Helix Energy Solutions Group, Inc. (HLX): Price and Financial Metrics

HLX Price/Volume Stats

| Current price | $12.44 | 52-week high | $13.05 |

| Prev. close | $12.54 | 52-week low | $8.82 |

| Day low | $12.41 | Volume | 2,373,796 |

| Day high | $12.89 | Avg. volume | 1,783,137 |

| 50-day MA | $11.53 | Dividend yield | N/A |

| 200-day MA | $10.47 | Market Cap | 1.90B |

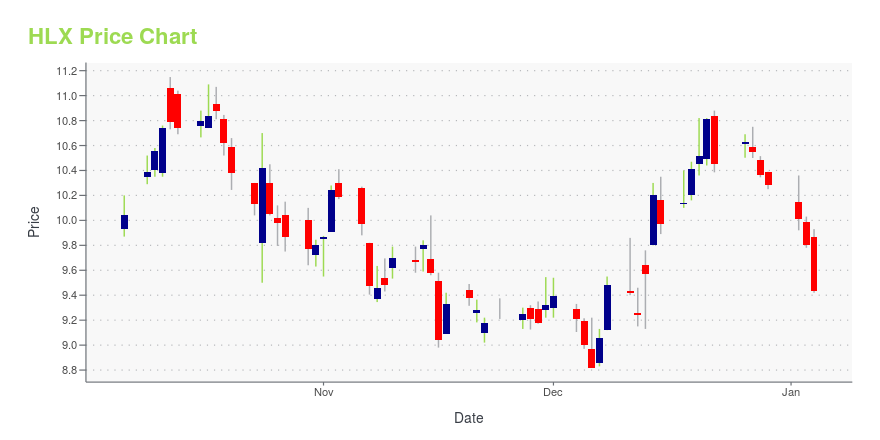

HLX Stock Price Chart Interactive Chart >

Helix Energy Solutions Group, Inc. (HLX) Company Bio

Helix Energy Solutions Group, Inc. provides specialty services to the offshore energy industry primarily in the Gulf of Mexico, North Sea, the Asia Pacific, and West Africa regions. The company was formerly known as Cal Dive International, Inc. and changed its name to Helix Energy Solutions Group, Inc. in March 2006. The company was founded in 1979 and is based in Houston, Texas.

Latest HLX News From Around the Web

Below are the latest news stories about HELIX ENERGY SOLUTIONS GROUP INC that investors may wish to consider to help them evaluate HLX as an investment opportunity.

7 Stocks to Buy if You’re Bullish on the Energy SectorOil prices are down right now, but there are some good energy stocks to buy if you're bullish about the energy sector. |

Shareholders Should Be Pleased With Helix Energy Solutions Group, Inc.'s (NYSE:HLX) PriceWith a median price-to-sales (or "P/S") ratio of close to 0.9x in the Energy Services industry in the United States... |

Pickering Energy Partners Acted as Co-Manager to Helix Energy Solutions Group, Inc.HOUSTON, December 11, 2023--Pickering Energy Partners ("PEP") acted as a Co-Manager on the $300,000,000 offering of 9.750% senior notes due 2029 for Helix Energy Solutions Group, Inc. (NYSE: HLX) which closed on December 1, 2023. |

The three-year decline in earnings for Helix Energy Solutions Group NYSE:HLX) isn't encouraging, but shareholders are still up 184% over that periodHelix Energy Solutions Group, Inc. ( NYSE:HLX ) shareholders have seen the share price descend 10% over the month. But... |

Helix Announces Pricing of Senior Notes OfferingHOUSTON, November 16, 2023--Helix Energy Solutions Group, Inc. (NYSE: HLX) announced today it has priced $300 million in principal amount of 9.750% Senior Notes due 2029 (the "Notes"). Helix intends to use the net proceeds from the offering, together with cash on hand and shares of its common stock, as necessary, to pay the cost of extinguishing its obligations with respect to its outstanding 6.75% Convertible Senior Notes due 2026 (the "2026 Convertible Notes"), which may include privately nego |

HLX Price Returns

| 1-mo | 8.65% |

| 3-mo | 9.89% |

| 6-mo | 23.17% |

| 1-year | 32.34% |

| 3-year | 199.76% |

| 5-year | 44.32% |

| YTD | 21.01% |

| 2023 | 39.30% |

| 2022 | 136.54% |

| 2021 | -25.71% |

| 2020 | -56.39% |

| 2019 | 78.00% |

Continue Researching HLX

Want to see what other sources are saying about Helix Energy Solutions Group Inc's financials and stock price? Try the links below:Helix Energy Solutions Group Inc (HLX) Stock Price | Nasdaq

Helix Energy Solutions Group Inc (HLX) Stock Quote, History and News - Yahoo Finance

Helix Energy Solutions Group Inc (HLX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...