Highwoods Properties, Inc. (HIW): Price and Financial Metrics

HIW Price/Volume Stats

| Current price | $30.62 | 52-week high | $30.71 |

| Prev. close | $29.14 | 52-week low | $17.06 |

| Day low | $29.01 | Volume | 1,600,300 |

| Day high | $30.71 | Avg. volume | 1,097,361 |

| 50-day MA | $26.52 | Dividend yield | 6.96% |

| 200-day MA | $23.63 | Market Cap | 3.25B |

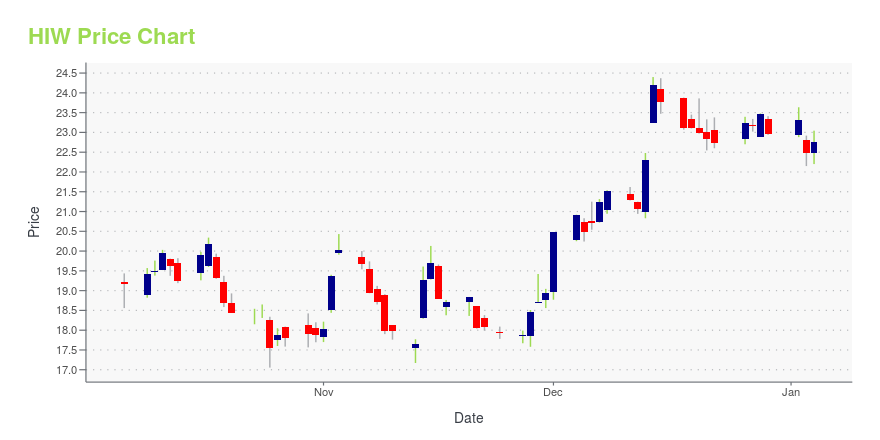

HIW Stock Price Chart Interactive Chart >

Highwoods Properties, Inc. (HIW) Company Bio

Highwoods Properties focuses on building its portfolio of office, industrial, and retail properties. The company was founded in 1978 and is based in Raleigh, North Carolina.

Latest HIW News From Around the Web

Below are the latest news stories about HIGHWOODS PROPERTIES INC that investors may wish to consider to help them evaluate HIW as an investment opportunity.

Highwoods' (HIW) Rating Outlook Revised to Negative by S&PHighwoods' (HIW) rating outlook gets revised to negative by S&P Global Ratings as overall office real estate market fundamentals continue to remain weak. Credit ratings were reaffirmed at BBB. |

Alexandria Real Estate Equities (ARE) Stock Jumps 7.1%: Will It Continue to Soar?Alexandria Real Estate Equities (ARE) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Should You Retain Highwoods (HIW) Stock in Your Portfolio Now?A Sun Belt market focused portfolio, aggressive capital-recycling program and healthy balance sheet bode well for Highwoods (HIW). However, competition from peers and high interest rates are key woes. |

Healthpeak (PEAK) Up 9.5% Since Last Earnings Report: Can It Continue?Healthpeak (PEAK) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Analysts Slashing Price Targets During A Quiet WeekThanksgiving week is usually quiet yet positive for stocks, and 2023 was no exception. Still, despite recent gains in the real estate investment trust (REIT) sector, analysts were busy sharpening their Thanksgiving knives this week on the price targets of several REITs. Take a look at four REITs whose current ratings were maintained this week but still experienced significant carvings on their price targets. NetSTREIT Corp. (NYSE:NTST) is a Dallas-based retail REIT with 547 properties across 45 |

HIW Price Returns

| 1-mo | 20.60% |

| 3-mo | 21.50% |

| 6-mo | 40.16% |

| 1-year | 35.59% |

| 3-year | -19.90% |

| 5-year | -7.99% |

| YTD | 38.81% |

| 2023 | -10.14% |

| 2022 | -33.58% |

| 2021 | 17.63% |

| 2020 | -14.76% |

| 2019 | 31.82% |

HIW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HIW

Want to see what other sources are saying about Highwoods Properties Inc's financials and stock price? Try the links below:Highwoods Properties Inc (HIW) Stock Price | Nasdaq

Highwoods Properties Inc (HIW) Stock Quote, History and News - Yahoo Finance

Highwoods Properties Inc (HIW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...