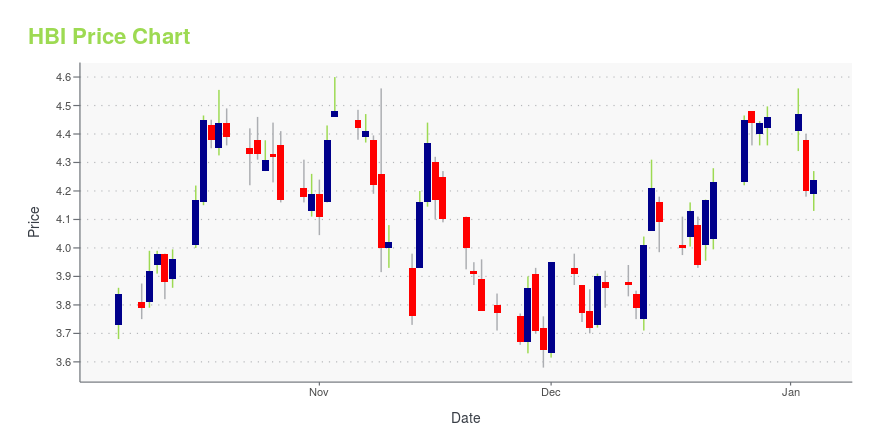

HBI Stock Price Chart Interactive Chart >

Hanesbrands Inc. (HBI) Company Bio

Hanesbrands Inc. is an American multinational clothing company based in Winston-Salem, North Carolina. It employs 65,300 people internationally. On September 6, 2006, the company and several brands were spun off by the Sara Lee Corporation.(Source:Wikipedia)

Latest HBI News From Around the Web

Below are the latest news stories about HANESBRANDS INC that investors may wish to consider to help them evaluate HBI as an investment opportunity.

Hanesbrands Has Upside Potential in Its Deleveraging JourneyNavigating the company's strategic turnaround for significant shareholder value |

Shareholders in Hanesbrands (NYSE:HBI) are in the red if they invested three years agoThe truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Hanesbrands... |

HanesBrands Appoints William S. Simon Chairman of the Board of DirectorsWINSTON-SALEM, N.C., December 15, 2023--HanesBrands (NYSE: HBI) today announced that its Board of Directors (the "Board") has appointed William S. Simon to serve as Chairman of the Board, effective December 31, 2023. His appointment follows Ronald L. Nelson’s decision to retire as Chairman and a member of the Board at the end of the year. |

Best Value Stocks? 15 Stocks Dr Michael Burry Bought and SoldIn this piece, we will take a look at 15 stocks Dr Michael Burry recently bought and sold. If you want to skip our introduction to the institutional investor, then take a look at 5 Stocks Dr Michael Burry Bought and Sold. Years after accurately predicting the 2008 financial crisis and making a fortune out […] |

2 Risky Stocks That Could SkyrocketApparel manufacturer Hanesbrands (NYSE: HBI) and media giant Warner Bros. Discovery (NASDAQ: WBD) are both trying to stage comebacks. For Hanesbrands, a tough post-pandemic economy is wrecking demand. For Warner Bros. Discovery, the age of streaming is pressuring the lucrative linear TV business. |

HBI Price Returns

| 1-mo | 27.39% |

| 3-mo | 37.05% |

| 6-mo | 34.06% |

| 1-year | 20.39% |

| 3-year | -63.73% |

| 5-year | -55.36% |

| YTD | 37.67% |

| 2023 | -29.87% |

| 2022 | -59.62% |

| 2021 | 18.43% |

| 2020 | 3.22% |

| 2019 | 22.90% |

Continue Researching HBI

Here are a few links from around the web to help you further your research on Hanesbrands Inc's stock as an investment opportunity:Hanesbrands Inc (HBI) Stock Price | Nasdaq

Hanesbrands Inc (HBI) Stock Quote, History and News - Yahoo Finance

Hanesbrands Inc (HBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...