Healthcare Triangle, Inc. (HCTI): Price and Financial Metrics

HCTI Price/Volume Stats

| Current price | $0.65 | 52-week high | $5.36 |

| Prev. close | $0.68 | 52-week low | $0.43 |

| Day low | $0.65 | Volume | 61,444 |

| Day high | $0.72 | Avg. volume | 298,719 |

| 50-day MA | $0.62 | Dividend yield | N/A |

| 200-day MA | $2.14 | Market Cap | 3.65M |

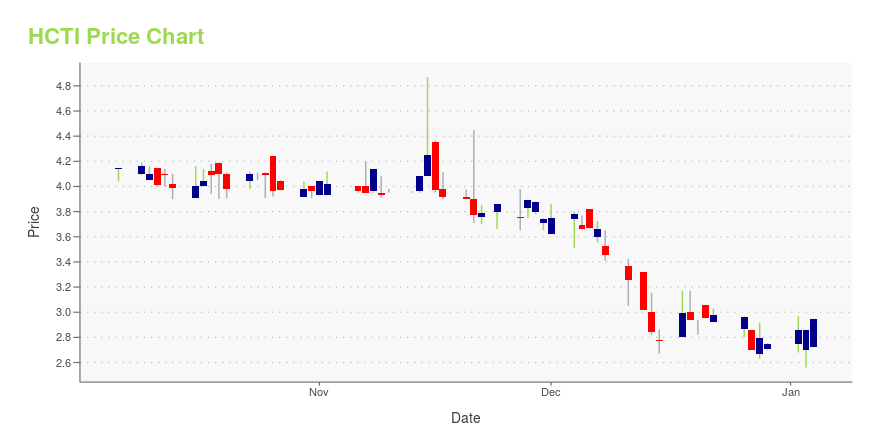

HCTI Stock Price Chart Interactive Chart >

Healthcare Triangle, Inc. (HCTI) Company Bio

Healthcare Triangle, Inc. operates as a healthcare information technology company. It provides a suite of software, solutions, platforms, and services that enables healthcare and pharma organizations to deliver personalized healthcare, precision medicine, advances in drug discovery, development and efficacy, collaborative research and development, respond to evidence, and accelerate their digital transformation. The company's software platforms include CloudEz, an enterprise multi-cloud transformation and management platform that enables customers to manage their cloud infrastructure across private, hybrid, and public cloud infrastructures; and DataEz, a cloud-based data analytics and data science platform for the data analytics and data science requirements of life sciences/pharmaceutical and healthcare provider organizations. Its platform also comprise readabl.ai, a cloud-based artificial intelligence/machine learning platform to ingest documents. In addition, it provides cloud IT services. The company was incorporated in 2019 and is based in Pleasanton, California.

Latest HCTI News From Around the Web

Below are the latest news stories about HEALTHCARE TRIANGLE INC that investors may wish to consider to help them evaluate HCTI as an investment opportunity.

Healthcare Triangle Reports Third Quarter 2023 ResultsPLEASANTON, Calif., Nov. 13, 2023 (GLOBE NEWSWIRE) -- Healthcare Triangle, Inc. (Nasdaq: HCTI) (“HCTI” or the "Company"), a leader in digital transformation solutions including managed services, cloud enablement, cybersecurity, data analytics, and AI data processing for the healthcare and life sciences industries, today announced results for the third quarter of 2023 ended September 30, 2023. Thyagarajan Ramachandran, CFO of Healthcare Triangle, said, “A return to predictable revenue growth is t |

Healthcare Triangle to Host Sessions on Digital Transformation and Ransomware Preparedness for Healthcare Systems at CHIME23 Fall ForumPLEASANTON, Calif., Nov. 08, 2023 (GLOBE NEWSWIRE) -- Healthcare Triangle, Inc (Nasdaq: HCTI) (“HCTI” or the "Company"), a leader in digital transformation solutions including managed services, cloud enablement, cybersecurity, data analytics, and AI data processing for the healthcare and life sciences industries, today announced its attendance at CHIME23 Fall Forum, a gathering of digital health leaders from around the globe, being held November 9-12, 2023, in Phoenix, Arizona. “Healthcare Trian |

Healthcare Triangle to Host Roundtable Discussion on Generative AI and Data Modernization Strategies for HealthcareKey learnings include strategies and best practices for leveraging new technologies while maintaining data security, privacy, and compliancePLEASANTON, Calif., Sept. 19, 2023 (GLOBE NEWSWIRE) -- Healthcare Triangle, Inc (Nasdaq: HCTI) (“HCTI” or the "Company"), a leader in digital transformation solutions including managed services, cloud enablement, cybersecurity, data analytics, and AI data processing for the healthcare and life sciences industries, today announced an upcoming roundtable hoste |

Healthcare Triangle to Host Webinar Addressing Ransomware Preparedness for HealthcareKey learnings for today’s event include methods for securing patient care and data integrity amid evolving cybersecurity challenges Lena Kannappan Lena Kannappan Head of Business, Strategy and Partnerships, Healthcare Triangle PLEASANTON, Calif., Sept. 12, 2023 (GLOBE NEWSWIRE) -- Healthcare Triangle, Inc (Nasdaq: HCTI) (“HCTI” or the "Company"), a leader in digital transformation solutions including managed services, cloud enablement, cybersecurity, data analytics, and AI data processing for th |

Short Squeeze Stocks: APRN, AURC Top List of 5 Most Likely Short SqueezesLooking to bet on the most likely short squeeze stocks? |

HCTI Price Returns

| 1-mo | 29.79% |

| 3-mo | -48.82% |

| 6-mo | -69.63% |

| 1-year | -84.88% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -76.32% |

| 2023 | 52.75% |

| 2022 | -90.07% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...