Hutchison China MediTech Limited (HCM): Price and Financial Metrics

HCM Price/Volume Stats

| Current price | $18.56 | 52-week high | $21.92 |

| Prev. close | $18.01 | 52-week low | $11.93 |

| Day low | $18.01 | Volume | 29,900 |

| Day high | $18.56 | Avg. volume | 128,490 |

| 50-day MA | $18.47 | Dividend yield | N/A |

| 200-day MA | $17.41 | Market Cap | 3.23B |

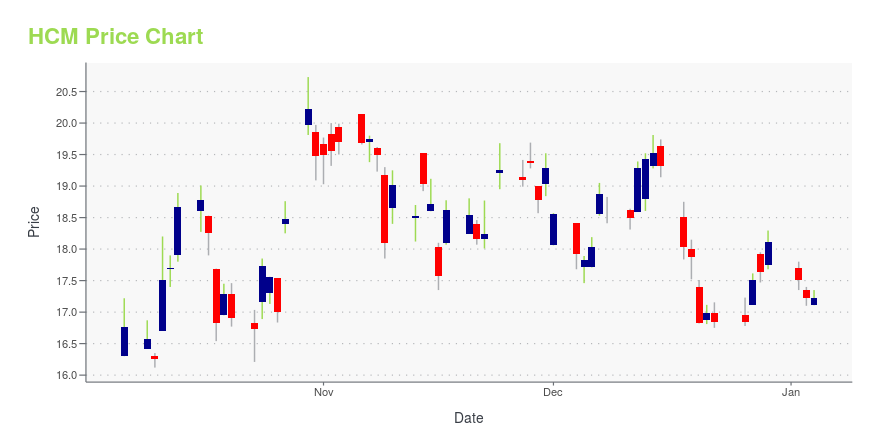

HCM Stock Price Chart Interactive Chart >

Hutchison China MediTech Limited (HCM) Company Bio

Hutchison China MediTech Limited engages in the research, development, manufacture, and sale of pharmaceuticals and health-related consumer products primarily in China. The company was founded in 2000 and is based in Hong Kong, Hong Kong.

Latest HCM News From Around the Web

Below are the latest news stories about HUTCHMED (CHINA) LTD that investors may wish to consider to help them evaluate HCM as an investment opportunity.

HUTCHMED Announces Continued Inclusion of ELUNATE® (fruquintinib) and SULANDA® (surufatinib) in the National Reimbursement Drug List in China at Current TermsHONG KONG and SHANGHAI, China and FLORHAM PARK, N.J., Dec. 13, 2023 (GLOBE NEWSWIRE) -- HUTCHMED (China) Limited (“HUTCHMED”) (Nasdaq/AIM:HCM, HKEX:13) today announces that under the 2023 simple renewal mechanism of the China National Healthcare Security Administration (“NHSA”), on January 1, 2024 the updated National Reimbursement Drug List (“NRDL”) will continue to include ELUNATE® (fruquintinib) and SULANDA® (surufatinib) at the same terms as the current two-year agreement. Mr Hong Chen, Se |

HUTCHMED Announces that it has Completed Enrollment of a Phase II/III Trial of Fruquintinib in Combination with Sintilimab for Advanced Renal Cell Carcinoma in ChinaHONG KONG, Shanghai and FLORHAM Park, N.J., Dec. 12, 2023 (GLOBE NEWSWIRE) -- HUTCHMED (China) Limited (Nasdaq/AIM:HCM, HKEX:13) (“HUTCHMED”) today announces that it has completed enrollment of its Phase II/III trial of fruquintinib in combination with sintilimab as second-line treatment for locally advanced or metastatic renal cell carcinoma (“RCC”) in China. The study is a randomized, open-label, active-controlled study to evaluate the efficacy and safety of fruquintinib in combination with |

HUTCHMED Highlights Clinical Data to be Presented at 2023 ESMO Asia and ESMO Immuno-Oncology CongressesHONG KONG and SHANGHAI, China and FLORHAM PARK, N.J., Nov. 30, 2023 (GLOBE NEWSWIRE) -- HUTCHMED (China) Limited (“HUTCHMED”) (Nasdaq/AIM:HCM; HKEX:13) today highlights that new clinical data from several ongoing studies with HUTCHMED investigational drug candidates fruquintinib, surufatinib and HMPL-295, which will be presented at the upcoming European Society for Medical Oncology (“ESMO”) Asia Congress, taking place on December 1-3, 2023 in Singapore, and the ESMO Immuno-Oncology Congress, t |

Deutsche Bank ADR Investor Conference: Presentations Now Available for Online ViewingCompany Executives Share Vision and Answer Questions at VirtualInvestorConferences.comNEW YORK, Nov. 10, 2023 (GLOBE NEWSWIRE) -- Virtual Investor Conferences, the leading proprietary investor conference series, today announced the presentations from the Deutsche Bank Depositary Receipts Virtual Investor Conference (“dbVIC”) held on November 8th and 9th are now available for online viewing. REGISTER NOW AT: https://bit.ly/3SyFOaq The company presentations will be available 24/7 for 90 days. Nove |

HUTCHMED Announces that Takeda Receives U.S. FDA Approval of FRUZAQLA™ (fruquintinib) for Previously Treated Metastatic Colorectal Cancer— FRUZAQLA is the first targeted therapy approved in the U.S. for metastatic colorectal cancer regardless of biomarker status or prior types of therapies in more than a decade — — U.S. approval of FRUZAQLA triggers first milestone payment from Takeda of US$35 million and royalties on net sales — HONG KONG, SHANGHAI, China and FLORHAM PARK, N.J., Nov. 09, 2023 (GLOBE NEWSWIRE) -- HUTCHMED (China) Limited (Nasdaq/AIM:HCM, HKEX:13) (“HUTCHMED”) today announced that its partner Takeda received app |

HCM Price Returns

| 1-mo | 6.42% |

| 3-mo | 2.20% |

| 6-mo | 43.54% |

| 1-year | 26.09% |

| 3-year | -55.61% |

| 5-year | -10.16% |

| YTD | 2.48% |

| 2023 | 22.53% |

| 2022 | -57.87% |

| 2021 | 9.56% |

| 2020 | 27.72% |

| 2019 | 8.58% |

Continue Researching HCM

Want to see what other sources are saying about Hutchison China MediTech Ltd's financials and stock price? Try the links below:Hutchison China MediTech Ltd (HCM) Stock Price | Nasdaq

Hutchison China MediTech Ltd (HCM) Stock Quote, History and News - Yahoo Finance

Hutchison China MediTech Ltd (HCM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...