Home Federal Bancorp, Inc. of Louisiana (HFBL): Price and Financial Metrics

HFBL Price/Volume Stats

| Current price | $13.52 | 52-week high | $14.25 |

| Prev. close | $13.93 | 52-week low | $11.26 |

| Day low | $13.52 | Volume | 3,343 |

| Day high | $13.93 | Avg. volume | 4,018 |

| 50-day MA | $13.36 | Dividend yield | 3.77% |

| 200-day MA | $12.68 | Market Cap | 42.22M |

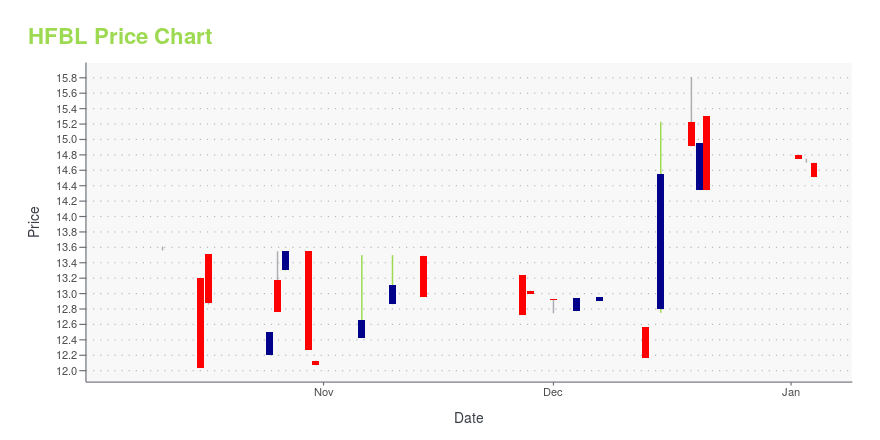

HFBL Stock Price Chart Interactive Chart >

Home Federal Bancorp, Inc. of Louisiana (HFBL) Company Bio

Home Federal Bancorp, Inc. of Louisiana operates as the holding company for Home Federal Bank, a federally chartered savings bank that provides financial services to individuals, corporate entities, and other organizations in the Shreveport-Bossier City metropolitan area. It accepts various deposits, such as passbook savings, certificates of deposit, and demand deposit accounts. The company also provides one-to-four family residential real estate loans; commercial-real estate secured loans; multi-family residential loans; commercial business loans; land loans; construction loans; home equity and second mortgage loans; equity lines of credit; and consumer non-real estate loans, including loans secured by deposit accounts, automobile loans, overdrafts, and other unsecured loans. It operates through its main office and seven full-service branch offices located in Shreveport and Bossier City, Louisiana. The company was founded in 1924 and is based in Shreveport, Louisiana.

HFBL Price Returns

| 1-mo | -1.17% |

| 3-mo | 1.88% |

| 6-mo | N/A |

| 1-year | 26.54% |

| 3-year | N/A |

| 5-year | 20.38% |

| YTD | N/A |

| 2024 | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | 0.00% |

HFBL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HFBL

Here are a few links from around the web to help you further your research on Home Federal Bancorp Inc of Louisiana's stock as an investment opportunity:Home Federal Bancorp Inc of Louisiana (HFBL) Stock Price | Nasdaq

Home Federal Bancorp Inc of Louisiana (HFBL) Stock Quote, History and News - Yahoo Finance

Home Federal Bancorp Inc of Louisiana (HFBL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...