Helbiz, Inc. (HLBZ): Price and Financial Metrics

HLBZ Price/Volume Stats

| Current price | $5.84 | 52-week high | $6.60 |

| Prev. close | $0.12 | 52-week low | $0.11 |

| Day low | $5.80 | Volume | 736,128 |

| Day high | $6.60 | Avg. volume | 64,286,434 |

| 50-day MA | $0.17 | Dividend yield | N/A |

| 200-day MA | $0.39 | Market Cap | 1.41B |

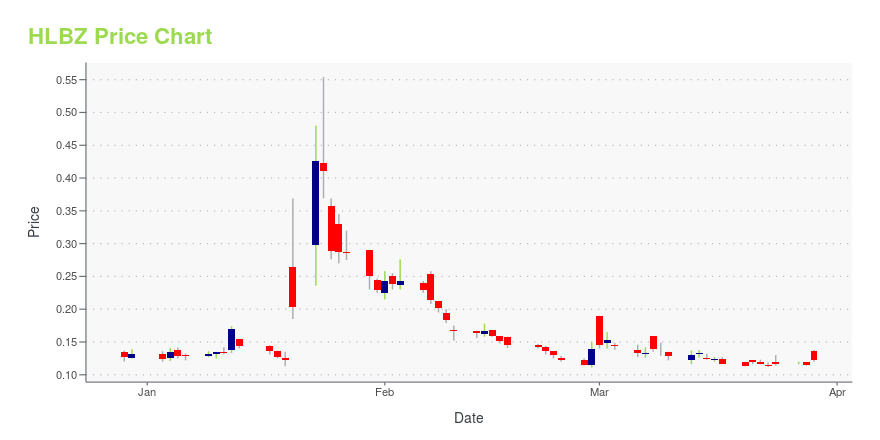

HLBZ Stock Price Chart Interactive Chart >

Helbiz, Inc. (HLBZ) Company Bio

Helbiz Inc. provides micro-mobility services. The company offers a fleet of vehicles, including e-scooters, e-bicycles, and e-mopeds all on one convenient platform in 35 cities worldwide. It utilizes a customized, proprietary fleet management platform, artificial intelligence, and environmental mapping to optimize operations and business sustainability. The company also focuses on expanding its urban lifestyle products and services to include live streaming services, food delivery, financial services, and others accessible within its mobile app. The company was incorporated in 2015 and is headquartered in New York, New York.

Latest HLBZ News From Around the Web

Below are the latest news stories about HELBIZ INC that investors may wish to consider to help them evaluate HLBZ as an investment opportunity.

Share Intel Confirms Sustained Imbalances That Do Not Correspond To Daily Trading ActivitiesNEW YORK, April 05, 2023--micromobillity.com Inc. (NASDAQ: MCOM), leading micromobility ecosystem, today announced that Share Intel's extensive analysis of MCOM stock has identified consistent imbalances and reported short interest, signaling the potential presence of illegal naked short sales. When compared to the average trading volume, these imbalances prove to be notably significant. The uncovered discrepancies may represent only the "tip of the iceberg," with the possibility of more extensi |

Why Are Trump Stocks RUM, DWAC Up Today?Stocks connected to former President Donald Trump are heading higher on Friday with heavy trading following news of his indictment. |

Why Is Digital World (DWAC) Stock Up 7% Today?Digital World (DWAC) stock is on the rise Friday after former President Donald Trump was indicted by a grand jury in New York City. |

Why Is Rumble (RUM) Stock Up 7% Today?Rumble (RUM) stock is gaining on Friday as investors react to news of former President Donald Trump being indicted by a New York court. |

HLBZ Stock Alert: Helbiz Preps to Change Name, Ticker SymbolWhatever its name, and whatever the price of its stock, HLBZ stock needs to generate revenue and a merger partner soon. |

HLBZ Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -98.85% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -97.62% |

| 2021 | -46.75% |

| 2020 | 4.88% |

| 2019 | N/A |

Loading social stream, please wait...