Hippo Holdings Inc. (HIPO): Price and Financial Metrics

HIPO Price/Volume Stats

| Current price | $26.58 | 52-week high | $35.44 |

| Prev. close | $26.37 | 52-week low | $14.58 |

| Day low | $25.80 | Volume | 54,528 |

| Day high | $26.58 | Avg. volume | 218,608 |

| 50-day MA | $25.61 | Dividend yield | N/A |

| 200-day MA | $25.56 | Market Cap | 668.67M |

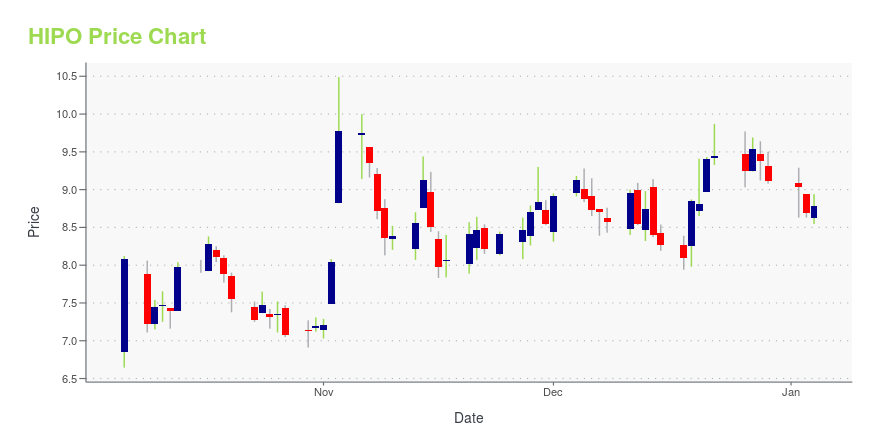

HIPO Stock Price Chart Interactive Chart >

Hippo Holdings Inc. (HIPO) Company Bio

Hippo Holdings Inc. provides property casualty insurance agency services. It offers various home insurance products for homeowners. The company is headquartered in Palo Alto, California.

HIPO Price Returns

| 1-mo | -5.94% |

| 3-mo | 8.00% |

| 6-mo | -4.29% |

| 1-year | 51.63% |

| 3-year | 28.70% |

| 5-year | N/A |

| YTD | -0.71% |

| 2024 | 193.53% |

| 2023 | -32.94% |

| 2022 | -80.78% |

| 2021 | N/A |

| 2020 | N/A |

Loading social stream, please wait...