Hims & Hers Health, Inc. (HIMS): Price and Financial Metrics

HIMS Price/Volume Stats

| Current price | $21.77 | 52-week high | $25.74 |

| Prev. close | $23.25 | 52-week low | $5.65 |

| Day low | $21.36 | Volume | 11,507,100 |

| Day high | $24.24 | Avg. volume | 7,490,487 |

| 50-day MA | $20.68 | Dividend yield | N/A |

| 200-day MA | $12.85 | Market Cap | 4.68B |

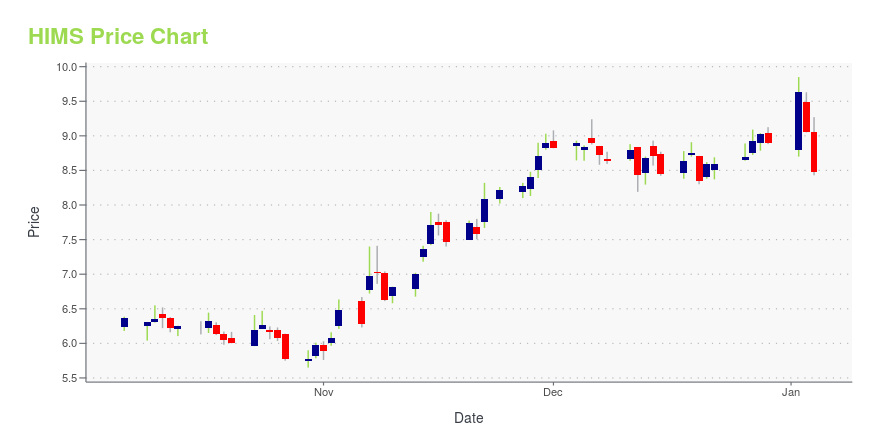

HIMS Stock Price Chart Interactive Chart >

Hims & Hers Health, Inc. (HIMS) Company Bio

Hims & Hers Health, Inc. provides health care software solutions. The Company offers multi-specialty telehealth platform that connects consumers to licensed healthcare providers, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, and primary care. Hims & Hers Health serves customers in the United States.

Latest HIMS News From Around the Web

Below are the latest news stories about HIMS & HERS HEALTH INC that investors may wish to consider to help them evaluate HIMS as an investment opportunity.

Hims & Hers Launches Holistic Weight Loss Program to Break the Endless Cycle of Weight Gain and LossSAN FRANCISCO, December 04, 2023--Hims & Hers Health, Inc. ("Hims & Hers", NYSE: HIMS), the leading health and wellness platform, today unveiled Weight Loss by Hims & Hers, a comprehensive and customizable clinical approach specifically designed to help people achieve their individual weight-loss goals. The company also announced that Craig Primack, MD, FACP, FAAP, FOMA, a pioneer in the field of clinical obesity medicine, has joined the company as SVP of Weight Management. |

5 Telehealth Stocks That Have Nothing But UpsideNavigate the exciting world of telehealth with our curated list of top telehealth stocks. |

It Is Time To Buy Hims & Hers StockHims & Hers is a pharmaceutical marketing, product, and distribution firm with a telehealth component. |

2024’s Hidden Gems: 7 Small-Caps Set for Explosive GrowthSmall-cap stocks outperform larger companies on an indexed basis, but finding the best among them individually isn't always easy |

Hims & Hers Health, Inc. Reports Third Quarter 2023 Financial Results and Raises Full Year 2023 OutlookSAN FRANCISCO, November 06, 2023--Hims & Hers Health, Inc. ("Hims & Hers" or the "Company", NYSE: HIMS), the leading health and wellness platform, today reported financial results for the third quarter ended September 30, 2023. |

HIMS Price Returns

| 1-mo | 0.97% |

| 3-mo | 74.16% |

| 6-mo | 146.83% |

| 1-year | 158.86% |

| 3-year | 165.49% |

| 5-year | N/A |

| YTD | 144.61% |

| 2023 | 38.85% |

| 2022 | -2.14% |

| 2021 | -55.14% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...